Cable One, the Phoenix-based mid-sized cable operator serving some of the poorest communities in the country is charging some of the nation’s highest prices for broadband service, raking in an unprecedented 47% margin in the fourth quarter of 2017, the highest in the cable industry.

Cable One, the Phoenix-based mid-sized cable operator serving some of the poorest communities in the country is charging some of the nation’s highest prices for broadband service, raking in an unprecedented 47% margin in the fourth quarter of 2017, the highest in the cable industry.

That growth has come courtesy of CEO Julie Laulis, who has doubled down on data caps — automatically enrolling customers in higher priced plans if they exceed data caps three times in any 12-month period, raised prices, and ended most new customer and customer retention promotions in favor of ‘take it or leave it‘ pricing, especially on broadband service. Laulis has also decided to devote most of Cable One’s marketing efforts on selling broadband service, while de-emphasizing cable television. As a result, customers dissatisfied with Cable One’s lineup are encouraged to leave quietly.

Because video programming is costly to provide and broadband is relatively cheap to offer, the more the company can extract from its internet customers, the higher the profits earned. In 2011, cable television represented 49.1% of Cable One’s $779 million in revenue, with residential and commercial broadband comprising 34%. Today, 57% of Cable One’s $960 million in revenue comes from selling internet service. Cable One not only de-emphasized its video business, it also raised prices on internet service to further enhance earnings.

New customers coming to Cable One can subscribe to an entry-level broadband plan of 100 Mbps with a 300 GB monthly data cap for $55 a month. There are no discounts or promotions on this plan. But Cable One also requires customers to lease ($10.50/mo.) or buy an added-cost cable modem, raising the price higher. To prevent customers from taking advantage of promotions on higher speed products, Cable One requires customers to disconnect from service for a full year before being considered a new customer once again.

Laulis

Cable One has been able to raise prices and attach stingy usage caps to customers primarily because there are no good alternatives in the rural markets it prefers. One analyst said 77% of Cable One’s customers are in largely rural areas of Arizona, Idaho, Illinois, Missouri, Montana and Oklahoma. But prices are clearly getting too high for some, because the company lost more video and phone customers that it gained in new broadband subscriptions during the fourth quarter of 2017.

The fact Cable One broadband is now considered by many subscribers to be “too expensive” is also reflected by the extremely anemic broadband growth at Cable One. In 2017, the company added just 1.5% to its residential broadband customer base, despite very limited competition from phone companies.

MoffettNathanson’s Craig Moffett has complained all winter that Cable One is sacrificing broadband subscriber growth in favor of profits from price increases.

“[Cable One has] the most limited broadband competition of any publicly traded operator, and they have the lowest starting penetration,” Moffett told his investors. “Should they not be growing broadband the fastest of anyone? If price elasticity is greater than anyone thinks, how long is the runway, not just for Cable One, but for any operator choosing a strategy of price increases rather than unit growth?”

Cable One is also squeezing its newest customers at its latest acquisition – NewWave, which now features pricing very similar to Cable One. It recently started to turn over past due NewWave customers to collections after going 40 days past due. Previously, it was 90 days before account holders were threatened with cancellation and collections.

For now, NewWave’s introductory offer remains: 100 Mbps High-Speed Internet is $39 for the first three months before these rates kick in:

Subscribe

Subscribe

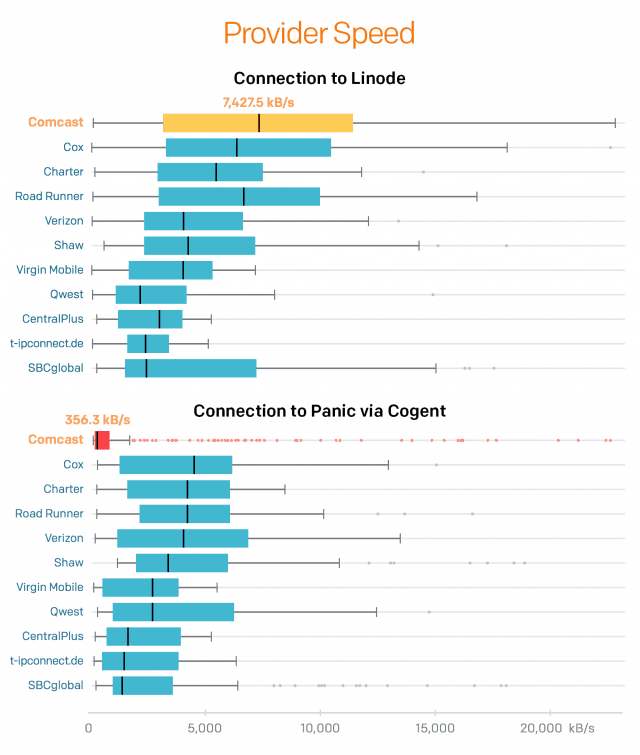

Comcast is raising internet speeds of several of its XFINITY internet service plans in the northeastern United States as it continues to battle Verizon’s fiber to the home network FiOS.

Comcast is raising internet speeds of several of its XFINITY internet service plans in the northeastern United States as it continues to battle Verizon’s fiber to the home network FiOS. The country’s largest cable internet service provider needed help from an app developer in Portland, Ore. to let it know its broadband pipes were full and to do something about it.

The country’s largest cable internet service provider needed help from an app developer in Portland, Ore. to let it know its broadband pipes were full and to do something about it.

In addition to giving the internet public policy community new evidence that peering fights leaving customers stuck in the middle might be heating up once again. It also suggests if Comcast was unaware of the problem, it does not reflect well on the cable company to wait weeks until a customer reports such a serious slowdown before fixing it.

In addition to giving the internet public policy community new evidence that peering fights leaving customers stuck in the middle might be heating up once again. It also suggests if Comcast was unaware of the problem, it does not reflect well on the cable company to wait weeks until a customer reports such a serious slowdown before fixing it.

“I shouldn’t have been surprised to learn industry completely re-wrote proposed broadband legislation to their favor as a ‘substitute bill’ in legislative committee today,” Orr wrote on her Facebook page on Feb. 19. “The substitute bill is substantially different than the original bill. And it wasn’t posted online or anywhere for anyone except insiders to have access to. CenturyLink and Spectrum are bullies. It’s wrong, and they are hurting Cheyenne and other Wyoming communities from gaining affordable access.”

“I shouldn’t have been surprised to learn industry completely re-wrote proposed broadband legislation to their favor as a ‘substitute bill’ in legislative committee today,” Orr wrote on her Facebook page on Feb. 19. “The substitute bill is substantially different than the original bill. And it wasn’t posted online or anywhere for anyone except insiders to have access to. CenturyLink and Spectrum are bullies. It’s wrong, and they are hurting Cheyenne and other Wyoming communities from gaining affordable access.”