Charter Spectrum denies it offers better deals to customers served by fiber-fast internet competitors than those stuck with the phone company’s slow speed DSL as their only alternative:

Charter Spectrum denies it offers better deals to customers served by fiber-fast internet competitors than those stuck with the phone company’s slow speed DSL as their only alternative:

Spectrum doesn’t set rates based on one area or the other, or based on what’s available to customers in specific locations, company spokesman Michael Pedelty said.

“We don’t make decisions based on that,” he said.

But Stop the Cap! has repeatedly found that with respect to promotional pricing, offered to entice customers to switch, that is not true.

“It is easy for any customer checking Spectrum’s new customer rates to test this for themselves,” said Stop the Cap!’s Phillip Dampier. “We did (again), and confirmed your street address and the providers that compete for your business make all the difference whether you are going to get a good deal or not.”

That is important because when providers won’t budge on regular prices, your only alternative is to switch. Some customers repeatedly bounce between providers to get a better deal. The savings can be dramatic. A customer with 400 Mbps internet-only service that remains with Spectrum for three years on a good three-year promotion will save more than $3,000 over customers that are offered only a one year promotion from Spectrum because their only other choice was DSL from the phone company.

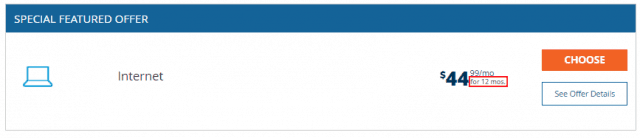

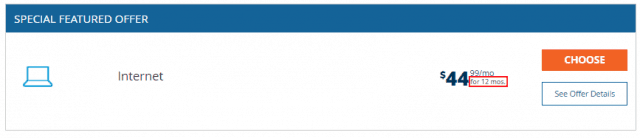

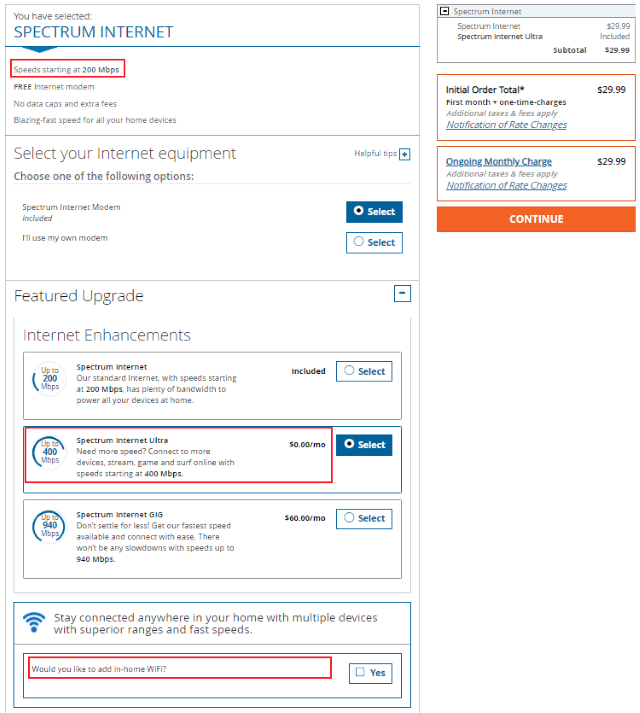

At Stop the Cap! headquarters in Rochester, N.Y., there is only one choice for broadband service — Charter Spectrum. Frontier Communications, the incumbent phone company, still only offers 3 Mbps DSL at this location, despite it being less than one mile from the Rochester city line. Spectrum does not see low-speed DSL as a competitive threat, because entering our address as a new customer brought forth this blasé offer for internet-only service, good for 12 months:

Notice this promotion is good for 12 months.

