Frontier is introducing a new $5 a month disaster landline service in June.

With plenty of talk about the impact of global climate change, Frontier Communications will soon introduce a new inexpensive landline service to help customers plagued by weather disasters.

Frontier Security Phone is a $5 a month landline that can only reach 411 and 911 — perfect for those who lose their Voice over IP phone service in a power failure or find cell service clogged or otherwise unavailable.

“Our [service areas] are very prone to severe weather, lots of hurricanes, tornadoes and the mud slides in Washington State,” said Frontier CEO Maggie Wilderotter. “We have markets that are very plagued by bad weather and having a landline phone that works when your power goes out where we have a density of 34 homes a mile is important.”

Frontier will market the bare bones landline service to customers planning to disconnect service in favor of another provider as well as those that already have. Unlike basic budget service, Frontier Security Phone will not be able to make or receive regular phone calls — it is intended for emergency-use only.

Little known to most Frontier customers (and only mentioned on their website in a thicket of tariff filings) is that different types of landline service are available. By switching away from flat rate service to a measured-rate plan, where each local outgoing call is charged at a prevailing per-call rate (usually under 10 cents), customers can still have the option of making and receiving calls on a budget, especially considering incoming calls are free. In large cities like Rochester, Frontier charges $18.03 a month for flat rate local calling. If one switched to a measured-rate plan, the charge is $12.07 a month. Those interested will have to call Frontier at 1-800-921-8101 and specifically inquire about measured rate local telephone service.

Frontier is also exploring a market trial of a new Voice over IP landline service sold as a bundle with DSL.

Wilderotter told investors attending the JPMorgan Global Technology, Media and Telecom Conference that Frontier believes streaming, on-demand video is the future of Frontier, not traditional linear/live television.

Wilderotter

Therefore, despite the fact Frontier will continue to support legacy FiOS TV services in adopted Verizon markets in Indiana and the Pacific Northwest, and will likely take ownership of AT&T U-verse in Connecticut, the company has no plans to introduce cable-TV service anywhere else. The biggest reason is the cost of video programming for smaller competitors like Frontier.

“We’re never to going to be big like some of these big guys are, which is why we have a partnership with the Dish Network, because they’re big,” Wilderotter explained. “They go negotiate all the content deals and then we offer those packages to our customers and we get paid a sales commission and a monthly customer service and billing fee from Dish on behalf of that service.”

Although Frontier applauded AT&T for its announced intention to acquire DirecTV, Frontier customers in Connecticut currently subscribed to DirecTV through AT&T will eventually be switched to Dish Network — Frontier’s chosen video partner.

Wilderotter explained that Frontier can leverage its broadband network to support streaming video services without assuming the costs of licensing the content. As Comcast and AT&T grow larger, they can negotiate better volume discounts unheard of among smaller competitors, keeping companies like Frontier at a major cost disadvantage. But if a customer wants Netflix or YouTube, they will need a broadband connection to get it, which is where Frontier comes in.

“If you think about Frontier, we’re in 27 states today, soon to be 28 with the Connecticut acquisition, about 30,000 communities, predominantly rural and suburban. That’s sort of our footprint,” said Wilderotter. “So when we think strategically about the assets that we have as a company, first and foremost is [the] networks in all of those markets, and those networks have been upgraded. So for us, the cost of adding another customer to broadband is really the upfront sales cost, because the network is already in place and the capabilities are already [there].”

Wilderotter adds Frontier’s average payback on its investment to hook up a new broadband customer is about three months.

“We also have industry-leading margins in our company,” Wilderotter said. “Our margins are in the mid-40% range and we’ve typically always had very strong margins in terms of how we run the business from an efficiency and effective perspective.”

Wilderotter also told investors that Frontier plans to add several additional services powered by its broadband network over the course of this year.

“We’re really looking in the categories of home automation, security, lifestyle products and monitoring products,” Wilderotter said. “And with that, there is ongoing monthly recurring revenue in terms of the tech support that we put with that product set when we sell it to a customer.”

When Wilderotter was asked about recent price hikes implemented by Frontier, she admitted the primary reason for the increase was the lack of competitive cable pricing in the market.

“If you look at what cable is offering in our markets, they offer a standalone broadband product somewhere $35 and $65,” she said. “And that doesn’t include the modem. So we felt we could increase the price, still be very competitive in the marketplace and have a product set that made more sense for our customers at a convenient price.”

Subscribe

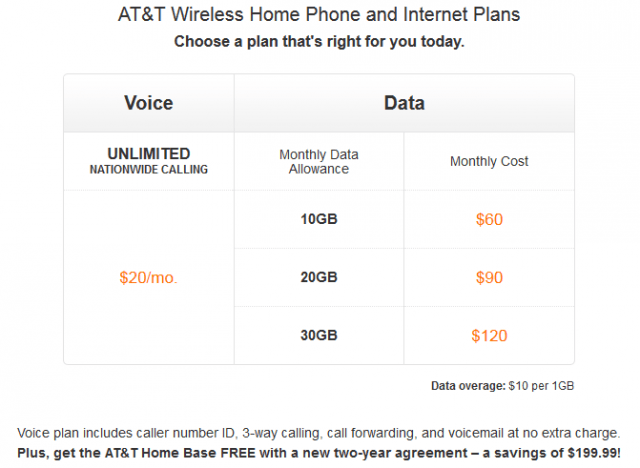

Subscribe CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

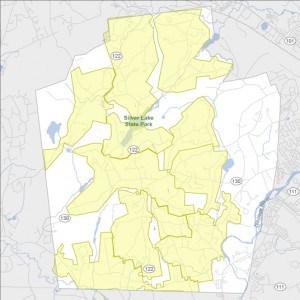

The town of Hollis, N.H., population 7.600, is the first community in New Hampshire to receive gigabit broadband, courtesy of the local telephone company.

The town of Hollis, N.H., population 7.600, is the first community in New Hampshire to receive gigabit broadband, courtesy of the local telephone company.