AT&T Mobility has news for its customers: “You’ll be hearing something from us in the near future,” says AT&T Mobility CEO Ralph de la Vega. He was speaking about an end to “unlimited” usage of its wireless network. Stop the Cap! reader Jeremy learned about it and sent word our way.

Of course, AT&T has always reserved the right to impose overlimit fees or terminate accounts that exceed 5 gigabytes per month, but most of the horror stories about enormous bills come from consumers using AT&T’s wireless broadband service on a computer. For iPhone users, who are force-fed a mandatory $30 monthly “unlimited” data plan, their wireless usage has not been subjected to an AT&T crackdown for whatever they consider “excessive” that month.

But that is likely to change, and soon. De la Vega warned listeners on a conference call held this week that AT&T’s considerations of ways to deal with extreme bandwidth users are “all in flux, but we will come up with ways that mitigate the [network] impact we’ve seen by a small number of customers who are driving inordinate usage.”

The company has been holding focus groups about Internet Overcharging schemes, trying to conjure up a public relations message that consumers will be duped into believing is fair. They’ve tested everything from meal scenarios to toll roadways, comparing “heavy users” with 18 wheelers and ordinary light users with Mini Coopers, asking participants if they felt it was fair “for the truckers to pay more?” One of our readers clandestinely participated in one of these, and managed to debunk their nonsense over a free lunch, with consumers incensed to discover the tolls they are charging are ludicrously profitable even at current rates.

When facts about Internet Overcharging are revealed, it’s not a question of who should pay more — it’s a demand to know why everyone isn’t paying less -and- why companies like AT&T aren’t investing a greater percentage of their fat profits in expanding their network.

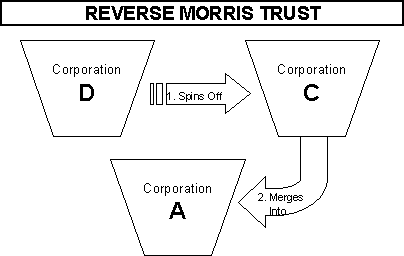

As I’ve written on several previous occasions, it comes as no surprise to me that some companies in the broadband industry have been looking for an excuse to throw all of our “favorite” Internet Overcharging schemes on customers — usage allowances, overlimit fees and penalties, or just throttling your connection to dial-up speeds. As I predicted, some will try an “either/or” scam on consumers, telling them they are “forced” to impose these kinds of profit grabs because the government is demanding Net Neutrality. One has absolutely nothing to do with the other of course, but it’s a convenient excuse to help rally consumers against Net Neutrality now, and impose higher pricing on consumers anyway. It is crucial that consumers do not fall for this ploy. There is no fairness in being overcharged for Internet access, such plans never truly provide “only paying for what you use” pricing, and no one should be willing to give up one for the other. In Canada, they ended up with no Net Neutrality -and- Internet Overcharging schemes, precisely what would happen here.

As has always been the case, AT&T blames a “small percentage” of their users for consuming massive amounts of bandwidth. Earlier this summer it was “three percent of Smartphone users use 40% of AT&T’s wireless network.” The us vs. them mentality is designed to divide consumers into finger pointing camps blaming their neighbors for “the problem” instead of asking pointed questions of the carrier making the claim. Some questions are:

- Exactly how much data do those “heavy Smartphone users” consume?

- What is AT&T’s cost per megabyte/gigabyte to deliver that data to consumers?

- Why does AT&T mandate iPhone customers purchase an “unlimited” data plan and then complain when customers utilize what they are paying for?

- Will AT&T significantly reduce pricing for mandatory data plan customers, or simply throw a usage allowance on existing accounts and expect consumers to pay the same?

- What percentage of AT&T’s profits are spent on their network and its expansion, and has that amount as a percentage increased or decreased in the last five years?

- If AT&T is suffering from smartphone congestion, why continue an exclusive deal for the iPhone, which AT&T claims contributes to a significant amount of that congestion?

- Why does AT&T marketing claim their wireless broadband plans are “unlimited” when, in fact, they are limited to 5 gigabytes of usage per month?

Jack Gold, an analyst at J. Gold Associates, told Computerworld carriers have a legitimate issue in considering an “overage charge,” for users who surpass a certain number of gigabytes of data per month.

“People will complain about an overage charge,” Gold said. “I guarantee complaints, but there’s no other way to deal with it short of building out more networks to give people the bandwidth they crave. There really are bandwidth hogs. You have 5% of the users taking up 90% of the bandwidth sometimes.”

Gold said he agrees with net neutrality rules that allow users to reach any Web site on the Internet, but argued that carriers can’t provide unlimited bandwidth to all users. Doing so “means everybody else is limited … The AT&Ts and Verizons have a legitimate point.”

Of course, Gold is in the business of representing business interests, not consumers. Does Gold have direct evidence of his numbers, or does he simply repeat what he has heard carriers tell him? Since consumers cannot easily find truly unlimited mobile broadband accounts in the American wireless industry today, de la Vega’s urgent statements about imposing limits on customers must target iPhone and other smartphone users specifically, because those are the only accounts AT&T hasn’t held hard to their 5GB usage cap.

Subscribe

Subscribe