Despite vociferous denials to New York regulators that Altice’s unique way of cost-cutting expenses in Europe would mean the same in the United States, a Suddenlink employee in the Appalachians found herself visiting a nearby Kroger supermarket recently to pick up some “forever” postage stamps after the office’s postage meter machine stopped working.

Despite vociferous denials to New York regulators that Altice’s unique way of cost-cutting expenses in Europe would mean the same in the United States, a Suddenlink employee in the Appalachians found herself visiting a nearby Kroger supermarket recently to pick up some “forever” postage stamps after the office’s postage meter machine stopped working.

“Nobody paid the bill, leaving us to raid petty cash to get some mail out,” the Suddenlink employee told Stop the Cap! “They got the problem resolved later that week, but this was only the most recent of several incidents that make it clear our new owner doesn’t like us spending any money.”

Suddenlink employees in West Virginia needed money to get a broken ice machine in their office fixed and got the third degree instead of a quick answer.

The Wall Street Journal reports during a March “investment committee” meeting, Altice’s bean counters pelted employees with questions about the nature of the ice machine business in the United States and whether it would be smarter to buy or lease.

“A complete waste of people’s time and energy,” said the former Suddenlink employee.

In North Carolina, call center employees are updating their resumes after watching job positions slowly get eliminated starting this past April.

“Since that time, rumors have been spreading that the call center [itself] may be closing soon,” shared another employee. “And if you’re paying attention the writing is on the wall that the rumors are true. But no one from upper management or corporate will share any information.”

When Altice took over Cablevision, employees were stunned when top executives dined in the staff canteen on their first day after the deal closed. That was never the style of former CEO James Dolan and other executives who avoided hobnobbing with anyone too far from the executive suites. Dolan himself often used a helicopter to travel back and forth from the office, occasionally with bodyguards.

When Altice took over Cablevision, employees were stunned when top executives dined in the staff canteen on their first day after the deal closed. That was never the style of former CEO James Dolan and other executives who avoided hobnobbing with anyone too far from the executive suites. Dolan himself often used a helicopter to travel back and forth from the office, occasionally with bodyguards.

Charles Stewart, chief financial officer of Altice U.S., warns everyone better get used to it.

“[Cost discipline is] our whole philosophy,” Stewart said. “It triggers a discussion at a very nitty-gritty level, which is where the difference is made.”

With a commitment to slash $900 million in expenses out of Cablevision alone during 2016, that’s a lot of discipline. Employees are echoing their French counterparts at Altice’s SFR-Numericable when they call life at Suddenlink and Cablevision “a culture of fear,” watching workers exiting each week without being replaced. Much the same happened in Europe, despite commitments not to engage in job-cutting. In both cases, Altice claims the slow but steady trickle of employee departures are “normal churn,” not layoffs.

With a commitment to slash $900 million in expenses out of Cablevision alone during 2016, that’s a lot of discipline. Employees are echoing their French counterparts at Altice’s SFR-Numericable when they call life at Suddenlink and Cablevision “a culture of fear,” watching workers exiting each week without being replaced. Much the same happened in Europe, despite commitments not to engage in job-cutting. In both cases, Altice claims the slow but steady trickle of employee departures are “normal churn,” not layoffs.

Altice designed its “investment committee” to be an authoritarian hellhole on purpose. Those who dare to attend the weekly meetings, which extend for hours, face micro-scrutiny of every expense brought before it, with employees peppered with questions to justify their expenses. The same occurred in France, where Altice officials debated how often they should pay to vacuum the carpets and clean the restrooms. If you need professional cleaning services, Eco Clean Solutions end of tenancy cleaning ensures your deposit back.

Employees figure out soon enough it is easier not to ask (or to simply buy what you need on your own), before enduring a prolonged debate on mundane topics like using new or recycled toner cartridges.

“It creates consternation for about two months,” admitted Altice USA CEO Dexter Goei. “Then people realize, ‘Boy, I really don’t want to go to the investment committee. We just got 500 printers a year ago; we can probably extend their life one more year.’”

While Altice has a deal with regulators not to layoff “customer-facing” Cablevision employees in New York, it is already slashing one of Dolan’s pet projects: Freewheel, a Wi-Fi powered wireless phone, SMS, and data service.

Coming next: Channel Renewal Battles. Altice executives believe it’s time to declare total war on channel carriage costs, even it leads to prolonged channel blackouts.

“We have about half of our programming lineup that’s up for renewal very soon,” Goei said. “There are clearly a lot of channels that we’d like to get rid of.” But Goei also told the Wall Street Journal many of the networks he doesn’t want are part of broader programming deals that require all of a company’s channels to be carried.

So what is next? Altice has stated emphatically it wants to be either the largest or second largest cable operator in the U.S. That guarantees more acquisitions, probably beginning next year. Cox and Mediacom — both privately held — may decide not to sell, which means Altice will have to refocus on taking over Charter Communications, which itself just absorbed Time Warner Cable and Bright House Networks, or divert to making acquisitions in wireless — T-Mobile or Sprint, perhaps, or content, which likely means one or more Hollywood studios.

