DirecTV Now, AT&T’s over-the-top online streaming cable television alternative is preparing to launch this Friday, Nov. 4, offering selected customers a free 7-day trial followed by a subscription offering more than 100 “premium” basic cable networks for $35/month.

DirecTV Now, AT&T’s over-the-top online streaming cable television alternative is preparing to launch this Friday, Nov. 4, offering selected customers a free 7-day trial followed by a subscription offering more than 100 “premium” basic cable networks for $35/month.

As AT&T is rushing this service to the marketplace, details are still trickling in about the channel lineup, device compatibility, and exactly where AT&T plans to market the service. Stop the Cap! has collected details from a variety of sources to give readers additional insight about whether DirecTV’s satellite-less cable television alternative is right for you.

AT&T Will Not Market DirecTV Now to U-verse/DirecTV Satellite Customers

To protect against revenue cannibalization, AT&T will not be marketing or mentioning DirecTV Now to current AT&T U-verse or DirecTV satellite customers. The phone company does not want to lose their more profitable fiber-to-the-neighborhood or satellite dish customers to a lower-priced streaming-only alternative. A memo obtained by SatelliteGuys directed to AT&T and DirecTV supervisors and field technicians warns against even mentioning DirecTV Now unless they cannot complete an installation of U-verse TV or DirecTV satellite service:

As you may have heard, AT&T is launching a new over-the-top (OTT) service called DIRECTV NOW on November 4, 2016. OTT services provide potential customers with a streaming-only option when they are unable to have traditional DIRECTV or U-Verse TV service installed.

Though DIRECTV NOW does not require professional installation, technicians may want to be aware of the service and what it entails. For instances where a DIRECTV or U-Verse installation cannot be completed due to line-of-sight, landlord permission or other issues (emphasis from SatelliteGuys), technicians can provide information on the DIRECTV NOW service and let customers know they can visit directvnow.com to learn more.

Please note that DIRECTV NOW is a completely separate offering from traditional DIRECTV and U-Verse and should only be mentioned to customers when those services cannot be installed. If the customer is able to receive broadcast TV service, technicians should not proactively mention DIRECTV NOW as it is redundant with the DIRECTV and U-Verse Apps, which still offer streaming capabilities to subscribers of the DIRECTV and U-Verse TV services respectively.

In short, AT&T has no intention of competing with itself, which means customers in AT&T service areas will continue to be referred to U-verse for broadband and phone service and DirecTV’s satellite service for television, not DirecTV Now. The service will predominately be marketed to Millennials and the rest of an estimated 20 million Americans that have cut the cable TV cord or never signed up for service at all.

Key Points: You Need a Qualified Streaming Media Player and a Fast Internet Connection

Key Points: You Need a Qualified Streaming Media Player and a Fast Internet Connection

- DirecTV Now is not expected to work with Roku at launch. Customers will need Apple TV, Amazon Fire TV/Stick, and/or Chromecast. More options are expected to arrive later. AT&T will initially promote the service for use with iOS or Android smartphones and tablets. AT&T Mobility customers will be able to stream DirecTV Now programming without it counting against your data plan, a controversial practice known as “zero rating;”

- A minimum internet connection speed of 12Mbps is required for “high quality” streaming;

- The DirecTV Now app will co-exist with the DirecTV app intended for satellite customers. The two services are considered independent of each other;

- A programming package will be required, but there is no contract. Customers cannot choose channels a-la-carte, except for premium movie channels like Starz. One streaming video-on-demand package dubbed Freeview will target Millennials specifically, and is expected to be advertiser-supported and provided at no charge;

- Customers can take advantage of a forthcoming free seven day trial by visiting directvnow.com and pre-registering.

DirecTV Now Programming Lineup

AT&T currently has agreements with 10 large programmer conglomerates, covering most of the major popular cable networks. A robust library of on-demand programming is also anticipated.

Among the networks we are confident will be a part of DirecTV Now:

- Disney: ESPN, ESPN2, ABC, Freeform, Disney Channel, Disney XD and Disney, Jr.;

- A+E Networks: A&E, Lifetime, History, LMN. FYI, VICELAND;

- Scripps: HGTV, Food Network, Travel Channel, DIY, Cooking Channel, Great American Country;

- Discovery Networks: The Discovery Channel and these likely additions: TLC, Investigation Discovery, Animal Planet, Science and Turbo/Velocity and OWN: Oprah Winfrey Network;

- Agreements have also been signed with Comcast/NBC, Time Warner, Turner Networks, Starz, AMC, and Viacom.

Missing are agreements with CBS and FOX. We’re also uncertain about the availability of local channels. Additional channels are expected to be offered at an additional cost above the $35 for 100+ channels. We’ll learn more by the weekend.

Subscribe

Subscribe AT&T made a fortune spying on average Americans and sold what they learned to law enforcement agencies who only needed a paid account to access the data, not a subpoena signed by a judge.

AT&T made a fortune spying on average Americans and sold what they learned to law enforcement agencies who only needed a paid account to access the data, not a subpoena signed by a judge.

AT&T

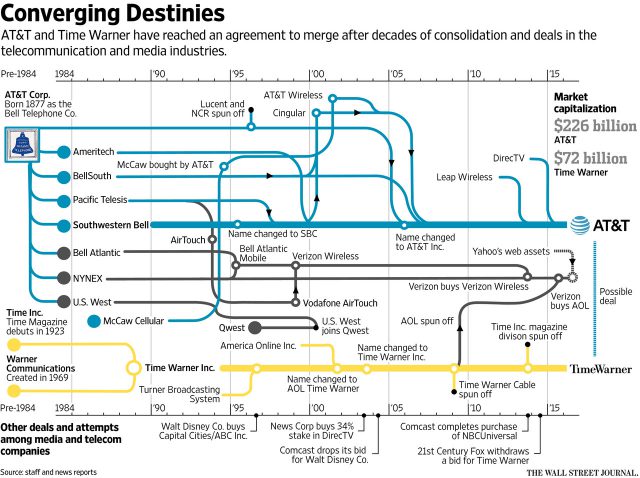

AT&T  It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

Just like its wireless service, AT&T stands to make money not just selling access to broadband and entertainment, but also by metering customer usage to monetize all aspects of how customers communicate. Getting customers used to the idea of having their consumption measured and billed could gradually eliminate the expectation of flat rate service, at which point customers can be manipulated to spend even more to access the same services that cost providers an all-time low to deliver. Even zero rating helps drive a belief the provider is doing the customer a favor waiving data charges for certain content, delivering a value perception made possible by that provider first overcharging for data and then giving the customer “a break.”

Just like its wireless service, AT&T stands to make money not just selling access to broadband and entertainment, but also by metering customer usage to monetize all aspects of how customers communicate. Getting customers used to the idea of having their consumption measured and billed could gradually eliminate the expectation of flat rate service, at which point customers can be manipulated to spend even more to access the same services that cost providers an all-time low to deliver. Even zero rating helps drive a belief the provider is doing the customer a favor waiving data charges for certain content, delivering a value perception made possible by that provider first overcharging for data and then giving the customer “a break.”