The Federal Communications Commission has concluded allowing AT&T and T-Mobile to merge will cause huge job losses and knock out a vital wireless competitor in an increasingly concentrated U.S. wireless marketplace.

The new 266-page document, produced by FCC staffers, directly challenges AT&T’s contention that the merger will bring about job creation and an improved mobile broadband network for millions of rural Americans.

The report comes on the heels of news the Commission will allow the FCC to withdraw its pending application before the FCC to win approval of the merger. That allows the company to resubmit the merger request at a later date.

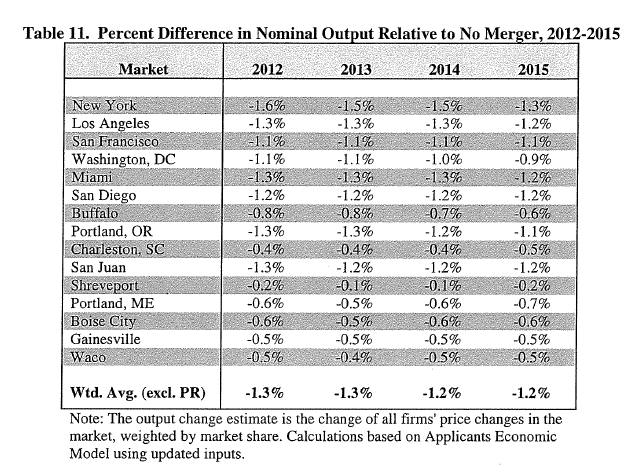

The FCC determined prices will increase an average of 6-7% in these cities if the merger deal gets approved.

The new report, occasionally redacted to remove competitive information, found AT&T vastly exaggerating the benefits of the deal, questioning whether it would indeed lead to lower prices for consumers, bring about enhanced service, and create new jobs.

Overall, the agency concludes, AT&T and T-Mobile have failed to meet their burden of proof that the merger is in the public interest. The FCC staffers found no compelling reason why AT&T needed T-Mobile to build out its 4G network to the majority of the country. Indeed, memos accidentally leaked to the Commission by AT&T’s legal team suggested AT&T executives rejected expansion plans as too costly. Instead, they proposed a $39 billion dollar merger with T-Mobile with a $6 billion deal cancellation clause. That penalty exceeds the $3.8 billion AT&T rejected spending to pursue 4G upgrades on its own.

Among the Commission report’s findings:

Among the Commission report’s findings:

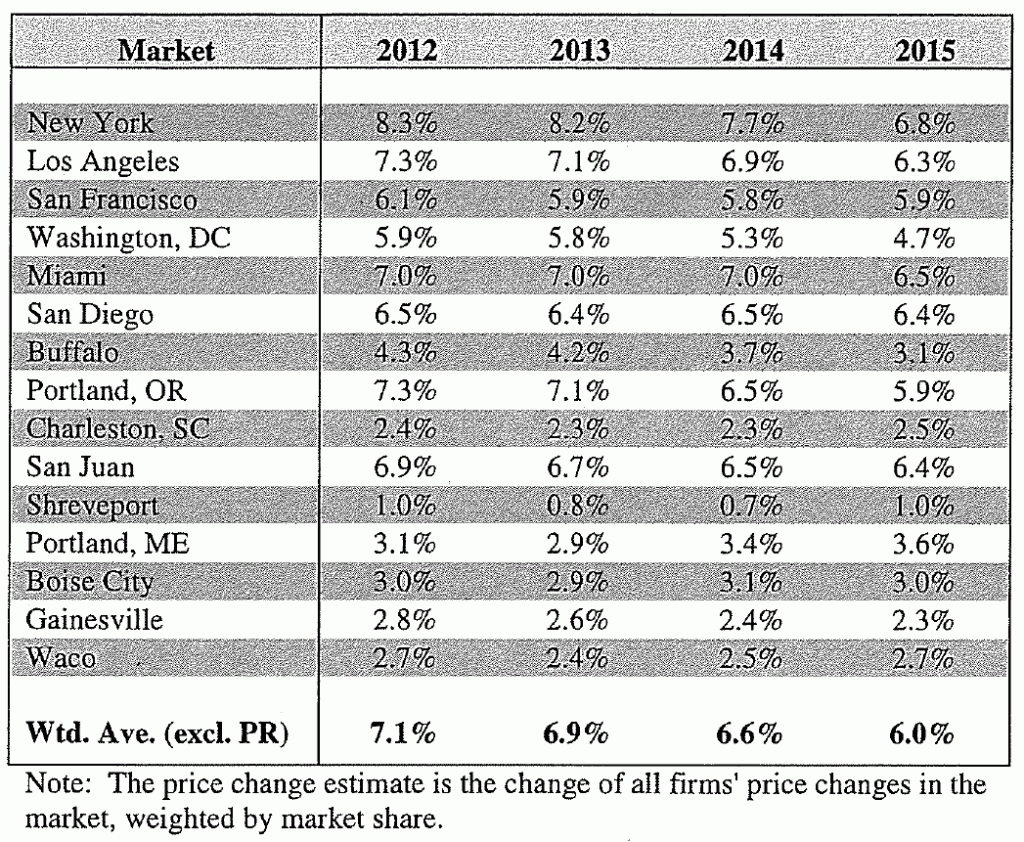

- The merger would increasingly concentrate the U.S. wireless marketplace, leading to unilateral and coordinated efforts to raise prices by remaining carriers;

