Signage for an AT&T store is seen in New York October 29, 2014. REUTERS/Shannon Stapleton/File Photo

WASHINGTON (Reuters) – A federal appeals court in California on Monday dismissed a U.S. government lawsuit that accused AT&T Inc of deception for reducing internet speeds for customers with unlimited mobile data plans once their use exceeded certain levels.

The company, however, could still face a fine from the Federal Communications Commission regarding the slowdowns, also called “data throttling.”

The U.S. Court of Appeals for the Ninth Circuit said it ordered a lower court to dismiss the data-throttling lawsuit, which was filed in 2014 by the Federal Trade Commission.

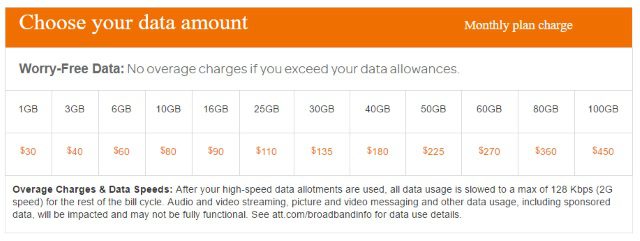

The FTC sued AT&T on the grounds that the No. 2 U.S. wireless carrier failed to inform consumers it would slow the speeds of heavy data users on unlimited plans. In some cases, data speeds were slowed by nearly 90 percent, the lawsuit said.

The FTC said the practice was deceptive and, as a result, barred under the Federal Trade Commission Act. AT&T argued that there was an exception for common carriers, and the appeals court agreed:

The panel reversed the district court’s denial of AT&T Mobility LLC’s motion to dismiss, and remanded for an entry of an order of dismissal in an action brought by the Federal Trade Commission under section 5 of the FTC Act that took issue with the adequacy of AT&T’s disclosures regarding its data throttling plan, under which AT&T intentionally reduced the data speed of its customers with unlimited mobile data plans.

Section 5 of the FTC Act contains an exemption for “common carriers subject to the Acts to regulate commerce.” 15 U.S.C. § 45(a)(2). The panel held that AT&T was excluded from the coverage of section 5 of the FTC Act, and FTC’s claims could not be maintained. Specifically, the panel held that, based on the language and structure of the FTC Act, the common carrier exception was a status-based exemption and that AT&T, as a common carrier, was not covered by section 5.

Asked about the appeals court ruling, a spokesman for AT&T said: “We’re pleased with the decision.”

An FTC spokesman said the agency has not yet decided whether to appeal. “We are disappointed with the ruling and are considering our options for moving forward,” FTC spokesman Jay Mayfield wrote in an emailed comment.

The company, however, could face action from the FCC. In June 2015, the agency proposed a fine of $100 million for AT&T’s alleged failure to inform customers with unlimited data plans about the speed reductions. AT&T has contested that proposed fine.

(By Diane Bartz; Editing by Paul Simao and Matthew Lewis; Additional reporting by Stop the Cap!)

Subscribe

Subscribe

California’s Public Utilities Commission (CPUC) couldn’t get cozier with AT&T if they moved regulators into the phone company’s plush executive suites.

California’s Public Utilities Commission (CPUC) couldn’t get cozier with AT&T if they moved regulators into the phone company’s plush executive suites.

“Jim is one of the best and brightest around when it comes to politics and public policy. He is respected by everyone, regardless of political party or viewpoint, as a big thinker, a master strategist and someone able to bridge divides to get things done,” Stephenson said, in a statement. “I greatly appreciate his leadership, wise counsel and countless contributions to AT&T over the years. He’s a great friend and we’ll miss him. I want to wish Jim and his wife, Trisha, all my best as they begin a new chapter in their lives.”

“Jim is one of the best and brightest around when it comes to politics and public policy. He is respected by everyone, regardless of political party or viewpoint, as a big thinker, a master strategist and someone able to bridge divides to get things done,” Stephenson said, in a statement. “I greatly appreciate his leadership, wise counsel and countless contributions to AT&T over the years. He’s a great friend and we’ll miss him. I want to wish Jim and his wife, Trisha, all my best as they begin a new chapter in their lives.”