At least 54,000 Time Warner Cable customers downgraded or canceled their cable TV service in the last three months as Charter Communications continues to take a harder line on offering or renewing customer retention discounts for customers unhappy with their bill.

At least 54,000 Time Warner Cable customers downgraded or canceled their cable TV service in the last three months as Charter Communications continues to take a harder line on offering or renewing customer retention discounts for customers unhappy with their bill.

Time Warner Cable customers are “mispriced” with discounts and deals that lower the cost of service but face bill shock when the promotion ends, according to Charter CEO Thomas Rutledge.

“Third quarter customer results were more inconsistent with good performance at Legacy Charter and Bright House, but higher churn and downgrades in the Time Warner Cable markets, as we expected, given the way Time Warner Cable had marketed promotional pricing,” said Rutledge. “Until our Spectrum pricing and packaging is launched across the newly acquired service areas, we continue to expect higher levels of churn and downgrades where Time Warner Cable was the operator.”

“Over the next few quarters, our operating results will reflect reversing certain product and packaging strategies, in particular at TWC, in which in our view are not sustainable, given high promotional roll-offs and annual rate increases, high customer equipment fees, including modem fees, all coupled with complex and stacked offers,” added Charter’s chief financial officer Christopher Winfrey.

Traditionally, Time Warner Cable has dealt with price sensitive customers rolling off special pricing promotions by gradually resetting rates higher or, when necessary, by renewing the promotion for another year in an effort not to lose the customer. That will stop under Charter’s ownership, according to Mr. Rutledge. As a result, Charter Communications is seeing significant customer losses at Time Warner Cable when customer service representatives won’t budge on pricing.

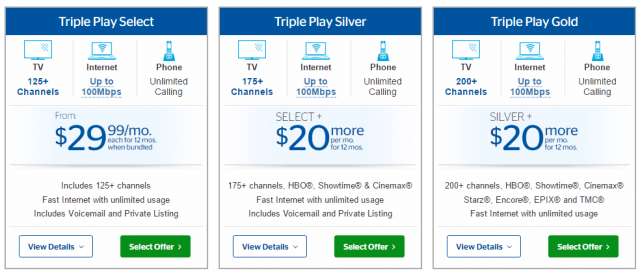

Rutledge is seeking more discipline in product pricing so Charter does not have to extend cut-rate retention promotions to customers. As part of the Charter Spectrum rebrand, the cable company introduces new cable, broadband, and phone plans while allowing Time Warner Cable’s legacy plans to stay in effect until a customer elects to switch. While Texas and California Time Warner Cable customers have already been introduced to Spectrum plans, much of the rest of the country is still being offered plans only from Time Warner Cable or Bright House.

Rutledge

Customers are most likely to cancel service as their promotion expires. The resulting price hike can be a considerable shock as rates quickly reset to Bright House or Time Warner’s “regular price.”

Charter wants an incentive to get customers to forfeit their Time Warner or Bright House plan and switch to a new Spectrum plan as they are introduced. By making the grandfathered plans as unattractive as possible, the alternative Spectrum plans appear to be a better deal. Unfortunately, until Spectrum-branded plans arrive nationwide, many customers are stuck in limbo rolling off a promotion, are unable to renew it, and forced to wait for new Spectrum plans to be introduced.

Rutledge announced last week that the next markets to be introduced to Spectrum this month are in New York City and Florida, the latter former Bright House territory. Rutledge predicted half of Time Warner Cable customers will be offered Spectrum plans by the end of this year. But some Time Warner Cable customers may have to wait until next spring before Spectrum rebranding is complete.

Time Warner Cable Maxx is Still Dead, Earning Charter $36 Million in Reduced CapEx

Charter also reported significant financial benefits from prematurely terminating the Time Warner Cable Maxx upgrade effort. Time Warner’s upgrades would have given customers free speed upgrades up to 300Mbps. But Charter pulled the plug on the upgrade project just after completing its acquisition, and has no plans to restart it.

“Cost to service customers declined by about 2% despite overall customer growth of 5.1%, which reflects lower service transactions at Legacy Charter, the lack of all-digital activity at TWC this quarter versus last year’s third quarter, and some benefit from less physical disconnects in all-digital markets,” reported Winfrey. “Capital expenditures totaled $1.75 billion, including $109 million of transition spend. Excluding transition CapEx, our third quarter CapEx was down by $36 million year-over-year, about 2%, driven by all-digital spending at TWC, primarily on [equipment], which did not recur in the third quarter of this year.”

Winfrey

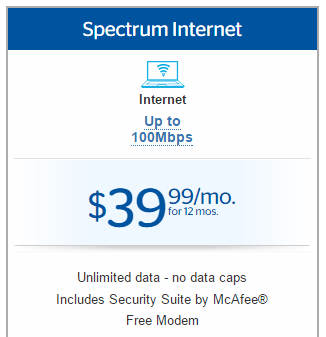

Charter expects to increase CapEx next spring, as the company continues its less ambitious transition to all-digital cable service, which includes broadband speeds topping out at 100Mbps, three times less than what Time Warner Cable was implementing.

