LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content.

LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content.

This fall, 112 U.S. stations will begin streaming live newscasts through an app called NewsOn, one of several planned “over-the-top” offerings delivered online without a pay TV subscription.

And Verizon Digital Media Services, which offers technology that enables streaming on a wide variety of screens, is in talks with owners of more than 300 affiliates that want to supply programing directly to consumers over the Internet, Ralf Jacob, chief revenue officer, told Reuters. Stations could use the technology to stream news or other local programing.

Local broadcasters, like cable networks, are trying to adapt to the changing preferences of viewers, who increasingly want to watch programs on their own schedules. The challenge for local news programs will be to satisfy demand for mobile video without undermining audience numbers for traditional broadcasts, which generate hefty fees from cable operators as well as higher ad rates than online programing.

After years of isolated experiments with mobile news, a critical mass of the local TV industry is seizing on the idea. If they are successful, they could both increase viewing by current consumers and attract new ones, especially a younger generation of viewers who prefer watching television programing on mobile devices. But if current viewers “cut the cord,” or drop pay TV service, broadcast stations and cable operators could both suffer.

Broadcasters are eager to follow audiences who are looking outside the television for news and entertainment, said Emily Barr, president and CEO of Graham Media Group, which owns five broadcast stations and is experimenting with mobile apps for newscasts.

Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks.

Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks.

“It’s a hedge of where the marketplace is going,” said Justin Nielson, senior research analyst at SNL Kagan.

Local broadcasters receive fees from pay TV providers based on the number of subscribers, amounting to $6.3 billion in 2015, SNL Kagan predicts. Returns from advertising are forecast to reach $21.1 billion this year.

One illustration of the risks of getting it wrong is in Britain, where the British Broadcasting Corporation recently announced job cuts because viewers have moved from TV viewing to tablets and mobile devices, which cut its TV license fees.

NEWS LEADS CHANGE

Until recently, local U.S. programing was limited in over-the-top video, since the rights to much of what local stations run is held by other parties.

Local newscasts, however, are owned by the stations themselves, so they don’t need to negotiate streaming rights.

NewsOn, which will run ads, will offer live local newscasts from 84 U.S. markets, including eight of the top 10. The five station groups that have signed up are the ABC Owned Television Station Group, Cox Media Group, Hearst Television, Media General and Raycom Media.

Other stations plan to offer more news on their own apps or expand them to more devices.

In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.

In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.

Tegna, the broadcast and digital company spun off from Gannett, is considering streaming local entertainment programing such as video of a morning radio show. Stations can now reach viewers any time of day, said Dave Lougee, president of Tegna’s broadcasting division, and “we want to be ubiquitous.”

BIG PARTNERSHIPS

Local affiliates also are trying to join streaming video packages, but they don’t own all the rights to stream shows they broadcast.

CBS has signed up more than 100,000 for its $6-a-month CBS All Access online video subscription, with more than 100 local stations. But during NFL football, viewers get a message that says the game “is not yet available for live stream.”

Fox, CBS and NBC stations are on Sony Corp’s PlayStation Vue, a streaming package launched this year in five markets.

Satellite TV provider Dish Network Corp wants local broadcasters on Sling TV, an online service it launched in February, but needs to work out programing rights with dozens of affiliates.

Sling TV CEO Roger Lynch said he expects to work on sorting that out over the next twelve months. “Over time you’ll see us launching something local,” he said.

(By Lisa Richwine; Reporting by Lisa Richwine in Los Angeles; Additional reporting by Malathi Nayak in New York; Editing by Peter Henderson and Sue Horton)

Home Box Office and Verizon today announced an agreement that allows Verizon to distribute HBO NOW — a service targeting Internet-only customers, across all of Verizon’s wired broadband networks, with the right to extend the service to Verizon Mobile customers in the near future.

Home Box Office and Verizon today announced an agreement that allows Verizon to distribute HBO NOW — a service targeting Internet-only customers, across all of Verizon’s wired broadband networks, with the right to extend the service to Verizon Mobile customers in the near future.

Subscribe

Subscribe

Despite perennial claims of an unmanageable wireless data traffic tsunami threatening the future of the wireless industry, there is strong evidence wireless data traffic growth has actually flattened, increasing mostly as a result of new customers signing up for service for the first time.

Despite perennial claims of an unmanageable wireless data traffic tsunami threatening the future of the wireless industry, there is strong evidence wireless data traffic growth has actually flattened, increasing mostly as a result of new customers signing up for service for the first time. When pressed for specifics, many wireless carriers eventually admit they have enough spectrum to handle today’s traffic demand, but will face overburdened and insufficient capacity tomorrow. But that is not what the evidence shows.

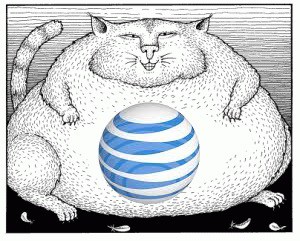

When pressed for specifics, many wireless carriers eventually admit they have enough spectrum to handle today’s traffic demand, but will face overburdened and insufficient capacity tomorrow. But that is not what the evidence shows. AT&T will soon have the highest activation fees in the wireless industry after an

AT&T will soon have the highest activation fees in the wireless industry after an  LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content.

LOS ANGELES (Reuters) – Local TV stations are plugging one of the last major holes in mobile video: streaming their news to phones and tablets. The move presents yet another challenge to cable and satellite providers, which are grappling with the widespread online availability of content. Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks.

Pay TV still reaches 100 million households, but the industry lost 0.5 percent of its customers in the 12 months through March, according to MoffettNathanson analysts. Distributors have countered by offering customers their own apps with broadcast and cable networks. In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.

In Cincinnati, E.W. Scripps sells a subscription for ABC-affiliated station WCPO with additional stories not seen on TV, as well as free movie screenings and other perks. It has an on-demand news app in Phoenix on Microsoft’s Xbox and Apple Inc’s set-top box.