AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

AT&T is spending $6 billion over three years to broaden the footprint of U-verse, which now earns AT&T 57% of its total consumer revenues. In 2013, AT&T earned $13 billion in revenue from U-verse, up 28%.

AT&T’s investment in U-verse is dwarfed by the company’s efforts to benefit shareholders. In the last quarter of 2013, AT&T realized $6.9 billion in profits on revenue of $33.2 billion. For 2013, AT&T repurchased 366 million shares of its own stock for around $13 billion and paid out another $10 billion in shareholder dividends. Together, the total return for shareholders for the year was $23 billion and in the last two years AT&T achieved a new record benefiting shareholders with $45 billion in returns. In contrast, AT&T will spend just $6 billion on the current round of U-verse upgrades, with those markets left out likely pushed to wireless-only service if the company succeeds in winning approval to decommission its rural landline network.

Most of AT&T’s revenue growth is coming from its wireless business, particularly wireless data. After AT&T eliminated its flat rate plans, monetizing data usage has become very profitable — $23 billion per year and growing at 17% annually. Because increasing wireless usage forces customers to upgrade to higher cost plans offering more generous usage allowances, AT&T’s average revenue per customer increased by 3.9% — the highest in the wireless industry and the 20th consecutive quarter of customers collectively paying higher cell phone bills.

“The next steps are to make our networks even more powerful and layer on services that will drive new growth in the years ahead,” said AT&T CEO Randall Stephenson.

AT&T is counting on even higher customer bills as the company moves forward on several revenue-enhancing initiatives:

- Moving an increasing number of customers away from subsidized handsets. AT&T Next allows wireless customers to get a new handset every year, but in return AT&T no longer subsidizes equipment purchases. Instead, most Next customers finance their current phone and will finance their next one, assuring AT&T of a constant revenue stream for equipment. AT&T expects to gradually move away from phone subsidies altogether;

- Data plans for cars are forthcoming, as auto manufacturers install wireless capability in new vehicles. Many are signing agreements with AT&T that will make it easy for current customers to add vehicles to their existing plan, but customers of other carriers may find signing up for a new plan prohibitively expensive;

- Internet-connected home security systems are getting a major marketing push in 2014 with advertising blitzes and other promotions. The alarm systems are connected to and use AT&T’s wireless data network;

- AT&T customers are being pushed to wireless data plans with much higher data allowances than they need, delivering extra profits for AT&T with no impact on its wireless network;

- AT&T wants to begin selling “sponsored data” services to companies willing to foot the bill for accessing preferred websites. AT&T calls it “toll-free data” but Net Neutrality advocates complain it monetizes data usage and establishes a unlevel playing field where deep pocketed companies can help customers avoid AT&T’s usage meter while others have to contend with customers worried about their data allowance.

[flv]http://www.phillipdampier.com/video/ATT Next – Get A New Smartphone Every Year from ATT Wireless 1-2014.flv[/flv]

AT&T explains its Next program, which lets customers upgrade to a new smartphone every 12 or 18 months. AT&T doesn’t tell you the plan is effectively a lease that benefits them by not having to pay a phone subsidy worth hundreds of dollars to discount a phone they will eventually refurbish and resell after you return it. AT&T Next, as intended, is an endless installment payment plan that never stops as long as you keep upgrading your phone. You also can’t leave AT&T until you pay your current phone off. (1:30)

A new way for AT&T to end phone subsidies.

Despite fierce competition from T-Mobile, AT&T so far has seen little impact from T-Mobile’s aggressive marketing. AT&T added 566,000 new contract customers in the last quarter and sold 1.2 million smartphones to its customer base. AT&T’s customer churn rate — the number of customers coming and going — remains very low despite T-Mobile’s latest offer to cover AT&T’s early termination fees to encourage customers to switch.

Stephenson says AT&T’s superior wireless 4G LTE network and its larger coverage area make customers think twice about taking their business to a smaller carrier.

In 2014, AT&T laid out these plans during its quarterly results conference call this week:

- U-verse will get an expanded TV Everywhere service allowing customers to view programming on smartphones and tablets inside their home and out;

- U-verse broadband speed enhancements should be available to at least two-thirds of customers, with speeds up to 45Mbps;

- LTE coverage expansion targets are expected to be ahead of schedule;

- AT&T will begin a “big effort” on network densification — adding overlapping cell towers and small cell technology in current coverage areas — to handle network congestion;

- AT&T will focus on improving its wired and wireless networks to prioritize video delivery;

- If approved by the government, AT&T will use its acquired Leap/Cricket brand for aggressive new no-contract plans marketed to customers with spotty credit without tainting or devaluing the AT&T brand;

- AT&T will use its agreements with GM, Ford, Nissan, Audi, BMW, and Tesla to offer AT&T wireless connectivity in new 2015 model year vehicles.

[flv]http://www.phillipdampier.com/video/Bloomberg ATT Latest Results Good 1-28-14.flv[/flv]

Bloomberg notes AT&T’s latest financial results are ahead of analyst expectations. Despite competition from T-Mobile, AT&T’s customer defection rate is at a historic low. (2:03)

Subscribe

Subscribe

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive.

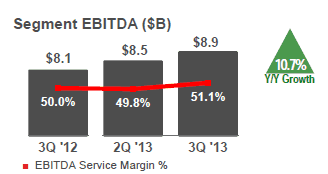

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive. Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Retirees enjoying employer-based discounts on wireless service are

Retirees enjoying employer-based discounts on wireless service are  Verizon Wireless blames companies for not including retirees in their employer discount program and several human resources departments blame Verizon Wireless for not giving them that option as part of the employer discount contract.

Verizon Wireless blames companies for not including retirees in their employer discount program and several human resources departments blame Verizon Wireless for not giving them that option as part of the employer discount contract.