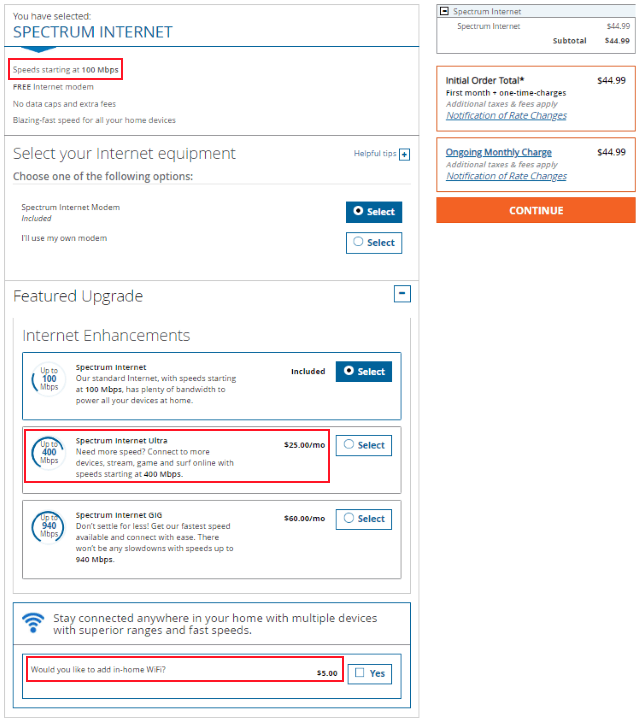

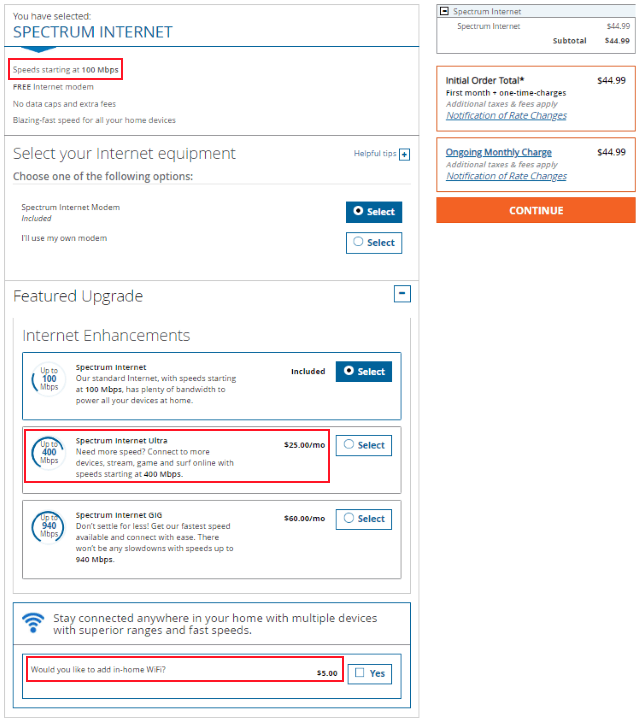

This offer is for 100 Mbps service. An upgrade to Ultra costs an extra $25 a month for 400 Mbps. Notice also, the Wi-Fi feature enabled on their router/modem equipment is $5 extra a month.

