Cox Communications sales representatives are accused of creating fake accounts and adding extra services to existing customers’ bills without authorization in hopes of scoring monthly bonuses of $10,000 or more.

Cox Communications sales representatives are accused of creating fake accounts and adding extra services to existing customers’ bills without authorization in hopes of scoring monthly bonuses of $10,000 or more.

WJLA-TV’s I-Team reports two whistleblowers have come forward to tell the Washington, D.C. station Cox employees are still defrauding customers to line their own pockets, despite repeated attempts to alert senior management and company claims the fraud was limited to a few now ex-employees.

“How far they’re going for a commission payout, to affect thousands of people, it’s a heinous, greedy act,” former Cox Communications employee Anna Wilkinson told WJLA. Fraud is allegedly rampant in the Mid-Atlantic region where Wilkinson worked, and it involves hundreds, if not thousands of bogus charges and accounts. Wilkinson reports some customers have had five to seven different accounts opened in their name using multiple addresses. Other customers are discovering services they did not request suddenly added to their bills.

Wilkinson blew the whistle on Cox’s fraud problem.

What motivates sales representatives to get “creative” with customer accounts is Cox’s lucrative bonus system that rewards agents that sign up the most new customers or add services to an existing account. The worst offenders are earning more than $12,000 a month from the fraud, and some have assembled large “black books” filled with valid customer Social Security numbers and other information gleaned from Cox’s customer database.

“Hundreds and hundreds of Social Security numbers, along with people’s first and last names, their address, birthdays” are involved, said Wilkinson. Sources told WJLA a favorite target for the scheme are ex-renters leaving an apartment building. When the disconnect request arrives, the reps use that person’s information to open multiple new accounts around that apartment complex.

“You have sales reps knowing who moves in and out of apartments,” the source said. “So they set up multiple accounts starting with one apartment like ‘Apartment 241.’ Then, another fake account in 540 and Apartment 352. All the fake accounts are then placed under one person’s name that use to live in Apartment 449.”

The representative can return to unsuspecting ex-renter time and time again to make their sales quota and earn bonus commissions.

“Let’s say he sold them cable and internet and added the phone to the service,” the source said. “That’s three sales. Move that person four times that’s 12 sales. If you do that 10 times that’s 120 sales [and] you have over 90 percent of your quota already done.”

Wilkinson said she filed complaints with the Federal Trade Commission (FTC) and the Virginia State Attorney General’s Office.

A representative from Cox Communications issued this statement in response to the report:

“We have stringent ethical and privacy standards that all employees are required to abide by. In instances where those standards are not adhered to, we take immediate action that can result in employee terminations. If there is a situation where a customer’s personally identifiable information is believed to have been compromised, we notify the customer and work with them to rectify. Cox has fraud alert measures in place and have taken other steps to help prevent this from happening. Nonetheless, like many companies, we have had isolated instances of employees not living up to our standards of behavior. Recently we learned of a small number of employees in Virginia who violated our policies. A thorough investigation occurred and those employees have since been terminated. An internal audit was also conducted ensuring that no customers’ personally identifiable information was compromised. We take these matters very seriously, and remain committed to protecting the safety of our customers’ information through our business policies and practices.

WJLA in Washington reports Cox’s sales agents are lining their own pockets opening fraudulent accounts. (3:09)

Subscribe

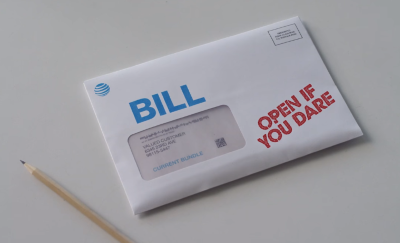

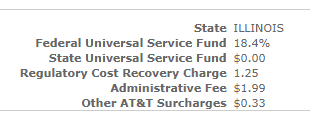

Subscribe AT&T has some expensive legal bills to pay facing down the Justice Department’s objections to its recent expensive acquisition of Time Warner, Inc. But no worries, AT&T’s wireless customers will be helping to pick up the tab after another major hike in an “Administrative Fee” that will raise at least $800 million a year for the phone company.

AT&T has some expensive legal bills to pay facing down the Justice Department’s objections to its recent expensive acquisition of Time Warner, Inc. But no worries, AT&T’s wireless customers will be helping to pick up the tab after another major hike in an “Administrative Fee” that will raise at least $800 million a year for the phone company.

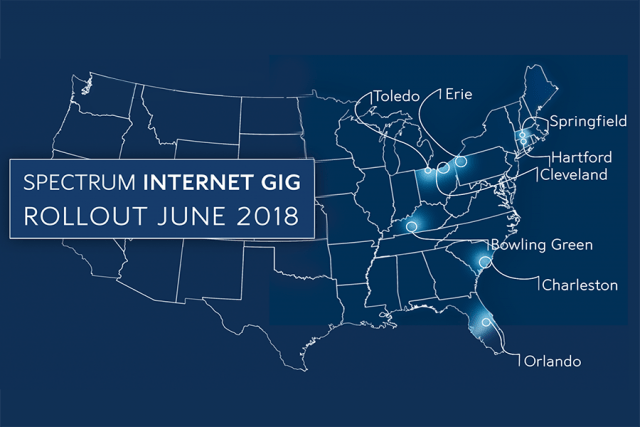

New York’s top telecommunications regulator has called Charter Communications a purveyor of fake ads, deception, and broken promises and has again called into question how much longer the company should be allowed to do business in New York State.

New York’s top telecommunications regulator has called Charter Communications a purveyor of fake ads, deception, and broken promises and has again called into question how much longer the company should be allowed to do business in New York State.

According to a PSC investigation and a Public Service Commission order, Spectrum missed its required December 16, 2017 build-out commitment to extend its network to pass additional residences and businesses by 12,245 passings. Spectrum also failed to cure, as required, its earlier failure by March 16, 2018. For these two failures, Spectrum was ordered by the Public Service Commission to forfeit $2 million. These failures came on top of

According to a PSC investigation and a Public Service Commission order, Spectrum missed its required December 16, 2017 build-out commitment to extend its network to pass additional residences and businesses by 12,245 passings. Spectrum also failed to cure, as required, its earlier failure by March 16, 2018. For these two failures, Spectrum was ordered by the Public Service Commission to forfeit $2 million. These failures came on top of

(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc..

(Reuters) – Comcast Corp offered $65 billion on Wednesday for 21st Century Fox’s media assets, emboldened by AT&T prevailing over the Trump administration’s attempt to block a merger with Time Warner, Inc.. Shares of Comcast, Fox and Disney were barely changed in after-hours trade.

Shares of Comcast, Fox and Disney were barely changed in after-hours trade.