Shaw Communications has fired back against accusations by Novus Entertainment that it is engaged in predatory pricing by filing a defamation suit in the British Columbia Supreme Court.

Shaw president Peter Bissonnette said Novus is intentionally spreading misinformation about Shaw’s competitive promotion in the Vancouver area, which he said charged $29.85 a month for a comprehensive package including digital HD cable, high-speed broadband, and telephone service that includes free long distance calling across North America.

Novus fired the first legal shot in July, accusing Shaw Cable of engaging in predatory pricing by offering cable, broadband, and telephone service “below cost” only to residents in the high rise buildings where Novus currently offers service in the city of Vancouver. Novus, a fiber optic-based competitor, offers service in 225 residential high rise buildings in downtown Vancouver, at prices that have traditionally been lower than those offered by Shaw, western Canada’s largest cable operator, based in Calgary, Alberta. Novus announced it was filing a predatory pricing case with the Competition Bureau of Canada and the BC Supreme Court.

Shaw officials counter that many of those high rise buildings are owned by Concord Pacific, which also has a major ownership interest in Novus Entertainment. Bissonnette dismisses Novus’ accusations of anti-competitive behavior, accusing Concord Pacific of blocking access to Shaw, preventing the company from wiring the buildings during their construction, which would have reduced costs significantly.

“Those buildings up until recently have never had access to our services,” he said.

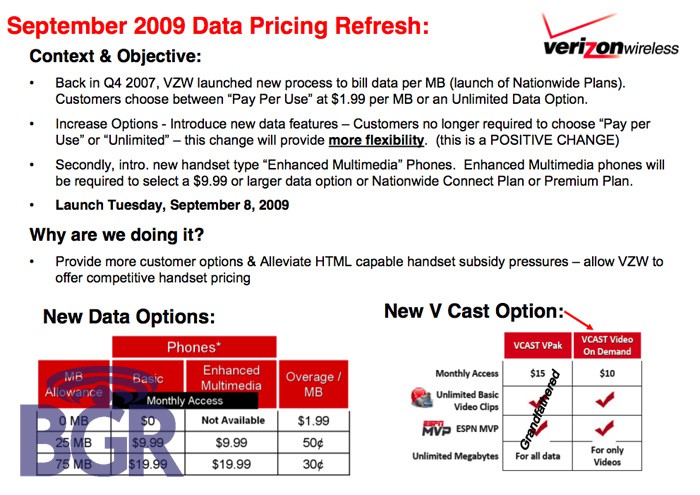

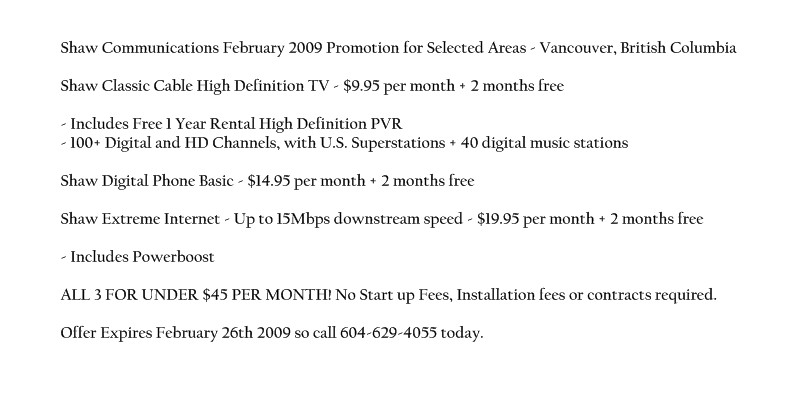

February 2009 Shaw Communications Promotional Pricing (click to enlarge)

Novus’ disdain for Shaw began this past February, when Concord Pacific employees noticed Shaw was promoting special discount offers targeting their buildings’ residents with special discounts for new Shaw customer signups. The special offers expired at the end of February, and the two companies stopped specifically targeting each other in greater Vancouver until July.

Novus co-president Doug Holman told the CBC that was when things really began to heat up.

The cable provider resumed its efforts in July with a more aggressive deal, which it promoted by slipping flyers under doors and with “street teams” that would stand in front of buildings and ask people entering and exiting whether they were Novus customers. If they were, they would get the $9.95 offer, he said.