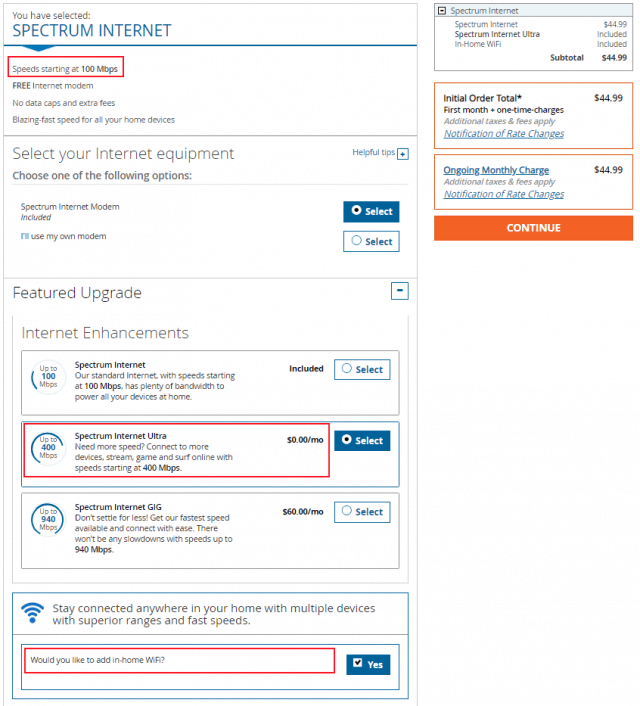

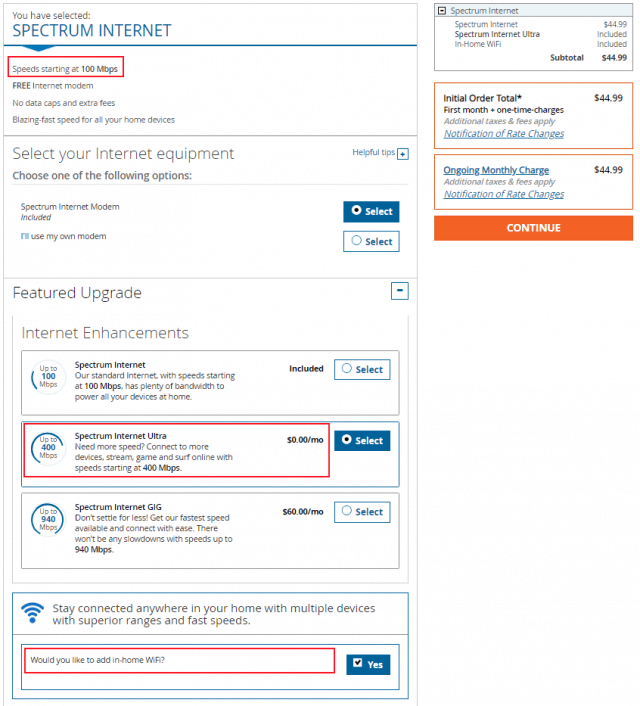

Across the street from us, the competitive situation is a little different. Neighbors have a choice of three providers — Charter Spectrum, Frontier DSL, or Greenlight’s fiber to the home network. Greenlight changes everything for Spectrum, as this new customer offer across the street illustrates:

Notice this promotion is also $44.99 a month, but is good for two years instead of one.

Notice the promotion is also for 100 Mbps, but check out the FREE upgrade to 400 Mbps, a $25 savings just because there is more serious competition. Also notice the $5 monthly Wi-Fi charge is gone.

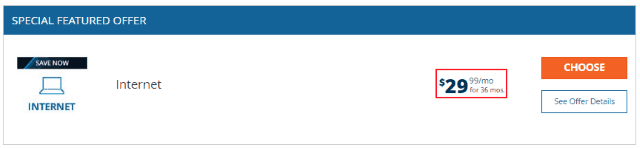

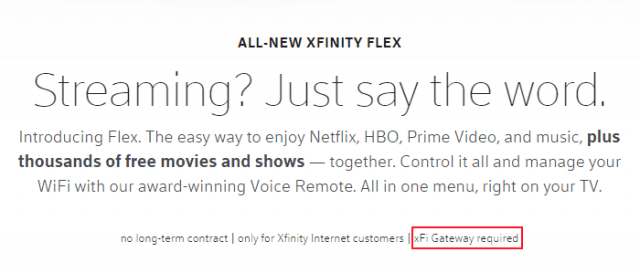

Where Google Fiber offers service (or offered, in the case of Louisville, Ky.) in addition to high-speed internet from the phone company, Spectrum’s promotions are even better:

