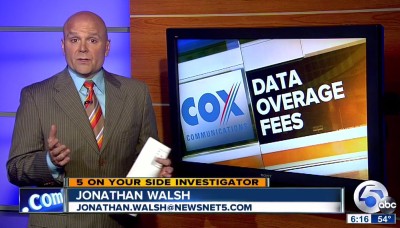

Stopping Cox’s money party from getting started, if we can help it.

Stop the Cap! today formally declares war on Cox’s usage cap experiment in Cleveland, Ohio and will coordinate several protest actions to educate consumers about the true nature of usage-based billing and how they can effectively fight back against these types of Internet Overcharging schemes.

Time Warner Cable quickly learned it was deeply mistaken telling customers that a 40GB monthly usage allowance was more than 95% of customers would ever need when introducing a similar concept April 1, 2009 in test markets including Rochester, N.Y., Austin and San Antonio, Tex., and Greensboro, N.C. The company repeatedly suggested only about five percent of customers would ever exceed that cap.

Six years later, it is likely 95% of customers would be paying a higher broadband bill to cover applicable overlimit fees or be forced to upgrade to a more expensive plan to avoid them. Before Time Warner realized the errors of its way, it claimed with a straight face it was acceptable to charge customers $150 a month for the same unlimited broadband experience that used to cost $50.

Cox’s talking points for customers and the media frames usage caps as a fairness enforcement tool. It is a tired argument and lacks merit because nobody ever pays less for usage-capped broadband service. At best, you pay at least the same and risk new overlimit charges for exceeding an arbitrary usage allowance created out of thin air. At worst, you are forced by cost issues to downgrade service to a cheaper plan that comes with an even lower allowance and an even bigger risk of facing overlimit fees.

Industry trade journal Multichannel News, which covers the cable industry for the cable industry does not frame usage caps in the context of fairness. It’s all about the money.

“If you’re a cable operator, you might want to strike [with new usage caps] while the iron is hot,” said MoffettNathanson principal and senior analyst Craig Moffett, a Wall Street analyst and major proponent of investing in cable industry stocks.

Multichannel News warned operators they “must tread carefully in how they deliver the usage-based message.” Instead of getting away with punitive caps, Time Warner Cable had to “rethink” its definition of fairness, keeping prices the same for heavy users of bandwidth but offering discounts to customers whose usage was lighter. No money party for them.

So how did Cox frame its message in the pages of an industry trade journal to fellow members of the cable industry? Was it about fairness or collecting more of your money. You decide:

Customers will be notified of their data usage and any potential overages beginning in mid- June but won’t have to pay for overages until the October billing cycle, a Cox spokesman said. That gives customers the chance either to alter their usage or step up to a more data-intensive plan. The additional charges serve as a temporary step-up plan for certain consumers, the spokesman said — they can keep their current level of service and pay the additional fee during months when usage spikes, like when their kids come home from college.

The Government Accounting Office, charged with studying the issue of data caps, found plenty to be concerned about. Consumers rightfully expressed fears about price increases and confusion over data consumption issues. In short, customers hate the kind of usage-based pricing proposed by Cox. It’s a rate hike wrapped in uncertainty and an important tool to discourage consumers from cutting their cable television package.

The Government Accounting Office, charged with studying the issue of data caps, found plenty to be concerned about. Consumers rightfully expressed fears about price increases and confusion over data consumption issues. In short, customers hate the kind of usage-based pricing proposed by Cox. It’s a rate hike wrapped in uncertainty and an important tool to discourage consumers from cutting their cable television package.

It’s also nakedly anti-competitive because Cox has conveniently exempted its television, home phone, and home security products from its usage cap. Subscribe to Cox home phone service? The cap does not apply. Use Ooma or Vonage? The cap does apply so talk fast. If a customer wants to use Cox’s Home Security service to monitor their home while away, they won’t eat away their usage cap. If they use ADT to do the same, Cox steals a portion of your usage allowance. Watch a favorite television show on Cox cable television and your usage allowance is unaffected. Watch it on Netflix and look out, another chunk is gone.

While Cox starts rationing your Internet usage, it isn’t lowering your price. A truly fair usage plan would offer customers a discount if they voluntarily agreed to limit their usage. But nothing about Cox’s rationing plan is fair. It’s compulsory, so customers looking for a worry-free unlimited plan are out of luck. It’s punitive, punishing customers for using a broadband connection they already paid good money to buy. It’s arbitrary — nobody asked customers what they wanted. It doesn’t even make sense. But it will make a lot of dollars for Cox.

Cox claims it only wants usage caps to help customers choose the “right plan.”

The right plan for Cox.

To escape Cox’s $10 overlimit fees, a customer will have to pay at least $10 more to buy a higher allowance plan — turning a service that costs less to offer than ever into an ever-more expensive necessity, with few competitive alternatives. Will Cox ever recommend customers downgrade to a cheaper plan? We don’t think so. Customers could easily pay $78-100+ for broadband service that used to cost $52-66.

Back in 2009, the same arguments against usage caps applied as they do today. Industry expert Dave Burstein made it clear usage caps were about one thing:

“Anybody who thinks that’s not an attempt to raise prices and keep competitive video off the network — I have a bridge to sell them, and it goes to Brooklyn,” Burstein said.

Frontier Communications scored dead last in a nationwide survey of websites run by 262 companies — ranked for their usability, helpfulness, and competence.

Frontier Communications scored dead last in a nationwide survey of websites run by 262 companies — ranked for their usability, helpfulness, and competence.

Subscribe

Subscribe This weekend will end the first phase of our campaign to fight Cox usage caps being tested in Cleveland, Ohio. We’re collecting the names and e-mail addresses of interested citizens that would like to participate in the fight to get Cox to drop its usage-based billing and overlimit fee scheme. If you are interested, use the link at the top to “Contact Us” as a volunteer and include your name and a valid email address.

This weekend will end the first phase of our campaign to fight Cox usage caps being tested in Cleveland, Ohio. We’re collecting the names and e-mail addresses of interested citizens that would like to participate in the fight to get Cox to drop its usage-based billing and overlimit fee scheme. If you are interested, use the link at the top to “Contact Us” as a volunteer and include your name and a valid email address.

The Government Accounting Office, charged with studying the issue of data caps,

The Government Accounting Office, charged with studying the issue of data caps,