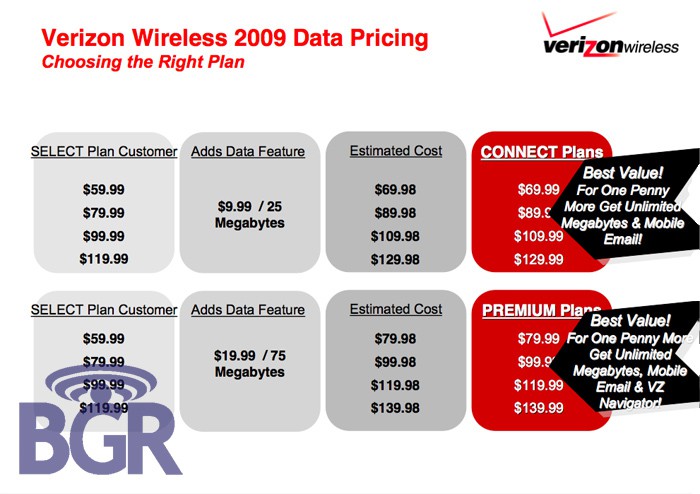

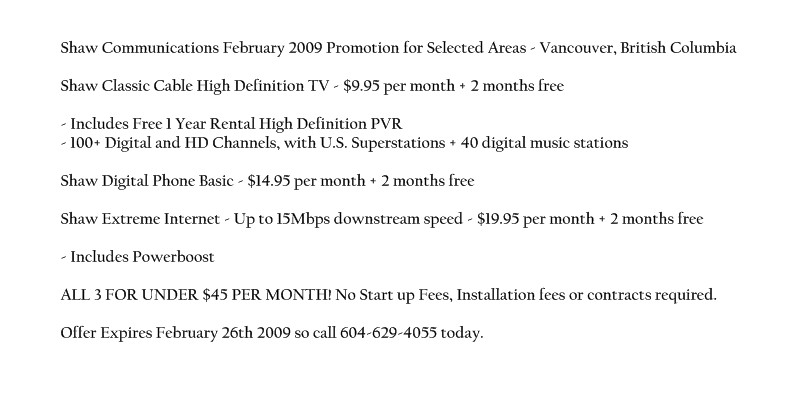

The $9.95 offer Holman mentions was an even more aggressive promotion than the one Shaw offered in February. The July promotion offered each component of Shaw’s package — television, broadband, and phone — for $9.95 a month each, with two free months thrown in, as the promotional flyer obtained by Stop the Cap! illustrates (shown on the left).

Shaw's flyer distributed to Novus customers (click to enlarge)

Who exactly could obtain this promotional pricing became a point of contention between the two companies. Shaw president Peter Bissonnette claims the promotion is not just available to existing Novus customers, but to any resident of West Vancouver, which he called “highly competitive” for cable and broadband service. Novus claims the promotion is targeted specifically at their customers, and is not widely known or available outside of its own customer base.

Vancouver residents sharing their experiences with Stop the Cap! report that Novus’ version is probably closer to the truth. When the skirmish went public with Novus’ PR and Twitter outreach campaign, many Shaw customers in Vancouver had no idea such an aggressive promotion existed. Neither did Telus customers (British Columbia’s telephone provider). Some Shaw customers called Shaw to complain about the wide disparity between the rates they were paying and those Novus customers enjoyed. Some Telus customers also called Shaw in late July to inquire whether they could sign up for the promotion. Existing Shaw customers were disqualified from the promotion because they were existing customers, and the Telus customers who shared their experiences with Stop the Cap! were told the “offer was not available in your area” by Shaw customer service representatives.

Indeed, other online forums reported some similar experiences, noting the offer was limited to a tight geographical area, notably right in the heart of Novus’ primary service areas — those high rise residential buildings.

One reader of Digitalhome.ca, one of Canada’s largest home entertainment forums, said Shaw would offer this promotion to him if he “moved downtown.” He also noted some friends who do live downtown are trying to shovel through a blizzard of promotional mailers from Shaw received day after day, as well as personal visits from Shaw sales employees knocking on the doors of residents known to live in buildings wired for Novus, despite posted signs “clearly marked ‘No Canvassing’.”

On the CBC website, one Vancouver resident has received dozens of promotional mailers and plans to return them to Shaw at some point: “It’s insane; some friends and I are saving them up to dump on Shaw’s doorstep at some future point.”

Over on Broadband Reports, one resident looking for service outside of Vancouver was told the promotion was not available:

“I phoned up Shaw asking them to give me this offer at my residential house that is not located in Vancouver. They would not. The closest deal that the Shaw customer service representative would give me is $70/month for six months and then $110/month after that – Citing at first that they could only offer this promotion to buildings with Novus/Telus/Bell. When I asked why I could not get the promotion at my house because I have Telus available, the CSR backtracked and told me that it was only available in multi-dwelling buildings. Eventually the CSR backed down and told me that Shaw was only offering the promotion to buildings with Novus.”

