Strong opposition to the proposed spinoff of Verizon service in West Virginia to Frontier Communications erupted Monday as the state Public Service Commission (PUC) published a flurry of written testimony filed with the state agency.

Some of the strongest criticism of the deal came from the state’s Consumer Advocate (CAD), an independent division of the PSC that represents residential utility customers. Division director Byron Harris testified the deal carried “too many risks” for the state, and suggested Frontier failed to do its homework before considering the implications of the deal for nearly the entire state’s telephone system. Harris added residents faced higher phone bills, early termination fees, little improvement in service, and was highly skeptical of Frontier’s promises to expand broadband service in the state, suggesting the company will not be in a financial position to offer acceptable “plain old telephone service,” much less broadband.

Harris testimony called on the Commission to reject the deal:

The proposed transaction poses too many risks for retail telephone customers in West Virginia from both a financial and an operational standpoint. The proposed transaction also poses too many risks for Verizon-WV’s wholesale customers and, ultimately, the tens of thousands of West Virginians served by these entities.

In his testimony on behalf of the CAD, Mr. Roycroft [one of two expert consultants hired to analyze the proposed sale] explains the operational difficulties that Frontier will face in assimilating the Spinco properties and operating systems. As Mr. Roycroft makes clear, the operational difficulties associated with a transaction as large as the one proposed are exacerbated by the fact that the proposed transaction – from an operational standpoint – actually involves two mergers in one:

- The acquisition of the legacy Bell Atlantic network and OSS in West Virginia, and

- The acquisition of the old GTE network and systems in 13 other states.

Mr. Roycroft details the multitude of risks that the proposed transaction presents for retail and wholesale telephone customers in West Virginia. Not only do customers face service and service quality risks, but they also face the risk of higher rates and/or other adverse terms and conditions of service such as early termination fees.

Mr. Hill points out, in his testimony, the many unrealistically optimistic financial projections Frontier makes in support of the proposed transaction. As Mr. Hill points out, Frontier’s projections rely too much on financial information that has been provided by the seller, Verizon, without independently verifying Verizon’s numbers. Frontier’s projections similarly rely on a number of assumptions about reducing access line loss, cutting operating expenses and capital expenditures, and realizing merger savings that would require Frontier to substantially reverse recent trends.

The fallout from the proposed merger not going well obviously affects retail and wholesale customers currently served by Verizon-WV and Frontier-WV as well. As discussed below, and in Mr. Roycroft’s testimony, Verizon-WV’s customers already have experienced sharp declines in their service quality, which is the predictable result of years of falling investment in the company’s telephone plant and workforce in West Virginia, as Verizon has focused its attention on other markets in other states and other service offerings, such as wireless service and video/Internet/telephone service provided via its FiOS offering (which is not offered in West Virginia).

The financial and operational risks associated with the proposed transaction jeopardize the combined company’s ability to maintain even current service quality in Verizon-WV’s service territory, let alone follow through on Verizon-WV’s obligation to improve that service quality going forward under the Plan.

Although the CAD obviously is (and has for some time been) concerned with the poor service quality currently provided to customers by Verizon-WV, the CAD believes that service is likely to get even worse under Frontier’s ownership. The proposed transaction will result in a post-closing Frontier that will not have the financial resources to be able to improve service quality for “plain old telephone service” – as voice-grade traditional telephone service is often called – in Verizon-WV’s service territory, much less to deploy broadband to the extent suggested in Frontier’s direct testimony.

Harris likened the deal to Frontier buying a used car from Verizon without knowing what’s under the hood.

Harris likened the deal to Frontier buying a used car from Verizon without knowing what’s under the hood.

“Frontier has essentially agreed to purchase a used car without first having the car examined by a mechanic. Without a thorough investigation of Verizon-WV’s plant, Frontier has no way of knowing whether its buying a pre-owned car that has had regular oil changes and proper tune-ups, or whether it is buying a clunker with a new paint job and a blown transmission. If Verizon-WV’s network has not been properly maintained (as the evidence seems to suggest), just like a car that hasn’t been properly maintained, getting it back to serviceable condition will be a very expensive proposition,” Harris testified.

Harris gave five specific reasons why the deal was bad for West Virginia:

First, Frontier has not done any in-depth analysis of the quality of the Spinco facilities that it is acquiring. This lack of analysis is disturbing on its face, as it would seem to be a fundamental area of inquiry for any prospective buyer. But the importance of this lack of meaningful review is magnified in West Virginia by the fact that Frontier knows, or reasonably should know, that Verizon-WV’s outside plant facilities in West Virginia are not in good shape. The Commission is well aware of the significant decline in service that Verizon- WV’s customers have experienced over the last several years. This decline is documented in the public record (in both the informal complaint records maintained by the Commission’s Staff, and in the record in proceedings related to Verizon-WV’s service quality docketed in the last few years). That record should have triggered a much more searching analysis by Frontier. This lack of analysis also impacts the overly optimistic assumptions that Frontier has used in its financial analysis of the transaction.

