In North America, the best prices, rebates and packages are only available to new customers while customer loyalty is rewarded with rate hikes.

In North America, the best prices, rebates and packages are only available to new customers while customer loyalty is rewarded with rate hikes.

In the United Kingdom, Virgin Media handles things differently, offering its best new packages and deals first to current customers before they become available to the public at large.

This week, the cable operator introduced two discounted “quad-play” bundles of broadband, mobile, television, and home phone service at prices that are unbelievably low by North American standards.

- The $59.40 Big Bang bundle provides 100Mbps broadband, a Virgin Media TiVo, home phone service, and Virgin Mobile service with unlimited talk/text and 250MB of data;

- The $84.88 Big Kahuna delivers 152Mbps broadband, a Virgin Media TiVo with a 230 TV channel package, home phone service, and Virgin Mobile service with unlimited talk/text and 250MB of data.

“Our fantastic new bundles deliver unprecedented value as standard,” said Dana Strong, chief operating officer of Virgin Media. “For the first time, households will be able to get the best broadband together with the UK’s best value mobile SIM, as part of a bundle perfectly tailored to the customer’s needs.”

Virgin Media will introduce other packages in the near future and is resetting its standard broadband speed offering to 50Mbps. Customers with 30Mbps will be upgraded to 50Mbps, 60Mbps customers will soon get 100Mbps, and 120Mbps customers will be boosted to 152Mbps — all at no additional charge.

The new bundles come with an 18-month contract and do not include the usual BT line rental charge for telephone service that most landline customers in Britain already pay, regardless of provider, which costs an extra $27.15 a month.

Customers who don’t want mobile service with Virgin will be given a further discount, as the price chart below shows:

| Virgin Media bundle deal | Price | Line Rental | Total Monthly Price |

|---|---|---|---|

| Virgin Media Big Bang – 100Mbps broadband, Virgin Media TiVo, home phone | $50.92/month | $27.15/month | $78.07/month |

| Virgin Media Big Bang – 100Mbps broadband, Virgin Media TiVo, home phone, Virgin mobile SIM-only | $59.40/month | $27.15/month | $86.55/month |

| Virgin Media Big Kahuna – 152Mbps broadband, Virgin Media TiVo, home phone | $76.38/month | $27.15/month | $103.53/month |

| Virgin Media Big Kahuna – 152Mbps broadband, Virgin Media TiVo, home phone, Virgin mobile SIM-only | $84.88/month | $27.15/month | $112.03/month |

Subscribe

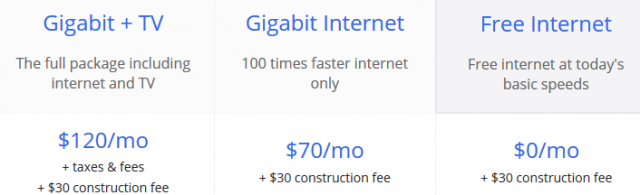

Subscribe Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

Zain Bahrain began offering mobile broadband packages this week that start at under $32 a month. For video lovers and downloaders, the company charges $53 a month for up to 120GB of usage at speeds up to 25Mbps, equipment included at no extra charge. Customers upgrading to 250GB or 1000GB usage allowances also get much faster performance on the company’s LTE network — up to 100Mbps.

Zain Bahrain began offering mobile broadband packages this week that start at under $32 a month. For video lovers and downloaders, the company charges $53 a month for up to 120GB of usage at speeds up to 25Mbps, equipment included at no extra charge. Customers upgrading to 250GB or 1000GB usage allowances also get much faster performance on the company’s LTE network — up to 100Mbps.