- Roaming agreements for remaining smaller and regional carriers could become more difficult and expensive to reach with fewer players in the marketplace;

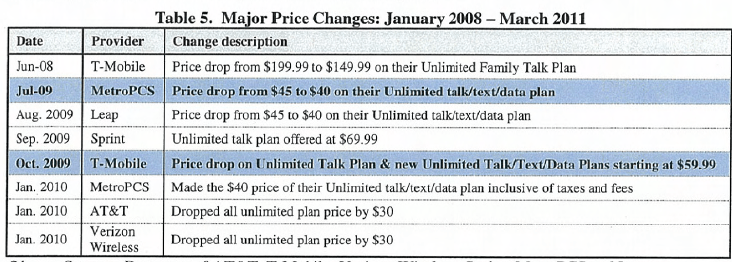

- Pricing innovation, a hallmark of T-Mobile, would be lost. T-Mobile is cited by the FCC as one of America’s most-disruptive carriers, forcing other companies to match their aggressive offers;

- Despite AT&T’s promises to grandfather existing T-Mobile customers to their existing plans, customers would be unable to upgrade to an equally innovative plan T-Mobile probably would have offered on its own. Instead, customers would be forced to choose one of AT&T’s more expensive, traditional plans;

- AT&T is overstating the importance of remaining competitors, especially regional carriers and Leap Wireless’ Cricket and MetroPCS, which all have a negligible market share and depend heavily on roaming agreements with companies like Verizon, Sprint, and AT&T to survive;

- Substantial evidence exists to believe without T-Mobile, AT&T and Verizon Wireless would likely raise prices and mimic each others’ respective service plans, pricing, usage allowances, and network policies;

- Sprint will probably be forced to raise prices as a consequence of the merger to pay for increasingly expensive backhaul and roaming services, often purchased from AT&T or Verizon. Sprint would also be pressured by market forces into pricing its services closer to AT&T and Verizon, if only to pay for handset and subscriber acquisition costs. Sprint’s new customers often come from T-Mobile or smaller providers — less often from AT&T and Verizon.

- AT&T did not submit sufficient evidence to demonstrate the combination of T-Mobile and AT&T’s cell sites would substantially relieve congestion issues, especially in America’s largest cities where AT&T’s network issues are the worst;

- AT&T’s own documents suggest the company will fire most of T-Mobile’s customer service staff post-merger, leading ironically to the loss of a customer service support unit that has a higher customer satisfaction rating than AT&T itself. Not only would T-Mobile customers be forced to deal with AT&T’s customer service, AT&T customers will have to compete with millions of T-Mobile customers for the time and attention of AT&T’s existing customer service representatives — a recipe for a congestion of a different kind;

- Much of the cost savings realized from the merger, earned from laying off T-Mobile workers, closing T-Mobile retail stores, terminating reseller agreements, and unifying billing, administration, and network technologies, will be realized by AT&T (and its shareholders), not average customers. The end effect for consumers will be higher prices and a deteriorating level of customer service.

Smaller, scrappier carriers with aggressive pricing have historically forced larger companies like AT&T and Verizon to compete by lowering prices and offering more generous calling and data plans.

The report angered AT&T’s chief lobbyist, Jim Cicconi, who called its release “troubling” because, in his words, it represents a “staff draft” not voted on by the Commission as a whole.

“It has no force or effect under the law, which raises questions as to why the FCC would choose to release it,” Cicconi said in a statement. “The draft report has also not been made available to AT&T prior to today, so we have had no opportunity to address or rebut its claims, which makes its release all the more improper.”

But the report’s substantial research suggests FCC staffers have taken a very close look at the arguments and the evidence submitted by AT&T, T-Mobile and opponents of the deal. The findings only favor AT&T and T-Mobile with a mild agreement that combining resources in certain markets where both compete might reduce network redundancy. But the cost to consumers is way too high, the report concludes.

Sprint couldn’t be happier with the report’s findings, saying in a statement:

“The investigation’s findings are clear. Approval of AT&T’s bid for T-Mobile would lead to higher prices for consumers, eliminate jobs, harm competition, and dampen innovation across the wireless industry.”

An unredacted copy of the findings will be available to the U.S. Department of Justice for its consideration as it presses its own legal case against AT&T to derail the merger on anti-competitive grounds.

Subscribe

Subscribe