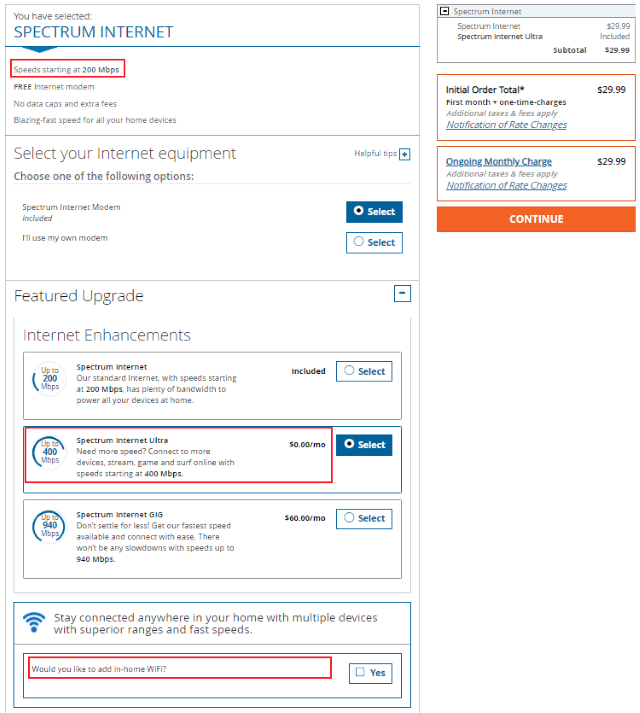

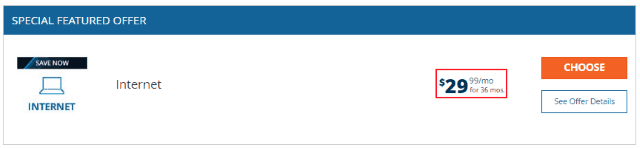

This deal is for $29.99 and is good for THREE years.

This promotion begins with 200 Mbps service, but offers a FREE upgrade to 400 Mbps and that pesky $5 a month Wi-Fi fee is nowhere to be found.

In short, any claim that Spectrum does not target different promotional pricing offers based on the competitive landscape on the ground is provably false. The evidence is right here.

Now let us consider how the cost of no competition will empty your wallet:

- Non-Competitive Pricing – 400 Mbps service with Wi-Fi: $74.99/month for 12 months; $95.99/month for next 24 months ($90.99 internet, $5 Wi-Fi)

- One Competitor Pricing – 400 Mbps service with Wi-Fi: $44.99/month for 24 months; $95.99/month for next 12 months ($90.99 internet, $5 Wi-Fi)

- Two Competitor Pricing – 400 Mbps service with Wi-Fi: $29.99/month for 36 months

Assuming you remained a customer for 36 months, paying regular prices after two of these promotions expired, here is what you would pay in full based on the latest rate card and advertised pricing (mostly the additional $5/mo Wi-Fi fee after a promo expires):

- Non-Competitor Pricing: $4,103.52¹

- One Competitor Pricing: $2,231.64² which delivers a savings of $1,871.88 over three years because of presence of one serious competitor.

- Two Competitor Pricing: $1,079.64³ which delivers a savings of $3,023.88 over three years because of the presence of Google Fiber and one other serious competitor.

¹$74.99 x 12 = $899.88; $95.99 x 24 = $3203.64

²$44.99 x 24 = $1079.76; $95.99 x 12 = $1151.88

³$29.99 x 36 = $1079.64

Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal.

Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal. Louisiana

Louisiana

Subscribe

Subscribe One of Frontier Communication’s largest legacy service areas is suffering from some of the same bad service reported by rural communities in states like California, Minnesota, and Florida.

One of Frontier Communication’s largest legacy service areas is suffering from some of the same bad service reported by rural communities in states like California, Minnesota, and Florida.

Charter Spectrum denies it offers better deals to customers served by fiber-fast internet competitors than those stuck with the phone company’s slow speed DSL as their only alternative:

Charter Spectrum denies it offers better deals to customers served by fiber-fast internet competitors than those stuck with the phone company’s slow speed DSL as their only alternative: