While AT&T is in no hurry to expand and upgrade U-verse broadband to its wireline customers in the United States, the Dallas-based company has spent more than $7 billion trying to attract wireless customers in Mexico that so far don’t show much interest in the U.S. company.

While AT&T is in no hurry to expand and upgrade U-verse broadband to its wireline customers in the United States, the Dallas-based company has spent more than $7 billion trying to attract wireless customers in Mexico that so far don’t show much interest in the U.S. company.

AT&T last month reported it is losing big south of the border. After spending $4.4 billion to acquire two competing wireless companies in Mexico and committing another $3 billion to upgrade their networks to 4G service, customers are continuing to abandon the carrier.

The losses AT&T continues to incur improving wireless service in Tabasco, Veracruz, and Baja California has not bothered AT&T to date — in fact the company plans to dump even more money into the Mexican cellular market, despite achieving a market share of only around 8.5 percent, effectively making it about as relevant as Sprint in the United States. Its largest competitors are the gigantic América Móvil, which has nearly 70 percent of the market and Telefónica, which holds a 22 percent share.

So far, AT&T has been forced to support different websites for its two different carriers – Iusacell and Nextel Mexico. The former also maintains the Unefon brand, which targets low income Mexicans with cheap prepaid service.

Part of AT&T’s problem recouping its investment is the fact Mexicans cannot afford the pricing Americans pay for cell service. While AT&T charges $50+ for a low-end cell plan in Texas, just across the Mexican border AT&T offers a $13 basic plan offering 500 calling minutes and 500MB of data.

AT&T’s decision to spend billions in Mexico while it reduces spending on further expansion of its U-verse network has nothing to do with Net Neutrality or Title II enforcement by the Federal Communications Commission. It is all about finding new customers. Wireless penetration has now topped 100 percent in the U.S. (because some families maintain multiple devices, sometimes with different carriers). In Mexico, less than 50% of the population has a cell phone and even fewer own smartphones. AT&T believes that gives it plenty of room to grow. AT&T believes wireless service brings the best potential for profits both inside and outside of the U.S., and the company thinks it can dramatically improve market share in Mexico and charge prices that will bring it a healthy return.

AT&T’s decision to spend billions in Mexico while it reduces spending on further expansion of its U-verse network has nothing to do with Net Neutrality or Title II enforcement by the Federal Communications Commission. It is all about finding new customers. Wireless penetration has now topped 100 percent in the U.S. (because some families maintain multiple devices, sometimes with different carriers). In Mexico, less than 50% of the population has a cell phone and even fewer own smartphones. AT&T believes that gives it plenty of room to grow. AT&T believes wireless service brings the best potential for profits both inside and outside of the U.S., and the company thinks it can dramatically improve market share in Mexico and charge prices that will bring it a healthy return.

Their customers apparently disagree. In Mexico, for the first nine months of the year, AT&T lost 689,000 wireless subscribers — a decline of almost 8 percent. Even customers attracted to try AT&T for the first time often decide to leave, giving AT&T Mexico a churn rate exceeding 5% — five times worse than what AT&T experiences in the United States.

Their customers apparently disagree. In Mexico, for the first nine months of the year, AT&T lost 689,000 wireless subscribers — a decline of almost 8 percent. Even customers attracted to try AT&T for the first time often decide to leave, giving AT&T Mexico a churn rate exceeding 5% — five times worse than what AT&T experiences in the United States.

Some Wall Street analysts are critical of AT&T throwing good money after bad down south. Michael Hodel of Morningstar doesn’t like what he sees. The incumbent Mexican telecom giant América Móvil has kept the lion’s share of the market for years and has vastly more scale than AT&T. Hodel sees losses for AT&T until 2018.

Others wonder how AT&T Mexico will be able to introduce the premium priced services it will depend on to get a return on its investment. The Mexican economy is unlikely to allow customers to pay substantially more for wireless service.

Others wonder how AT&T Mexico will be able to introduce the premium priced services it will depend on to get a return on its investment. The Mexican economy is unlikely to allow customers to pay substantially more for wireless service.

AT&T CEO Randall Stephenson has told investors if AT&T builds a 4G network, customers will come and pay AT&T’s asking price.

“We are convinced that what we experienced in the U.S., we will experience in Mexico,” Stephenson said at an investor conference in May. “So you are going to see the mobile Internet revolution take off in Mexico. We intend to ride that wave.”

Free trade supporters and those who support the deregulation of the Mexican telecom market are trying to use AT&T’s experience as evidence that free markets and trade works.

“AT&T’s moves are the clearest evidence of success in Mexico’s reforms, and it’s hard to overstate the importance,” said Christopher Wilson, deputy director of the Mexico Institute at the Woodrow Wilson International Center for Scholars in Washington.

For customers, it isn’t a matter of free trade. It’s good coverage at a reasonable price that matters most, and AT&T Mexico has not yet achieved that.

Arturo Diaz, originally an Iusacell customer in Mexico City, recently dropped his AT&T Mexico service.

“Their coverage is not very good outside of large cities and AT&T’s reputation is to raise prices, which they seem to do a lot in the U.S.,” Diaz said. “If you can afford a better phone and plan, you switch to América Móvil. With the stronger American dollar, the peso is devalued again, so more people will likely want a budget prepaid plan which they can get from Telcel. I’m not sure what AT&T is doing in Mexico and their plans from two different companies are a mess. I signed up with América Móvil last month.”

Subscribe

Subscribe

In the first quarter under Drahi, SFR boosted margins by 21% based on ruthless cost cutting. But a stunning 445,000 customers quickly left the operator. Critics contend Drahi’s cost cutting does temporarily boost profits, but also allows network quality to degrade, eventually alienating customers who leave. Drahi then uses SFR’s smaller customer base as an excuse for further cost-cutting. Between 2006-2011, Drahi eliminated half of the wireless provider’s workforce and outsourced much of his call center customer support operations.

In the first quarter under Drahi, SFR boosted margins by 21% based on ruthless cost cutting. But a stunning 445,000 customers quickly left the operator. Critics contend Drahi’s cost cutting does temporarily boost profits, but also allows network quality to degrade, eventually alienating customers who leave. Drahi then uses SFR’s smaller customer base as an excuse for further cost-cutting. Between 2006-2011, Drahi eliminated half of the wireless provider’s workforce and outsourced much of his call center customer support operations. “He’s a beast,” one employee told LeJDD

“He’s a beast,” one employee told LeJDD  Call centers that handle customer service requests were “on the verge of suffocation,” reported LeJDD. One small call center operator had to send his attorney to SFR’s offices to threaten them over an outstanding bill of one million euros. Drahi demanded an immediate 35% discount if the attorney wanted to leave with a check in hand.

Call centers that handle customer service requests were “on the verge of suffocation,” reported LeJDD. One small call center operator had to send his attorney to SFR’s offices to threaten them over an outstanding bill of one million euros. Drahi demanded an immediate 35% discount if the attorney wanted to leave with a check in hand. LeJDD

LeJDD  Verizon Wireless has informed employees Wednesday that its national operation will be reorganized resulting in significant job cuts.

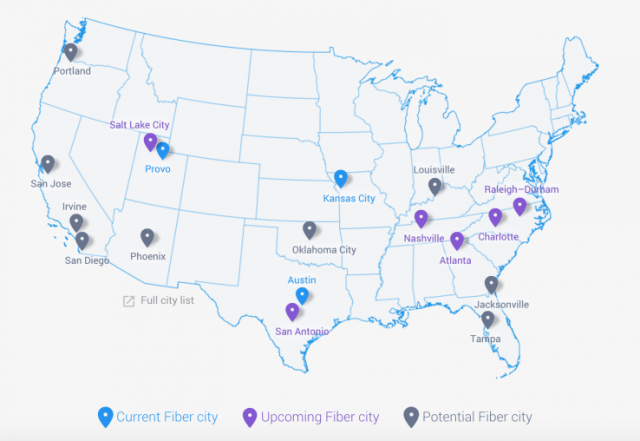

Verizon Wireless has informed employees Wednesday that its national operation will be reorganized resulting in significant job cuts. Google Fiber today

Google Fiber today

“I think Verizon needs to hear from the American people,” Sanders added. “We want them to create more broadband. We want them to pay their workers a decent wage. We want them to sit down and negotiate a decent contract.”

“I think Verizon needs to hear from the American people,” Sanders added. “We want them to create more broadband. We want them to pay their workers a decent wage. We want them to sit down and negotiate a decent contract.”