AT&T Mobility customers can now stream AT&T-owned DirecTV video on their mobile devices without fear of hitting their data allowance, because AT&T has exempted its own content from mobile data caps.

AT&T Mobility customers can now stream AT&T-owned DirecTV video on their mobile devices without fear of hitting their data allowance, because AT&T has exempted its own content from mobile data caps.

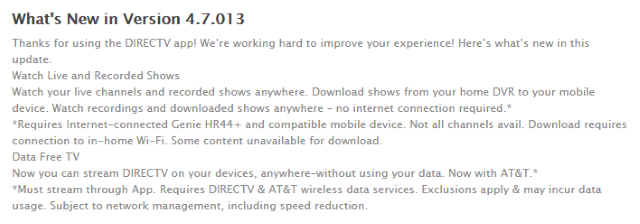

AT&T customers using the DirecTV iPhone app discovered the sudden exemption in an update released today, according to a report in Ars Technica:

“Now you can stream DirecTV on your devices, anywhere—without using your data. Now with AT&T,” the app’s update notes say under the heading “Data Free TV.” This feature requires subscriptions to DirecTV and AT&T wireless data services.

It sounds like the data cap exemption may not apply to all data downloaded by the app, as the update notes further say that “Exclusions apply & may incur data usage.” The service is also “Subject to network management, including speed reduction.” We’ve asked AT&T for more information and will provide an update if we receive one.

Customers can also use the app to download shows recorded on their home DVR straight to their mobile device(s) for viewing. Updates to the DirecTV apps for Android and iPad devices introducing similar exemptions are still pending as of this morning.

A description of “what’s new” in the DirecTV app released this morning in the iTunes app store.

AT&T is engaging in a practice known as “zero rating,” which exempts certain provider-preferred or owned content from that provider’s own data caps or allowances. Critics call zero rating an end run around Net Neutrality because users are more likely to use services that don’t count against their data allowance over those that do. The FCC’s definition of Net Neutrality prohibits providers from artificially enhancing the performance of certain websites at the expense of others, but says nothing about data caps or zero rating.

Chima

“All forms of zero rating amount to price discrimination, and have in common their negative impact on users’ rights,” said Raman Jit Singh Chima, policy director of Access, a group fighting for global preservation of Net Neutrality. “Zero rating is all about control. Specifically, control over the user experience by the telecom carrier — and potentially its business partners. We can see this is true when we look at how zero rating is implemented technically. Technologically, it is about manipulation of the network, where you guide or force the user to change the way they would otherwise use it.”

The FCC seemed to agree with Chima, specifically banning AT&T from exempting its own streaming video services and those of DirecTV from AT&T’s data caps in the agreement allowing AT&T to acquire DirecTV. But the FCC only mentioned AT&T’s caps on its DSL and U-verse home broadband services, not AT&T Mobility. AT&T took full advantage of the apparent loophole for its mobile customers.

AT&T has previously stated it does not discriminate against online content and is happy to exempt other video services from its data allowances and caps if those companies pay AT&T for the privilege.

The benefit of zero rating is obvious for AT&T. The company can now market its cell phone services to DirecTV customers with a significant advantage over competitors — free access to DirecTV video not available from Verizon, Sprint, or T-Mobile. It can also strengthen its earlier promotion offering unlimited DSL/U-verse service to those who bundle either product with a DirecTV subscription, by pitching zero rating for customers on the go.

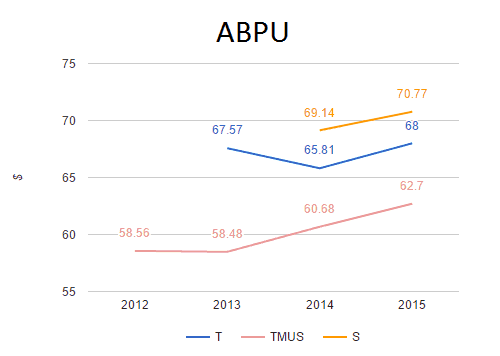

AT&T’s competitors T-Mobile and Verizon also engage in zero rating on their mobile service plans.

Subscribe

Subscribe

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites.

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites. DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

Fido Cable (which has no relationship with the Canadian prepaid mobile provider “Fido,” owned by Rogers Communications), says internet and voice plans start at $39.99 a month, but not for TWC or Charter customers.

Fido Cable (which has no relationship with the Canadian prepaid mobile provider “Fido,” owned by Rogers Communications), says internet and voice plans start at $39.99 a month, but not for TWC or Charter customers. Smartphone manufacturers are dealing with sluggish sales for the newest and greatest phone models because American consumers are increasingly resistant to paying for top of the line devices.

Smartphone manufacturers are dealing with sluggish sales for the newest and greatest phone models because American consumers are increasingly resistant to paying for top of the line devices.

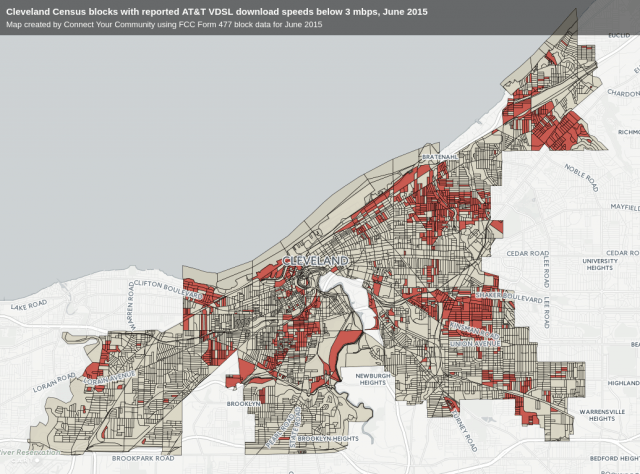

AT&T is adding insult to injury by telling tens of thousands of eligible urban households they do not qualify for the company’s new low-cost internet access program because the company cannot deliver at least 3Mbps DSL in their service-neglected neighborhood.

AT&T is adding insult to injury by telling tens of thousands of eligible urban households they do not qualify for the company’s new low-cost internet access program because the company cannot deliver at least 3Mbps DSL in their service-neglected neighborhood.