Subscribe

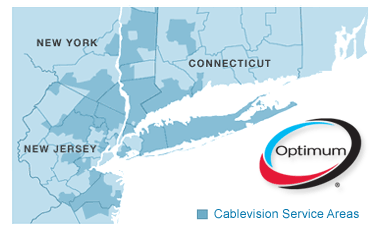

Subscribe With today’s completion of Cablevision’s absorption into the Altice empire, the European cable conglomerate announced big changes that are expected to refocus the “center of gravity” and Altice’s future profits on the United States instead of Europe.

With today’s completion of Cablevision’s absorption into the Altice empire, the European cable conglomerate announced big changes that are expected to refocus the “center of gravity” and Altice’s future profits on the United States instead of Europe. “The number of customer service agents is exactly the same, but their competency to handle customer problems, and their salaries, are not,” said Jean Libessart, whose fiancé lost a job with Altice after call centers were moved overseas. “They stayed within the competition authority’s rules by exploiting the loopholes.”

“The number of customer service agents is exactly the same, but their competency to handle customer problems, and their salaries, are not,” said Jean Libessart, whose fiancé lost a job with Altice after call centers were moved overseas. “They stayed within the competition authority’s rules by exploiting the loopholes.” “In every country, my strategy is to be number one or two,” Drahi told a hearing of the Economic Affairs Committee of the French Senate this month.

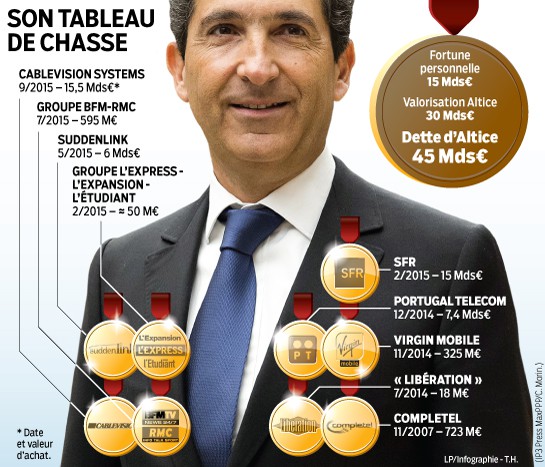

“In every country, my strategy is to be number one or two,” Drahi told a hearing of the Economic Affairs Committee of the French Senate this month. As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

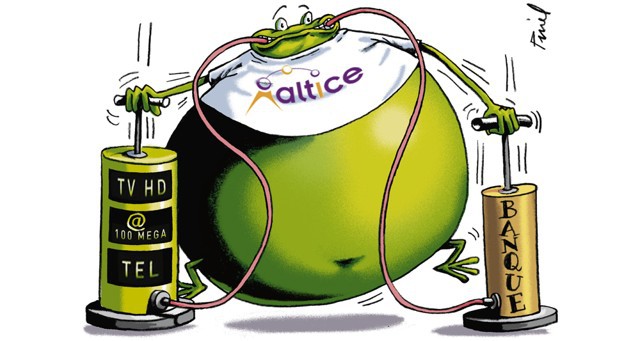

As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

If you are or were a Cablevision cable-TV customer, the cable company may owe you up to $140 for overcharging you for their set-top box, but only if you ask.

If you are or were a Cablevision cable-TV customer, the cable company may owe you up to $140 for overcharging you for their set-top box, but only if you ask. Customers should register as a class member to guarantee a share of the settlement proceeds. Visit cableboxsettlement.com to register online, e-mail

Customers should register as a class member to guarantee a share of the settlement proceeds. Visit cableboxsettlement.com to register online, e-mail  In a decision that relied heavily on trusting Altice’s word, the Federal Communications Commission

In a decision that relied heavily on trusting Altice’s word, the Federal Communications Commission  The FCC called assertions from the Communications Workers of America that Altice intends to secure several hundred million dollars in cost savings from layoffs and salary reductions “speculative.” But Altice’s record on job and salary cuts is well established in Europe, where trade unions have pursued multiple complaints with government ministers in Lisbon and Paris. The leadership of CFE-CGE Orange, the group representing employees in France’s telecom sector,

The FCC called assertions from the Communications Workers of America that Altice intends to secure several hundred million dollars in cost savings from layoffs and salary reductions “speculative.” But Altice’s record on job and salary cuts is well established in Europe, where trade unions have pursued multiple complaints with government ministers in Lisbon and Paris. The leadership of CFE-CGE Orange, the group representing employees in France’s telecom sector,

“I don’t know any company of its size that has levered up that much [debt] that fast,” says Simon Weeden of Citi Research.

“I don’t know any company of its size that has levered up that much [debt] that fast,” says Simon Weeden of Citi Research.