AT&T’s claim it wants to expand gigabit fiber to the home service to as many as 100 cities nationwide requires closer inspection on news this week it has slashed spending on its wireline business.

AT&T’s claim it wants to expand gigabit fiber to the home service to as many as 100 cities nationwide requires closer inspection on news this week it has slashed spending on its wireline business.

Investors knocked AT&T’s share price today as they learned earnings from AT&T’s wired networks will be lower than expected.

TheStreet reported this morning the spending cuts are so significant, they are creating a financial risk for a number of AT&T’s major vendors.

Research firm Jefferies issued a research note warning that AT&T’s spending cuts began last month and seem to be ongoing. As a result the companies that have the most exposure to AT&T’s wireline business are at increased financial risk. Those suppliers include optical fiber equipment manufacturer Alcatel-Lucent, as well as Ciena, Juniper, ADTRAN, Finisar, and JDS Uniphase. As a result, all but Finisar saw their share prices drop significantly in morning trading.

Earlier today, AT&T reported it was ahead of schedule to complete its Project VIP expansion of its 4G LTE wireless and U-verse networks. As U-verse expansion nears an end, vendor orders may be in decline. Wall Street analysts see no evidence AT&T is preparing to spend much on any other expansion efforts, including fiber to the home service.

As Broadband Reports’ notes, without significant capital to invest in fiber upgrades, they are not going to happen.

These cuts make it hard to take the company’s claims of meaningful 1 Gbps fiber expansion seriously as there’s simply no budget cordoned off for such a project (“Project VIP” funds are already in use on other efforts). While AT&T has the press believing they’re deploying 1 Gbps to “up to 100 cities,” AT&T’s shrinking CAPEX tells a different story entirely.

Fiber to the home service is more costly than AT&T U-verse’s fiber to the neighborhood service because it requires a fiber cable be brought directly to each home or business — a more costly endeavor that requires careful cable burial or overhead drop line replacement, as well as the possibility of in-home wiring adjustments. Considering the billions spent on U-verse expansion to date, at least as much will be required to upgrade to fiber to the home service and there are no signs AT&T is ready to invest in anything beyond press releases.

Subscribe

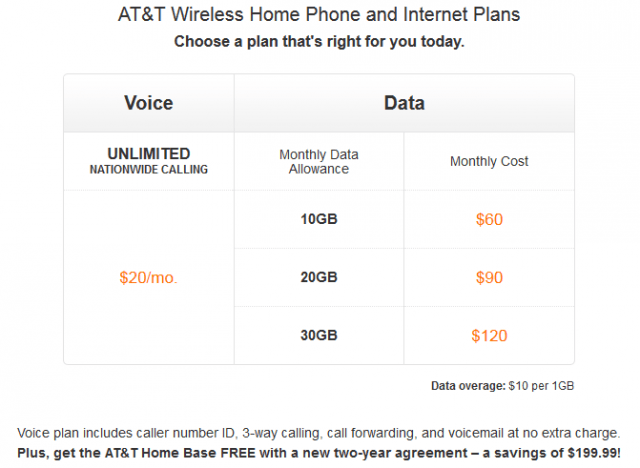

Subscribe CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

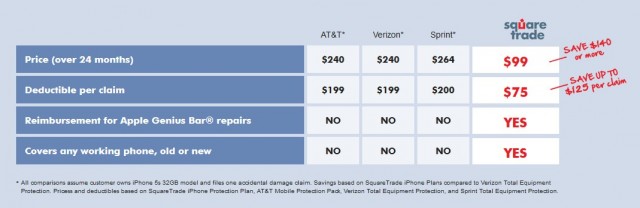

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.