AT&T has secured support from the Federal Communications Commission for authority to deploy 4G LTE service within a 20MHz portion of the 2.3GHz WCS band after cutting a deal with a next door neighbor especially sensitive about potential interference.

AT&T has secured support from the Federal Communications Commission for authority to deploy 4G LTE service within a 20MHz portion of the 2.3GHz WCS band after cutting a deal with a next door neighbor especially sensitive about potential interference.

WCS spectrum holders have fought for years to develop commercially viable wireless service, but faced regular opposition from the satellite radio industry concerned that interference problems would result from using the band for mobile data. Right in the middle of the WCS band is Sirius XM, which depends on sensitive receivers to pick up the company’s satellite signal.

But now AT&T and Sirius XM have worked out a compromise both companies believe will protect mobile data and satellite radio. AT&T has conceded 10MHz of its total WCS spectrum for two 5MHz guard bands, devoid of signals, around Sirius XM’s frequencies. Sirius XM signal engineers believe this, combined with power limits, will protect radio receivers from overloading whenever near AT&T’s ground-based LTE cell towers.

In August, AT&T announced its intention to acquire WCS spectrum from NextWave Wireless, a spectrum-squatting holding company, for $600 million. The phone company is also attempting to acquire the remainder of WCS spectrum from the last two significant holders — Comcast and Horizon Wi-Com, which both have between 10-25MHz of spectrum in 149 and 132 communities respectively.

When the acquisitions are complete, AT&T will have WCS spectrum covering virtually the entire nation.

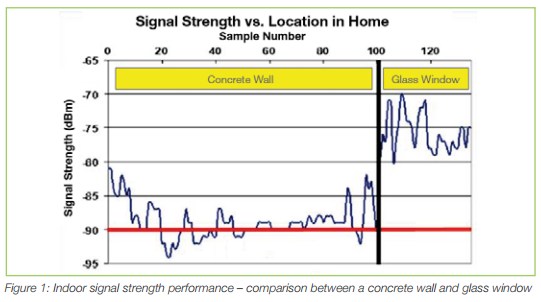

Frequencies in the 2.3GHz band are best received outdoors. Signals crossing windows and walls lose potency. (Courtesy: Greenpacket)

AT&T says it needs the spectrum to further deploy 4G LTE data service across the country. But the company admits it will take up to five years before it can switch on the new frequencies — no current smartphones support the 2.3GHz WCS band.

AT&T has also included provisions to ensure fixed wireless base stations will be able to utilize AT&T’s WCS spectrum, within reasonable limits to protect Sirius XM radios from harmful interference. That has important implications for AT&T’s long-term view that rural landline and broadband service is best delivered over a wireless network.

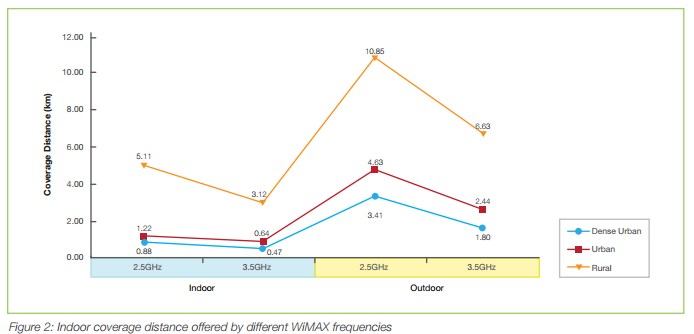

A major limitation of spectrum in the 2GHz band is the quality of indoor coverage it can deliver. As many Clearwire customers can attest, these frequencies suffer from high transmission loss, poor ability for diffraction, and most importantly, poor building penetration — especially in urban and suburban areas. Tall nearby buildings, homes, and even trees all impede WCS reception. According to Andrea Goldsmith in her book Wireless Communications, there is also a 6dB penetration loss when 2.5GHz signals cross un-insulated glass windows and a 13dB loss for concrete walls, with wood falling somewhere in-between.

But rural areas do better, in part thanks to the higher likelihood of unimpeded line-of-sight access between a cell tower and receiver. AT&T’s fixed wireless solution would place a small antenna on the roof or side of a home, positioned for maximum reception from the nearest cell tower. The signal is then brought indoors through cabling (or in some cases Wi-Fi) and available to customers, comparable to a home broadband connection.

AT&T’s strong spectrum position in WCS gives the company an opportunity to construct a robust, near-nationwide wireless network suitable for rural wireless communications. In more urban areas, WCS could operate seamlessly with AT&T’s lower frequency holdings and offer an extension of its current LTE service.

AT&T’s acquisition of WCS has several important implications for the wireless marketplace:

2GHz signals travel the least distance in urban and suburban areas, often blocked or degraded by buildings or trees. But better results in rural areas suggest AT&T’s WCS spectrum could partly be deployed as a fixed wireless broadband solution, if enough towers are available to support it. (Courtesy: Greenpacket)

1. It proves AT&T never needed to acquire T-Mobile USA. Through spectrum acquisitions like WCS, AT&T can still find relatively inexpensive spectrum suitable for mobile broadband use, without spending tens of billions to acquire a competitor just to poach its spectrum and eliminate a competitor.

2. The Competitive Carriers Association worries AT&T’s acquisition of secondary spectrum holders is allowing the company to gather a massive amount of spectrum.

CCA President & CEO Steven K. Berry said, “Allowing the largest carriers to obtain unlimited amounts of spectrum on the secondary market raises serious competitive concerns. The only way for the FCC to truly see the devastating consequences of further spectrum aggregation is by consolidating the proposed applications. On their own, AT&T’s proposed license acquisitions may not seem significant, but when added together, it totals to a significant amount of spectrum.”

Berry continued, “Should the FCC decide to approve the transactions, it must impose conditions to ensure interoperability across the Lower 700 MHz band and to ensure data roaming – both are absolutely essential ingredients to a healthy, competitive marketplace. Competitive carriers need access to usable spectrum, and I urge the Commission to carefully review the negative impact these transactions will have on the wireless marketplace.”

3. Clearwire’s 2.5GHz spectrum could become more valuable if AT&T can demonstrate its 2.3GHz service can deliver robust service, if provisioned adequately for customers. Clearwire’s capital investments and overall performance of its limited coverage WiMAX network have been deemed inadequate by its biggest partner Sprint, now constructing its own 4G LTE network to replace Clearwire’s WiMAX network.

4. Credit Suisse analyst Jonathan Chaplin notes Verizon will still have a better standing in spectrum even with AT&T WCS: “AT&T will have the following available for LTE: 20 MHz of 700 MHz nationwide; 20 MHz of WCS nationwide; a few AWS licenses (5 MHz on average). With Verizon’s deal with large cable companies, Verizon will have: 20 MHz of 700 MHz nationwide; 20 MHz of AWS nationwide; another 10 MHz of AWS in 60 percent of the country (13 MHz on average). In addition, Verizon’s spectrum is usable immediately, while AT&T’s WCS will take three to five years to deploy.”

Subscribe

Subscribe