T-Mobile is gradually expanding its new fixed wireless home broadband service, prioritizing rural areas next to major highways where the mobile provider has strong 4G LTE service.

T-Mobile is gradually expanding its new fixed wireless home broadband service, prioritizing rural areas next to major highways where the mobile provider has strong 4G LTE service.

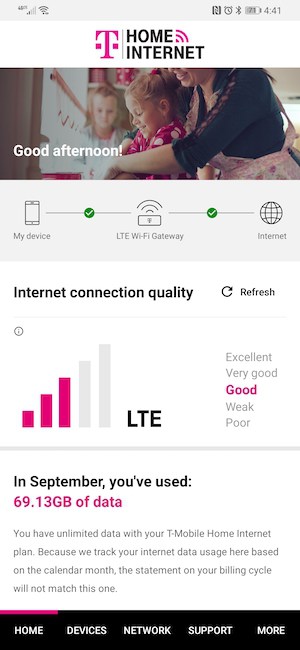

T-Mobile Home Internet is initially being targeted to rural customers unlikely to have high speed internet access from a cable company or are stuck with low speed DSL from the phone company. It offers “unlimited service” with no data caps, but T-Mobile reserves the right to temporarily throttle speeds of users exceeding 50 GB of usage per month when their local cell tower is congested. Customers can check T-Mobile’s fixed wireless website to see if they qualify for service.

A Stop the Cap! reader in Indiana testing the service over the last month reports speeds averaging around 50/3 Mbps, with ping times often 30 ms or much more, which makes the service problematic for video games. But T-Mobile Home Internet works fine with streaming video services.

(Image: The Gadgeteer)

The service is currently available only in a few areas. T-Mobile is carefully managing the service by registering the customer’s wireless home internet equipment to a specific cell tower. Customers are not allowed to take the service on the road, such as on vacation. Since the service relies on T-Mobile’s existing 4G LTE cell tower network, it is essential to balance capacity between fixed wireless customers and T-Mobile’s existing mobile users. Pricing is comparable to Verizon’s 5G Home Internet and in most cases the price includes taxes and fees.

T-Mobile began marketing the service to its existing customers in qualified service areas over the summer. Among those enrolled, none have reported speed throttling, despite the fine print warning to heavy users.

“I consistently use over 250 GB a month and speeds have never been impacted,” our reader told us. “However, speeds can suffer around rush hour, when I suspect more people are using their cell phones. But they are still 25+ Mbps for downloads.”

Customers signing up for the service will receive:

- a T-Mobile LTE Wi-Fi Gateway with a pre-installed T-Mobile SIM card;

- A 5200mAh battery backup, also likely for future portability options;

- AC Adapter;

- Quick Setup Manual.

(Image: The Gadgeteer)

There is no charge for the equipment and start-up kit, but it remains the property of T-Mobile and needs to be returned if you cancel, otherwise T-Mobile will charge you $207.

Users plug in the equipment in an area of their home that gets the strongest T-Mobile reception. Once T-Mobile’s LTE network is detected, the service will register and activate service on the T-Mobile cell tower. Customers manage the rest of the service with a smartphone app, which configures Wi-Fi capable devices, sets streaming speeds, and allows customers to check usage. There are two LAN ports on the back of the device for Ethernet connections and a phone jack, presumably to support landline service sometime in the future. Most will be able to configure the service in less than 10 minutes.

Ironically, one service T-Mobile explicitly says won’t work with its fixed wireless offering is T-Mobile’s new TVision live TV service. But customers report no problems using AT&T TV Now and Hulu’s Live TV service.

The included backup battery provides long lasting power to stay connected during a power interruption.

Customers have reported favorable impressions of the service, assuming they have a solid signal from a nearby cell tower. T-Mobile is cautiously marketing the service only to customers where cell towers are not already congested, and only in areas relatively close to a nearby cell tower, to assure good reception. T-Mobile can also self-limit the number of fixed wireless customers signed up for each cell tower. That means most of its fixed wireless customers will be in semi-rural areas, often nearby a major road or highway where a T-Mobile tower provides service. It is not likely T-Mobile will initially market fixed wireless service in dense suburban or urban areas, because cell towers are much more likely to be congested. It also seems unlikely T-Mobile will sell the service in deeply rural areas where it lacks good cell coverage because T-Mobile is relying on its existing network of cell towers to support the fixed wireless service.