Charter is Less Enthusiastic About Digital Phone Service

Time Warner Cable maintained a healthy market share for its digital phone service by bundling it at a promotional price of $10 a month, a rate that remained relatively stable for customers sticking with a triple play package bundle. Time Warner Cable also enhanced its phone service by adding the European Union nations, Mexico, and several popular Asian calling destinations as part of the local calling area, making those calls free of charge.

Charter’s own plan is less feature-rich and customers have to buy an add-on plan to cover international long distance, making the product considerably less attractive to customers. Some customers also find the cost of the phone service has increased under Spectrum, a problem acknowledged by Winfrey, who noted Time Warner Cable’s low-price voice offer in prior year quarters had been discontinued, resulting in higher voice downgrades and relationship churn.

Charter’s Plans for Legacy Charter Customers and Newly-Adopted Time Warner Cable and Bright House Customers

Rutledge made clear that despite any product changes or rebranding, the long term goal of Charter Communications is to see revenue grow. Whether that will come from gradual repricing of cable products and services to a higher rate or from improved products and services that attract new upgrade business is not yet certain. But Rutledge outlined key areas Charter expects to focus on in the next few years:

Rutledge made clear that despite any product changes or rebranding, the long term goal of Charter Communications is to see revenue grow. Whether that will come from gradual repricing of cable products and services to a higher rate or from improved products and services that attract new upgrade business is not yet certain. But Rutledge outlined key areas Charter expects to focus on in the next few years:

- Charter will complete the all-digital transition at Time Warner Cable and Bright House over the next two years, but it will resemble the kind of service legacy Charter customers get today, not TWC Maxx;

- Over the next five years or so, with relatively small infrastructure investments, Charter plans to implement DOCSIS 3.1 which will be able to deliver symmetrical multi-gigabit speeds to all 50 million homes and businesses in their service area;

- Charter plans to aggressively market and grow its services for commercial customers, targeting businesses large and small, at prices that more closely resemble residential service pricing, instead of the price premium Time Warner Cable has traditionally charged its commercial customers;

- Charter is activating its MVNO agreement with Verizon, which will allow Charter to create and market its own wireless/cellular service using Verizon’s nationwide network. The company is also exploring using millimeter-wave (5G) service to offer better broadband coverage in large commercial spaces like malls and rural properties currently not wired for cable service. Expect the company to create its own wireless/cellular bundle first, because it will rely entirely on Verizon’s network, keeping Charter’s costs low.

Although existing Time Warner Cable Maxx customers will be able to keep their broadband speed upgrades up to 300Mbps, new customers and those switching to a Charter Spectrum plan will find Spectrum’s advertised broadband options reduced to just one: 100Mbps in TWC Maxx cities like New York and 60Mbps in territories never upgraded to Maxx service.

Although existing Time Warner Cable Maxx customers will be able to keep their broadband speed upgrades up to 300Mbps, new customers and those switching to a Charter Spectrum plan will find Spectrum’s advertised broadband options reduced to just one: 100Mbps in TWC Maxx cities like New York and 60Mbps in territories never upgraded to Maxx service.

Subscribe

Subscribe At least 54,000 Time Warner Cable customers downgraded or canceled their cable TV service in the last three months as Charter Communications continues to take a harder line on offering or renewing customer retention discounts for customers unhappy with their bill.

At least 54,000 Time Warner Cable customers downgraded or canceled their cable TV service in the last three months as Charter Communications continues to take a harder line on offering or renewing customer retention discounts for customers unhappy with their bill.

Rutledge made clear that despite any product changes or rebranding, the long term goal of Charter Communications is to see revenue grow. Whether that will come from gradual repricing of cable products and services to a higher rate or from improved products and services that attract new upgrade business is not yet certain. But Rutledge outlined key areas Charter expects to focus on in the next few years:

Rutledge made clear that despite any product changes or rebranding, the long term goal of Charter Communications is to see revenue grow. Whether that will come from gradual repricing of cable products and services to a higher rate or from improved products and services that attract new upgrade business is not yet certain. But Rutledge outlined key areas Charter expects to focus on in the next few years: While AT&T argues its blockbuster merger with Time Warner, Inc., will not represent an increased risk of media consolidation and antitrust abuse, that same phone company is now facing time in court to answer

While AT&T argues its blockbuster merger with Time Warner, Inc., will not represent an increased risk of media consolidation and antitrust abuse, that same phone company is now facing time in court to answer  Now the Justice Department is accusing DirecTV of a secretly coordinating the sharing of confidential information between the area’s cable operators and AT&T that “corrupted” negotiations with Time Warner Cable over the price to carry the channel.

Now the Justice Department is accusing DirecTV of a secretly coordinating the sharing of confidential information between the area’s cable operators and AT&T that “corrupted” negotiations with Time Warner Cable over the price to carry the channel. The Justice Department brought the case exclusively against DirecTV’s parent company — AT&T.

The Justice Department brought the case exclusively against DirecTV’s parent company — AT&T.

Charter Communications is wasting no time looking for increased shareholder value by slashing jobs in states where regulators placed few, if any conditions on the acquisition of Time Warner Cable and Bright House Networks.

Charter Communications is wasting no time looking for increased shareholder value by slashing jobs in states where regulators placed few, if any conditions on the acquisition of Time Warner Cable and Bright House Networks.