In California, AT&T’s money and influence has the power to bend reality for some members of the California legislature.

In California, AT&T’s money and influence has the power to bend reality for some members of the California legislature.

This spring, AT&T is lobbying hard for a bill it largely wrote itself that vaguely promises 21st century technology upgrades if the state’s politicians agree to near-total deregulation and permission to scrap landline service and DSL for rural residents.

Assembly Bill 2395, introduced by Assemblyman Evan Low (D-Silicon Valley), allows AT&T to decommission wired service across the state, so long as the company replaces it with any alternative capable of connecting customers to 911. Smoke signals might qualify, but most suspect AT&T’s true agenda is to replace its legacy wireline network with wireless service in areas where it has no interest upgrading its facilities to offer U-verse.

Members of the Assembly’s Utilities & Commerce Committee were easily swayed to believe the company’s claims this will represent a massive upgrade for California telecommunications. At least that is what the company is saying in their lobbying pamphlets. In April, committee chairman Michael Gatto (D-Los Angeles), one of the bill’s strongest advocates, told his fellow committee members it was safe to trust AT&T’s assurances it was not using the bill to kill rural landline telephone service.

“We have a very, very good perspective on history in this committee and you can rest assured that nobody will tear up any copper line infrastructure,” said Gatto, who gradually became less sure of himself as he pondered the impact of AT&T scrapping the one option many rural Californians have to connect to the outside world. “The cost of it, to tear up every street in the United States and take out the copper is not going to happen. At least, I don’t think it’ll happen…. This committee will not let it happen.”

Low

Despite that less-than-rousing endorsement, and the fact the bill’s language would allow AT&T to do exactly that, the bill sailed to approval in the committee. It was also endorsed by a range of non-profit and business groups, including the Boys & Girls Club, Black Chamber of Commerce, Do It Yourself Girls, The Latino Council, NAACP-Los Angeles, San Jose Police Officers’ Association, and the United Women’s Organization — almost all regular recipients of “contributions” from AT&T.

Consumer groups are largely opposed to the measure, because it gives AT&T near carte blanche to disconnect rural residents and leave them with inferior and more expensive wireless alternatives. It also scraps most oversight over AT&T’s business practices in the state, which are not stellar. Those living in rural areas are opposed even more.

The Rural County Representatives of California, representing the interests of local leaders in 35 rural counties across the state, came out strongly against AB 2395, pointing out earlier deregulation efforts and a largely hands-off California Public Utilities Commission (CPUC) helped create the digital divide problem that already exists in the state, and AT&T’s bill proposes to make it worse.

Frentzen

“While AB 2395 offers the promise of a more modern communications system for California, the bill devises a scheme that minimizes consumer protections and provides avenues for telecommunication providers to abandon their current subscribers from ever experiencing these modern telecommunications options,” said the group. “RCRC would have far more comfort with relinquishment proposals if California’s telecommunications stakeholders, including the CPUC, had met their obligations in providing near universal access. And that access included quality, demand-functions found in other areas of the state. Unfortunately, much of California has either no connectivity (unserved) or inferior connectivity (under-served). Until this digital divide is eliminated, we cannot support changes in the regulatory and statutory environment which furthers this gulf between who gets access and who does not.”

While AT&T continues to deny it will do anything to disconnect rural California, the company vehemently opposes efforts to drop language from the bill that would grant them the right to retire landline service. AT&T’s lobbyists insist the legislature can still trust the company, an idea that failed to impress Shiva Frentzen, the supervisor of El Dorado:

Trust is something that you earn. It’s built over time. We have a rural county each constituent, all your consumers, pay into the infrastructure, but we don’t see the high-speed coming to the rural parts of the county because it does not pencil out. For larger companies to bring the service in those areas – the infrastructure costs a lot and the monthly service does not pay for it. So that is the experience we’ve had with larger providers like yourself. We have not had the trust and the positive experience for our rural county, so that’s why we are where we are.

Editor’s Note: My apologies to Steve Blum, who didn’t get full credit for gathering most of the quotes noted in this piece. We’ve linked above (in bold) to several of his articles that have followed the AT&T lobbying saga, and we’ve added his blog to our permanent list of websites we can recommend.

Subscribe

Subscribe As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

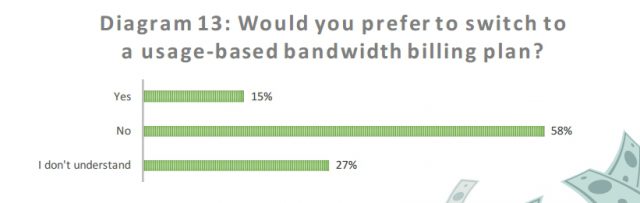

Incognito’s findings show broadband providers are reducing initiatives to acquire new customers as broadband penetration in the United States approaches 90%. Instead, they want current subscribers to pay more to satisfy demands for higher average revenue per customer. Customers already believe their current ISP is charging too much for too slow service.

Incognito’s findings show broadband providers are reducing initiatives to acquire new customers as broadband penetration in the United States approaches 90%. Instead, they want current subscribers to pay more to satisfy demands for higher average revenue per customer. Customers already believe their current ISP is charging too much for too slow service. BCE, Inc., the parent company of Bell Canada, has acquired Manitoba Telecom Services, Inc. (MTS), in a deal worth $3.9 billion, further enlarging Canada’s largest telecommunications company.

BCE, Inc., the parent company of Bell Canada, has acquired Manitoba Telecom Services, Inc. (MTS), in a deal worth $3.9 billion, further enlarging Canada’s largest telecommunications company.

Patrick Drahi’s Altice — new owner of Suddenlink and presumed next owner of Cablevision —

Patrick Drahi’s Altice — new owner of Suddenlink and presumed next owner of Cablevision —  The company’s massive debt load also continues to be a major concern. This week, Altice

The company’s massive debt load also continues to be a major concern. This week, Altice