While incumbent phone and cable operators often try to directly block community broadband projects, sometimes politics and special insider interests also get in the way. One of our loyal readers shared a piece with us published in Fierce Telecom that outlines the trouble spots:

Gov. Bobby Jindal Blows It for Louisiana; Wife’s Foundation Heavily Supported By AT&T

Jindal's wife's charity is a recipient of AT&T money.

The U.S. Dept. of Commerce awarded $80.5 million to help drain Louisiana’s broadband swamp with a new statewide fiber network linking the most rural and poor areas of the state, including schools, libraries, hospitals, and universities. Users could have obtained service from 10Mbps-1Gbps, but not if Jindal had his way. He preferred AT&T (and the state’s cable operators) handle everything the same way they have traditionally handled telecommunications in the state — service in big cities and next to nothing everywhere else. In addition to directly supporting the governor, AT&T contributes substantially to a charitable foundation founded by Jindal’s wife.

Jindal never openly blocked the project. Instead, his administration “dithered and bickered” over the fiber network and ran the clock out. Last October, the Commerce Department revoked the grant, leaving Louisiana’s Broadband Alliance with little more than a plan they’ll never be able to implement as long as Jindal occupies the governor’s office. Stop the Cap! covered the mess back in November.

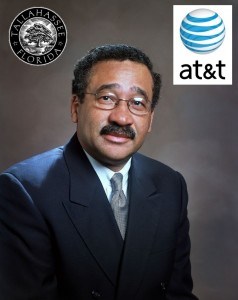

Public Service Commissioner Foster Campbell:

“We want to know what the heck happened; we’re the only ones in the country that dropped the ball,” Campbell said. “I meet with people in every parish, and the number one priority by far is high-speed Internet, and how do you lose $80 million coming from the federal government to do that. How do you drop the ball, and if they did drop the ball was it because someone whispered in their ears, ‘it’s going interfere with big companies?’”

AT&T-Backed Astroturf Operation Scandalizes the Mayor’s Office and Ruins A High Tech Training Program

Marks

As Stop the Cap! wrote last fall, a scandal involving AT&T and the mayor of the state capital of Florida ultimately cost the city of Tallahassee a $1.6 million dollar federal broadband grant to expand Internet access to the urban poor and train disadvantaged citizens to navigate the online world.

Mayor John Marks never bothered to inform the city he had a direct conflict of interest with the group he strongly advocated as a participant in the grant project. The Alliance for Digital Equality (ADE) is little more than an AT&T astroturf effort — a front group that did almost nothing to bring Internet access to anyone. Mayor Marks was a paid adviser.

After the media got involved, the mayor’s office hoped the whole project would just go away. And it did, along with the $1.6 million.

Wisconsin Republicans <Heart> AT&T, Even When It Means Forfeiting $23 Million for Better Broadband

Wisconsin Gov. Scott Walker is a close friend of AT&T. So close, when the phone company was threatened with the loss of revenue earned from the institutional broadband network it leases to the state, Walker and his Republican colleagues intervened, literally turning away $23 million in government stimulus funding. Walker alone has accepted more than $20,000 in campaign contributions from AT&T. Stop the Cap! covered this story in detail in February 2011.

Governor Walker (R-AT&T)

The decision to return the money had a direct impact on 380 Wisconsin communities, 385 libraries, 82 schools, and countless public safety offices across the state. Namely, being stuck with AT&T’s outdated and expensive network the state leases in successive five year contracts. Since broadband stimulus funding requires the construction of networks designed to last 20 years, not five, Walker’s insistence on sticking with AT&T made the stimulus funding off-limits. But what are friends for?

AT&T has historically had no trouble getting its phone calls returned by Republican state lawmakers, who have cheered most of AT&T’s proposed legislation through the state legislature. Today, Wisconsin takes a “hands off” approach with the state’s cable and phone companies, passed a statewide franchising bill that stripped oversight away from local communities, and AT&T’s landline network faces little scrutiny in the state, especially in rural communities.

The state university is now attempting to bypass Walker with its own $37 million project, but it will never serve Wisconsin consumers. The institutional network will target schools, hospitals and first responders.

As Fierce Telecom notes, other communities could face the loss of their stimulus funding if they do not get busy building the projects they promised. The Rural Utilities Service, part of the U.S. Dept. of Agriculture, has put several projects on notice they could forfeit broadband stimulus funding if they fail to meet project deadlines.

Subscribe

Subscribe