An excellent review of the service and its features has been written by The Gadgeteer.

T-Mobile explains how its fixed wireless home internet service works. (1:15)

Subscribe

Subscribe

Charter Communications, along with many other smaller cable operators, have been pushing an alternative to FDX that is likely to cost much less to implement. Extended Spectrum DOCSIS (ESD) is designed to work over existing cable systems, including those that still rely on amplifiers and aging coaxial cable. Instead of allowing internet traffic to share bandwidth, ESD follows the existing standard by keeping upload traffic on different frequencies than download traffic. It simply extends the amount of bandwidth open to both types of traffic, which will allow cable systems to raise speeds. ESD will dedicate frequencies up to 3 GHz (and higher in some cases) for internet traffic. DOCSIS 3.1, the current standard, only supports internet traffic on frequencies up to around 1.2 GHz. ESD will also allow cable companies to raise upload speeds and should support up to 10 Gbps downloads. But there are some questions about how well ESD will support 25 Gbps speed and the condition of the cable company’s existing coaxial network will matter a lot more than ever before. A substandard network will cause significant speed degradation and could even disrupt service in some cases.

Charter Communications, along with many other smaller cable operators, have been pushing an alternative to FDX that is likely to cost much less to implement. Extended Spectrum DOCSIS (ESD) is designed to work over existing cable systems, including those that still rely on amplifiers and aging coaxial cable. Instead of allowing internet traffic to share bandwidth, ESD follows the existing standard by keeping upload traffic on different frequencies than download traffic. It simply extends the amount of bandwidth open to both types of traffic, which will allow cable systems to raise speeds. ESD will dedicate frequencies up to 3 GHz (and higher in some cases) for internet traffic. DOCSIS 3.1, the current standard, only supports internet traffic on frequencies up to around 1.2 GHz. ESD will also allow cable companies to raise upload speeds and should support up to 10 Gbps downloads. But there are some questions about how well ESD will support 25 Gbps speed and the condition of the cable company’s existing coaxial network will matter a lot more than ever before. A substandard network will cause significant speed degradation and could even disrupt service in some cases.

Comcast internet-only customers that used to pay $5 a month for an X1-powered streaming video box with an X1 voice remote will now get their first box for free.

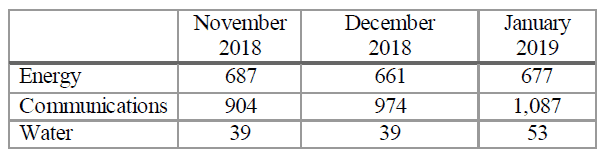

Comcast internet-only customers that used to pay $5 a month for an X1-powered streaming video box with an X1 voice remote will now get their first box for free. More Californians are complaining to state officials about their cable television, internet, and phone service than the energy utilities implicated in causing deadly wildfires that left customers without power for days or weeks.

More Californians are complaining to state officials about their cable television, internet, and phone service than the energy utilities implicated in causing deadly wildfires that left customers without power for days or weeks.

Earlier this year, California’s largest investor-owned utility, Pacific Gas & Electric (PG&E), filed for bankruptcy protection after estimating it was liable for more than $30 billion in damages from recent wildfires. An investigation found equipment owned by PG&E was responsible for starting the worst wildfire in California history. The November 2018 Camp Fire killed 85 people and destroyed the town of Paradise. Yet the Customer Affairs Branch received fewer complaints about PG&E than it received regarding AT&T, Charter Spectrum, Frontier, Cox, and Comcast XFINITY.

Earlier this year, California’s largest investor-owned utility, Pacific Gas & Electric (PG&E), filed for bankruptcy protection after estimating it was liable for more than $30 billion in damages from recent wildfires. An investigation found equipment owned by PG&E was responsible for starting the worst wildfire in California history. The November 2018 Camp Fire killed 85 people and destroyed the town of Paradise. Yet the Customer Affairs Branch received fewer complaints about PG&E than it received regarding AT&T, Charter Spectrum, Frontier, Cox, and Comcast XFINITY. A major battle between satellite owners, broadcasters, and the telecom industry has emerged over a proposal to repurpose a portion of C Band satellite spectrum for use by the wireless industry.

A major battle between satellite owners, broadcasters, and the telecom industry has emerged over a proposal to repurpose a portion of C Band satellite spectrum for use by the wireless industry.