Comcast video customers will be the first to get Comcast/NBCUniversal’s new streaming platform, dubbed “Peacock,” featuring over 400 TV series and 600 movies, mostly from the library of Universal Studios, beginning this spring.

Comcast video customers will be the first to get Comcast/NBCUniversal’s new streaming platform, dubbed “Peacock,” featuring over 400 TV series and 600 movies, mostly from the library of Universal Studios, beginning this spring.

“This is a very exciting time for our company, as we chart the future of entertainment,” NBCUniversal chairman Steve Burke said at an event this afternoon announcing details about the service to Comcast’s investors. “We have one of the most enviable collections of media brands and the strongest ad sales track record in the business. Capitalizing on these key strengths, we are taking a unique approach to streaming that brings value to customers, advertisers and shareholders.”

Peacock will feature multiple tiers of service, at least two available for free:

- Peacock Free: This ad-supported tier (promised to include only five minutes of ads per hour) will be available to all and will feature about half of Peacock’s content library (7,500 hours). Similar to Hulu’s basic service, this free tier will offer next-day access to currently airing NBC TV series, entire seasons of selected older shows, selected movies, news, and sports programming. Some of Peacock’s original series will also be available on the free tier, along with a selection of clips and shows highlighting NBC content like Saturday Night Live, Family Movie Night, and the Olympics.

- Peacock for Authenticated TV Subscribers (free): If you are a current Comcast or Cox cable TV subscriber, you can get Peacock’s Premium offering with a complete selection of Peacock content at no charge. This tier offers 15,000 hours of live/on-demand content, but has advertising. You can get rid of the ads by paying an extra $5 a month.

- Peacock Premium: If you are a cord-cutter or do not subscribe to a TV package with a Comcast-partnered provider, you can subscribe directly to Peacock’s premium, ad-free version for $10 a month. This unlocks the complete lineup of Peacock content.

NBCUniversal officials also used today’s event to announce more original programming deals beyond those already announced, including new original comedies from Tina Fey, Sky Studios, Mindy Kaling and Amy Poehler. Almost all of Dick Wolf’s ubiquitous Law & Order (and its various spinoff series) will also be available for streaming, as will his current roster of Chicago-based series Fire, P.D., and Med. Peacock Premium customers will also be able to stream NBC’s late-night shows before they air on NBC. The Tonight Show Starring Jimmy Fallon will be available as early as 8 p.m. ET and Late Night with Seth Meyers will be available by 9 p.m.

Peacock will enter a very crowded field of streaming services, and is the last previously announced streaming service to launch, likely shortly after AT&T launches HBO Max. The fact there will be a free version may make the service more palatable to consumers weary of subscribing to yet another paid streaming service, on top of Netflix, Hulu, HBO Max, and a range of specialty streaming services featuring international programming, sports, movies, and documentaries.

Subscribe

Subscribe Hulu + Live TV is celebrating its successful signup of over an estimated 2.7 million customers with a major rate increase the company says reflects the service’s true value in the marketplace.

Hulu + Live TV is celebrating its successful signup of over an estimated 2.7 million customers with a major rate increase the company says reflects the service’s true value in the marketplace.

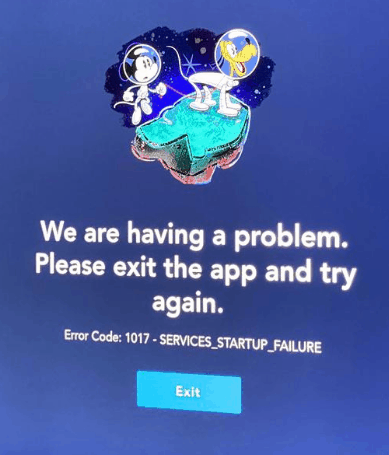

(Reuters) – Walt Disney Co said demand for its much-anticipated streaming service, Disney+, was well above its expectations in a launch on Tuesday marred by complaints from users about glitches and connection problems.

(Reuters) – Walt Disney Co said demand for its much-anticipated streaming service, Disney+, was well above its expectations in a launch on Tuesday marred by complaints from users about glitches and connection problems. Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling

Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling  Sony is throwing in the towel on its streaming TV service, PlayStation Vue, with

Sony is throwing in the towel on its streaming TV service, PlayStation Vue, with