Second, Frontier’s overly optimistic financial projections increase the risk that the post-merger company will not be able to remedy Verizon-WV’s current poor service quality or to provide its promised broadband deployment. Verizon is obviously a larger and more financially sound company than Frontier. For a company such as Frontier which historically pays out greater dividends than its net income, the risk that the optimistic financial projections will not transpire is magnified.

Third, as of October 14, 2009, Frontier still had not determined how it will handle the additional call center volumes that will occur when the company acquires access lines in West Virginia. Obviously, the proposed transaction would adversely affect the public if it is approved without a concrete plan to handle service calls from current Verizon-WV customers.

Fourth, similarly, no concrete plan has been put forth by Verizon for serving customers in West Virginia who are currently served out of central offices in Maryland. Again, the proposed transaction would adversely affect the public if it is approved without a concrete plan to serve Verizon-WV customers who are currently served from central offices in Maryland.

Fifth, current Verizon-WV retail customers face the prospect of increased rates and/or early termination fees as a result of having their current package or bundle service migrated to a similar package or bundle offered by Frontier. In discovery, Frontier has to date refused to identify the packages that will be offered to replace current Verizon-WV packages or to state at what price the packages will be offered to such customers. Verizon- WV customers with bundles that include Verizon broadband service also appear to likely face significant early termination fees of at least $120 if they elect not to transition or migrate to Frontier’s service after closing. This likelihood appears even greater when the companies’ obtuse response on this subject is considered. When the CAD asked whether Verizon-WV customers who elected not to remain with Frontier post-closing, would be charged any early termination fees, the companies merely stated that they will “honor the terms of their contracts with customers.” Obviously, “honoring” the terms of a contract that includes an early termination fee could very well mean enforcing that provision of the service agreement.

Hundreds of New York state residents were unfairly charged early termination fees that eventually brought Frontier to the attention of the New York Attorney General’s office, which obtained relief in the form of full refunds for affected New York residents.

Ironically, even though Verizon may seek to exit West Virginia’s landline telephone business, the company will continue to exist as a competitive player in the state — through Verizon Wireless, its mobile telephone division. Verizon Wireless sent letters to customers urging them to terminate their home phone lines. That will spell additional competition for Frontier Communications, as Stephen Hill testified, on behalf of the Consumer Advocate Division:

“Simplify your life and your budget by cutting the cord on your home phone today.” It is reasonable to believe that such a letter coming from the company that had been a customer’s land-line phone service provider urging them to end that type of service and return to their former provider’s wireless service, would have an impact on Frontier’s ability to maintain that customer. The presentations to Frontier’s board of directors regarding the merger do not discuss potential competition from Verizon.

Perhaps the more troubling aspect of Verizon as a formidable competitor, however, is that, under the current post-merger plan, Verizon will continue to operate the billing and back-office functions of most of the local exchange operations sold to Frontier. Under such circumstances, Verizon becomes both a business partner and a competitor of Frontier-a situation that would put Verizon in an even greater competitive position than it would be otherwise (Le., if it weren’t also leasing operating systems to Frontier). Therefore, it is quite possible that, due to competition-in which Verizon is likely to play an important role-the reduction in the rate of revenue decline forecast for the future may not be realized. Instead, the rate of access line loss may accelerate from historical conditions, making the fbture financial picture for a combined Frontier/Spinco more tenuous than now forecast.

Strong opposition also came from other providers, some of whom who may be affected by the sale through wholesale agreements currently in place with Verizon, as well as from the Communications Workers of America (CWA).

Susan Baldwin, who served as Director of Telecommunications for the Massachusetts Dept. of Public Utilities, submitted testimony on behalf of CWA. In her testimony she stated, “If the transaction goes awry, consumers will bear the consequences….Even if the transaction does not go awry, it will adversely affect consumers because Frontier’s financial constraints will prevent it from investing in the WV telecommunications infrastructure.” Baldwin strongly urged rejection of the proposed deal.

David Armentrout, on behalf of FiberNet stated, “Frontier lacks the requisite resources, experience, and incentive to comply with wholesale obligations it will take on …in West Virginia.”

Some companies waived their right to file direct testimony but asserted their right, along with the parties who did file today, to file rebuttal testimony in December.

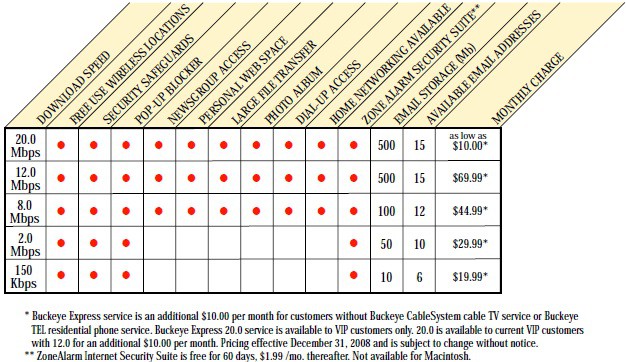

Coming up… The truth about Frontier’s DSL products, network capacity, and why their 5GB Acceptable Use Limit is part of official testimony calling on the Public Service Commission of West Virginia to just say no to Frontier Communications.

Subscribe

Subscribe