Another reader who did live in the right neighborhood and ostensibly should have qualified was told he did not:

“I called 15 minutes ago and spoke to a CSR about setting it up in my Kits apartment (moving on Aug 15, do not have an account with Shaw currently) and he came right out and told me it’s only for Novus customers. I said I understood it to be an offer to multi-dwelling buildings and that Telus was offered in my apartment as well, but he said that I don’t qualify because I’m not in a Novus building.”

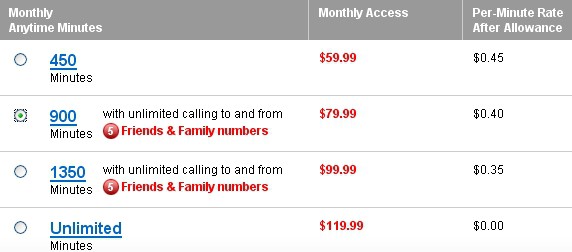

Sign outside of The Concordia in Vancouver promoting Shaw Communications' special offer (click to enlarge)

One possible clue about who this promotion was intended for could be found on a signboard placed just outside the entrance of one Vancouver building heavily promoting the Shaw offer (see photo on right).

Meanwhile, both companies continue their war of words:

“They’ve publicly stated in the past that they’re going to become the bane of the life of Shaw,” Shaw’s Bissonnette said. “True to their word, they’ve embarked on this defamation campaign.”

Counters Novus’ Holman: “That number [$9.95] is way below our cost. We don’t know what Shaw’s cost is, but it’s hard to believe it could be that low and that their cost savings could be that much better than ours,” Holman said. “If we price matched on that, we’d be losing buckets of money.”

Vancouver residents have mixed reactions to the war of words (and pricing.)

Some are eager to take advantage of the competitive price war, and are dropping Novus for a year’s worth of service from Shaw at a fraction of the regular price, citing the savings during the current economic climate.

Others defend Shaw’s aggressive pricing as competition, brutal as it might appear, doing its job in reducing prices for consumers. Some have suggested the aggressive rate cutting exposes the enormous profit margins enjoyed by the cable industry, particularly pointing to Shaw’s comments that they are not losing money, even at the low prices they are charging in certain areas of Vancouver, as clear evidence of the gouging that goes on elsewhere in cable pricing.

But some Vancouver residents are defending “the little guy,” upset that Shaw may be using its market power and presence across western Canada to put an upstart like Novus out of business.

One CBC reader summed up the views of Novus defenders:

I’m increasingly annoyed by how heavy-handed Shaw is being in this price war. I qualify for Shaw’s anti-competitive price, but have no intention of switching to get it. If I leave Novus now then I’d be playing right into Shaw’s dream of a city-wide monopoly.

And that’s before I even start to mention the aggression of Shaw’s sales tactics. Green-shirted employees on every street corner downtown, bugging me multiple times as I walk from point A to point B on a weekly basis. Two or three pieces of junk mail a week that get around the red dot I have in my mailbox that indicates I Do Not Want Junk Mail, because they’re addressed to Current Occupant.

I’m all for healthy competition, but this ain’t it.

A few Novus customers have found a happy middle ground while the war plays out in the courtroom. They contacted Novus and asked them to match Shaw’s prices:

Novus customers who are tempted to switch should contact Novus, as they will match the deal. That is what I did, and I am now paying $10 bucks a month for 20Mbps (23.79 according to Speedtest.net) download speed. My total Internet bill over the next year will be $120 for a service that is equivalent to Shaw’s “High Speed Warp” package, a service that costs $94 a month! That’s the apples to apples comparison, and it works out to be a $1000 savings for Novus customers.

I felt really guilty asking Novus to match, since I am extremely happy with their service and was paying a very reasonable $30 a month. But it’s hard to pass up a deal like that, and I will do my best to spread the gospel about how much better value Novus is over Shaw, and especially Telus and Bell. Healthy competition is great, but I do hope the CRTC steps in to ensure Novus isn’t bullied out of the market.

Telus hasn’t gotten involved because they are more concerned with selling the worst service at the highest price, while Bell is busy pitching you on how fast their service is to your face, and then throttling your speed behind the scenes to the point where Google has come out against them. I haven’t had any bad experiences with Shaw myself, but Novus is a real gem.

So those of you who live in downtown Vancouver should do the logical thing, and stick with Novus. You have access to a service that most people across North America, let alone Canada, drool over.

Subscribe

Subscribe