Comcast will announce later this morning it has reached an agreement to acquire all of Time Warner Cable in an all-stock deal worth $44 billion.

Comcast will announce later this morning it has reached an agreement to acquire all of Time Warner Cable in an all-stock deal worth $44 billion.

If approved by regulators, Comcast will dramatically increase its size as the nation’s largest cable operator with over 33 million subscribers — vastly outnumbering every other cable company in the country. It also likely means Time Warner Cable broadband subscribers will eventually be subject to Comcast’s usage caps and overlimit fees, now being market tested around the country.

The offer of $159 a share for Time Warner Cable stock – $1 less than what TWC CEO Rob Marcus demanded for a buyout – is far higher than the $133 a share in cash and stock offered earlier by Charter Communications.

Tonight’s revelation that Time Warner Cable and Comcast reached a deal, first reported by CNBC, likely caught Charter by surprise. Charter had tried to acquire Time Warner Cable for months, going as far as nominating candidates for TWC’s board of directors that could have influenced a sale of the company. At the same time, Charter thought it was negotiating a friendly deal with Comcast to divide Time Warner Cable territories between the two companies.

Time Warner Cable management offered no clues they were negotiating with Comcast and delivered a presentation to shareholders last week promising major upgrades for Time Warner customers and future success as a standalone cable operator. All of those plans are now in doubt.

Time Warner Cable management offered no clues they were negotiating with Comcast and delivered a presentation to shareholders last week promising major upgrades for Time Warner customers and future success as a standalone cable operator. All of those plans are now in doubt.

Comcast and Time Warner Cable reportedly believe the deal will quickly pass any antitrust review before the end of the year because neither company competes in the same markets, but Comcast will offer to divest a token three million subscribers from the combined company, according to sources.

The FCC formerly limited cable companies from owning or controlling more than 30% of the cable industry, but Comcast successfully sued to have that ownership cap overturned. A belief the deal would present looming antitrust problems could be grounds for the U.S. Department of Justice to oppose the deal, likely terminating it.

Consumer groups hope the deal gets derailed as soon as possible.

Consumer groups hope the deal gets derailed as soon as possible.

“In an already uncompetitive market with high prices that keep going up and up, a merger of the two biggest cable companies should be unthinkable,” said Free Press president Craig Aaron. “This deal would be a disaster for consumers and must be stopped. No one woke up this morning wishing their cable company was bigger or had more control over what they could watch or download. But that — along with higher bills — is the reality they’ll face tomorrow unless the Department of Justice and the FCC do their jobs and block this merger. Stopping this kind of deal is exactly why we have antitrust laws.”

Subscribe

Subscribe

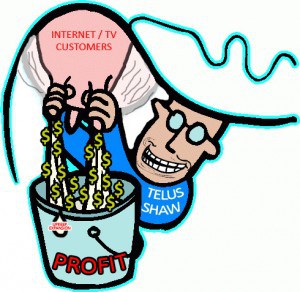

Bigger discounts can be had for television and Internet service — cable television remains immensely profitable in Canada and broadband is cheap to offer, especially in cities. Americans often pay $80 or more for digital cable television packages, Canadians pay an average of $60.

Bigger discounts can be had for television and Internet service — cable television remains immensely profitable in Canada and broadband is cheap to offer, especially in cities. Americans often pay $80 or more for digital cable television packages, Canadians pay an average of $60.

The U.S. Department of Labor has

The U.S. Department of Labor has

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”;

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”; “If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.

“If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.