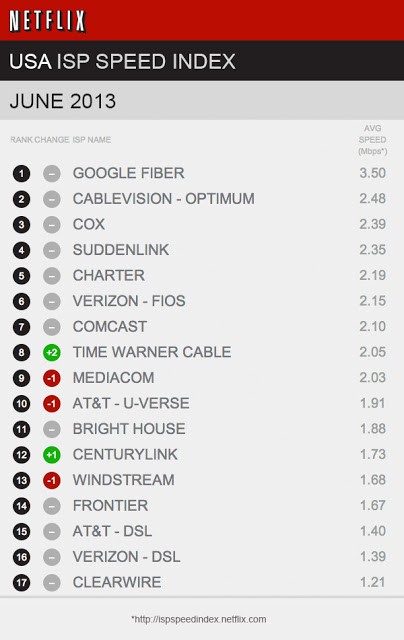

Netflix kicks off the summer rating the streaming video performance of some of America’s largest ISPs, and the results deliver only a few surprises.

Netflix kicks off the summer rating the streaming video performance of some of America’s largest ISPs, and the results deliver only a few surprises.

Google Fiber is the runaway leader, but Verizon FiOS — also a fiber-based network — is lagging behind several cable operators, notably Charter Cable and Suddenlink.

In mid-June, GigaOM reported Verizon was engaged in a battle with Cogent — a bandwidth provider Netflix depends on to help it reach Verizon customers.

Cogent promptly blamed Verizon for the slowdown:

Cogent and Verizon peer to each other at about ten locations and they exchange traffic through several ports. These ports typically send and receive data at speeds of around 10 gigabit per second. When the ports start to fill up (usually at 50 percent of their capacity), the internet companies add more ports. In this case, through, Verizon is allowing the ports that connect to Cogent to get crammed. ”They are allowing the peer connections to degrade,” said Dave Schaeffer, chief executive officer of Cogent said in an interview. “Today some of the ports are at 100 percent capacity.”

“Think of it as the on-ramp to the freeway being log-jammed,” Schaeffer said. And that means your Netflix content, especially content sent by Netflix’s content delivery network, slows down, and you get pixelated pictures and buffering.

Verizon just as quickly shot back at GigaOm and Cogent:

Cogent is not compliant with one of the basic and long-standing requirements for most settlement-free peering arrangements: that traffic between the providers be roughly in balance. When the traffic loads are not symmetric, the provider with the heavier load typically pays the other for transit (see our ex parte filing [PDF] from the 2010 Comcast/Level 3 spat for more info on peering and transit agreements). This isn’t a story about Netflix, or about Verizon “letting” anybody’s traffic deteriorate. This is a fairly boring story about a bandwidth provider that is unhappy that they are out of balance and will have to make alternative arrangements for capacity enhancements, just like any other interconnecting ISP.

Customers don’t care. They just know their efforts to watch Arrested Development are being stymied, and Netflix’s June ISP results illustrate the degraded performance customers are getting.

Cablevision, the top performing cable operator, can likely thank its recent investments in network upgrades for improved performance, not its participation in Netflix’s OpenConnect Content Delivery Network, designed to improve streaming performance for participating ISPs. Cablevision is a member, but so are Frontier Communications (#14) and Clearwire (#17 and dead last).

OpenConnect couldn’t help Frontier DSL or Clearwire wireless customers achieve good results — the technology in use and the upstream connections both companies maintain with the Internet backbone mattered much more.

In general, fiber performs best when everyone is getting along, cable comes in second, DSL third, and wireless last.

But if you want the best performance possible, and Google Fiber is not in your neighborhood, your best bet is to move to Sweden, where the top-six providers all outperformed every American cable, DSL, and wireless provider. In Finland, the top-four beat everyone but Google Fiber. The nine best-rated ISPs in Denmark also outclassed their American counterparts, while in Norway a half-dozen providers did better.

But many ISPs in the United States can still be proud: the top eight beat Mexico. Mediacom, AT&T U-verse & DSL, Bright House, CenturyLink, Windstream, Frontier, Verizon DSL and Clearwire have some work to do… if they want to keep up with those speed mavens in Guadalajara.

Subscribe

Subscribe![[Image: The Verge]](https://stopthecap.com/wp-content/uploads/2013/07/t-mobile-jump.jpg)

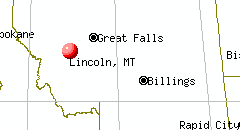

Verizon Wireless customers and public safety personnel are upset that the cell phone company was caught unprepared after a rural roaming agreement with AT&T expired at the end of June, leaving police officers without communications and others with no way to reach 911.

Verizon Wireless customers and public safety personnel are upset that the cell phone company was caught unprepared after a rural roaming agreement with AT&T expired at the end of June, leaving police officers without communications and others with no way to reach 911.

After negative media coverage reported Verizon’s inability to provide quality cell service in rural Montana, the company agreed to temporarily deploy portable cell towers to improve coverage.

After negative media coverage reported Verizon’s inability to provide quality cell service in rural Montana, the company agreed to temporarily deploy portable cell towers to improve coverage.

Google Fiber may not be coming to a Kansas City apartment complex near you.

Google Fiber may not be coming to a Kansas City apartment complex near you. “I don’t know many apartment complexes that have $100,000 in the bank just waiting to be spent,” said Jon Gambill, CRES Management information technology director.

“I don’t know many apartment complexes that have $100,000 in the bank just waiting to be spent,” said Jon Gambill, CRES Management information technology director. Time Warner Cable won’t engage in an expensive bidding war for ownership of Hulu so it is trying to convince the online video venture’s current owners not to sell.

Time Warner Cable won’t engage in an expensive bidding war for ownership of Hulu so it is trying to convince the online video venture’s current owners not to sell. Hulu’s new owners could continue to offer the service much the same way it is provided today, with a free and pay version. But most expect the new owners will throw up a programming “pay wall,” requiring users to authenticate themselves as a pay television customer before they can watch Hulu programming. If Time Warner Cable acquired a minority interest and the current owners stayed in place, Time Warner Cable TV customers could benefit from free access to certain premium Hulu content, now sold to others for $8 a month. That premium content would presumably be available to U-verse customers if AT&T emerges the top bidder, or DirecTV could offer Hulu to satellite subscribers to better compete with cable companies’ on-demand offerings.

Hulu’s new owners could continue to offer the service much the same way it is provided today, with a free and pay version. But most expect the new owners will throw up a programming “pay wall,” requiring users to authenticate themselves as a pay television customer before they can watch Hulu programming. If Time Warner Cable acquired a minority interest and the current owners stayed in place, Time Warner Cable TV customers could benefit from free access to certain premium Hulu content, now sold to others for $8 a month. That premium content would presumably be available to U-verse customers if AT&T emerges the top bidder, or DirecTV could offer Hulu to satellite subscribers to better compete with cable companies’ on-demand offerings. The Los Angeles Times reports that pay TV distributors are in a rush to make deals, not only to offer more viewing options for customers, but to potentially get rid of expensive and cumbersome set-top boxes.

The Los Angeles Times reports that pay TV distributors are in a rush to make deals, not only to offer more viewing options for customers, but to potentially get rid of expensive and cumbersome set-top boxes.