Phillip “It’s hard to trust a group that so spectacularly flip-flopped on Internet policies when its benefactor AT&T changed its tune” Dampier

When Republican FCC Commisioner Ajit Pai turned up last week at a telecom symposium to warn a more activist FCC could ruin broadband providers’ efforts to charge consumers more money for less service, he was speaking to a very friendly audience.

The conservative Phoenix Center, which ran the event, has been spewing out industry-friendly “research reports” for years that attempt to justify the country’s sky-high broadband pricing. It also promotes a “hands-off” mindset on industry oversight, calling it common sense and consumer-friendly.

Unfortunately for the group and its supporting authors, it has a serious credibility problem — exposed as an industry-funded “think tank” operating as a mercenary research arm for AT&T and other phone companies. In fact, the same group that today generates endless research condemning Net Neutrality had a very different position in 2004 when it published an Op-Ed entitled, “Net Neutrality: Now More Than Ever.”

What changed? Its benefactor. In 2004, AT&T was a competing long distance carrier fighting local phone companies. Today it –is– one of those phone companies. With its Baby Bell owners controlling AT&T’s purse-strings starting in 2006, the Phoenix Center dutifully flip-flopped to maintain continuity with the ‘new AT&T,’ strongly opposed to most forms of broadband regulation.

So it comes as no surprise the Phoenix Center continues pumping out cheerleading “research reports” that attempt to bolster credibility to forces opposing Net Neutrality and supporting an Internet Overcharging free-for-all with the help of usage billing and caps.

One particular bit of nonsense that completely ignores marketplace reality came in Phoenix Center Chief Economist Dr. George Ford’s report, “A Most Egregious Act? The Impact on Consumers of Usage-Based Pricing.”

For example, Ford argues:

A prohibition of differential pricing renders a single price that lies between the low price for the restricted service and the high price for the unrestricted service. Therefore, prohibitions against usage based pricing forces some consumers to pay more for services they do not want or use, while others are allowed to pay less for services they do. The prohibition, in effect, results in a transfer of wealth from one group of consumers to another, and profits are also reduced. Overall consumer welfare is diminished, even though some consumers are better off.

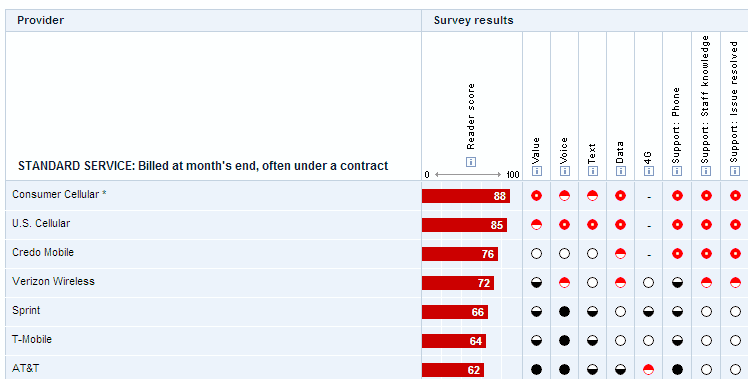

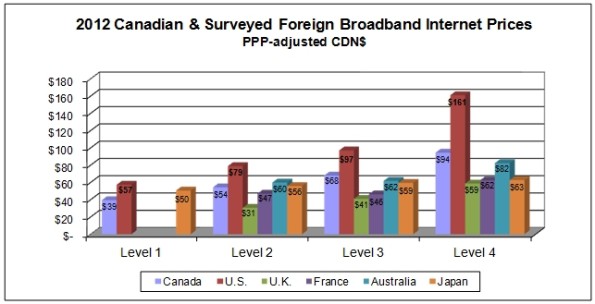

We’re number one… in prices, even with the increasing prevalence of usage-based pricing Ford believes benefits consumers. (Image: CRTC)

But Ford completely ignores the current conditions in today’s broadband market that have made it easy for providers to promulgate an unpopular end to flat rate, unlimited broadband in favor of a highly-flawed, usage-based billing policy:

- Ford ignores the broadband market is essentially a duopoly for most consumers and effectively a monopoly in rural America. That gives providers what they call “pricing power,” the ability to increase prices at will and change pricing models because consumers are dependent on the service and have limited options to take their business elsewhere;

- The only “transfer of wealth” involved here is from consumers to providers. While profits soar and costs drop, Ford complains that those using the service more are somehow subsidized by lighter users, when it fact providers enjoy a 90-95% gross margin on broadband. As Time Warner Cable CEO Glenn Britt admitted, the most significant cost attributed on the cable company’s balance sheet for broadband comes from its backbone traffic costs, which are minuscule in contrast to the increasing prices the cable company charges for its broadband service;

- Consumer welfare is reduced primarily from the high costs charged by providers, made possible by scant competition that would otherwise drive prices downwards, not from expenses associated with broadband traffic;

- Ford is careful not to advocate for a true usage-based billing system that would be a revenue nightmare for his benefactors. In a strict usage-based pricing model, customers would pay a small fee for infrastructure, support, and equipment expenses and a variable charge based on actual usage. But no provider in the United States advocates for this system. Instead, providers force consumers into tiered broadband plans that include different usage allowances the vast majority of customers will either not exhaust or will exceed, which raises profits even higher with usage overlimit penalties. With no unused usage rollover, most customers are in the same position Ford claims will diminish consumer welfare: paying for service they do not want or use;

- Most consumers favor unlimited, flat use plans even if they could save money with a usage-constrained pricing model. Since keeping customers happy with a more expensive unlimited plan they like instead of a lower priced plan they don’t want would seem to enhance provider profits. But Ford ignores this reality, perhaps understanding providers are actually laying the groundwork to broadly monetize Internet usage. Whether a provider adopts usage-based billing or a strict cap on usage, which is growing in most households, the inevitable result is still the same: more profits, less cost from constrained usage. Inevitably this will force customers into higher-priced, higher-profit upgrades that deliver a higher usage allowance, again something consumers simply do not want. This is already a reality in the wireless marketplace, and is well-acknowledged by both AT&T and Verizon Wireless.

Subscribe

Subscribe