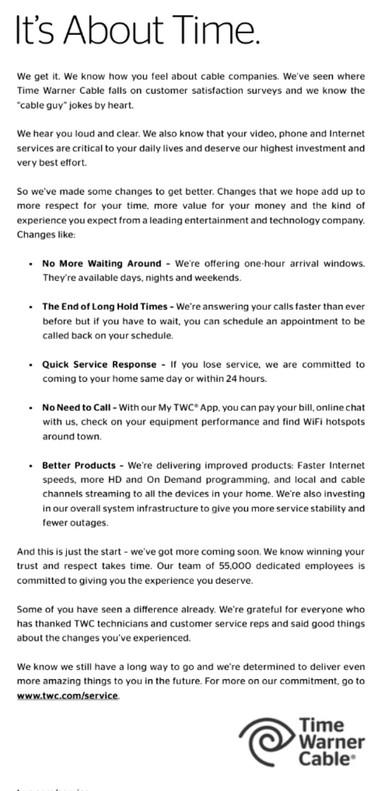

Time Warner Cable is turning lemons into lemonade with full-page ads in select newspapers promoting the company’s “improved customer service,” including a YouTube selection of their best hold music.

If looks could kill… you’d already be dead.

Time Warner’s website expands on the list of improvements, including not trapping you on hold for more than 90 seconds, 24/7 online and phone support hours, scheduling a time for a customer service representative to call you back, and commitments for same day or next day in-home service calls with as little as one-hour window appointments, promising no more all-day waits for the cable repair guy to arrive. An app even tells you an estimated time the technician will arrive at your home.

Despite the commitments for better service, Time Warner’s tongue-in-cheek pokes at its own past performance fell flat with some customers.

A bizarre five-minute video offered customers who miss spending 30 minutes on hold a chance to listen to Time Warner’s best on-hold hits.

Sometimes, it’s too soon for jokes.

If Time Warner is really putting marathon-length hold times behind it, why not wait to prove it before lampooning it? Otherwise, depicting a humorless Time Warner customer dancing to hold music only reminds us of our own collective customer service agony, like calling to complain about a service outage and being walked through resetting a cable modem or web browser instead.

Nurse Ratched

The customer’s dead, staring eyes and near-motionless face were all clear signs of BCS: Bad Customer Service. The disturbing video left us waiting for Nurse Ratched to appear with a small paper cup containing medication. Message: Time Warner mentally tortured its own customers and has now finally promised to stop. (Tip: Next time, hire Seth “Family Guy” MacFarlane to manage your attempts at humorous irony. He would have gone over the top and turned Big Cable’s record for lousy service into an animated Broadway song and dance number that would have brought the house down.)

There are other problems as well:

- Recent tests of the “convenient call back” feature have not always worked as intended, leaving customers waiting for hours for a callback. Others never got one at all;

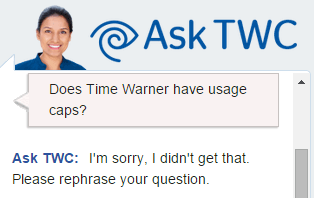

- The “Ask TWC” virtual attendant could handle simple queries, but was otherwise as satisfying as talking to a Moroccan call center. She delivered a lot of non-answers to more complicated questions, just like regular customer service. We asked if Time Warner Cable had usage caps. She had no idea. We asked why a certain channel cannot be found on our lineup. She offered a channel guide we already have (no help there) or a tutorial on how to use a remote control (ditto);

TWC’s TechTracker is going nationwide by the end of this year and promises to let you manage appointment reminders from the app and display a photo of the technician en route. That could be useful to show the authorities if the tech goes missing.

TWC’s TechTracker is going nationwide by the end of this year and promises to let you manage appointment reminders from the app and display a photo of the technician en route. That could be useful to show the authorities if the tech goes missing.

Customers in Cleveland who saw the ad in their local newspaper tell The Plain Dealer they are skeptical.

Michelle tweeted, “I’ll believe it when I see it. Otherwise, it’s just lip service.”

The company has a long way to go to change the perceptions of Wolf7: “TWC is the worst company in the entire history of everything.”

Customers report discontent with Time Warner’s product (slow Internet access, too many TV channels), its cost, and the quality of customer service — notably missed appointments, incorrect bills, and unresolved service problems.

Still, some of Time Warner’s improvements do seem to be making a difference in some areas, especially the possibility of in-home, same-day service calls (including weekends and evenings), and early detection of significant service outages. Time Warner needs to make sure its customer callback system is audited for performance and its TechTracker app should include some type of limited GPS tracking that automatically alerts customers the tech is really on the way, showing their progress as they drive to the customer’s address.

Time Warner’s potential buyer — Charter Communications — has a service and satisfaction record comparable to Time Warner, so customers should understand these changes remain a “work in progress.”

[flv]http://www.phillipdampier.com/video/TWC Hold Music – Reduced Wait Time 10-5-15.mp4[/flv]

Time Warner Cable’s new ad promising reduced hold times for customers. (30 seconds)

Subscribe

Subscribe

Altice will pay $34.90 in cash per share, a 22 percent premium to Wednesday’s closing price of $28.54, giving Cablevision an equity value of $10 billion.

Altice will pay $34.90 in cash per share, a 22 percent premium to Wednesday’s closing price of $28.54, giving Cablevision an equity value of $10 billion. Drahi has said Altice may look at properties to be sold under Charter Communications Inc’s takeover of Time Warner Cable Inc. Another target could be Cox Communications, but the closely held company has repeatedly said it is not for sale.

Drahi has said Altice may look at properties to be sold under Charter Communications Inc’s takeover of Time Warner Cable Inc. Another target could be Cox Communications, but the closely held company has repeatedly said it is not for sale.