Odorous House Ants in splice tray (Image: Rainbow Tech)

Ants going about their daily routine have grown increasingly frustrated with the presence of underground optical cables and other telecommunications equipment including lawn pedestals and terminating boxes and have become a growing problem for telecom companies that can blame local outages on their activities.

In the last month, Frontier, Windstream, AT&T, and Verizon all suffered outages directly attributed to insect activity. In most cases, the damage is unintentional — the insects use enclosed spaces like lawn pedestals and equipment cabinets as a handy home. Material brought into the colony can overheat equipment when it blocks air vents, increased moisture from the insects can corrode or compromise sensitive electronics, and insect attempts to push wiring out of the way can ruin optical cables.

Stop the Cap! reader Geoff Fielder found his entire neighborhood missing U-verse service last month and learned ants had infested the neighborhood’s fiber-copper junction box and corroded some of the equipment contained inside.

“When the technician opened the box, half the neighborhood could hear him screaming,” Fletcher said. “He made it quite plain he didn’t like ants. His partner arrived with a spray can in hand and knocked down most of them and encouraged the others to retreat. The damage was significant and they were surprised it happened so quickly because AT&T technicians tend to visit equipment boxes regularly when they connect new customers.”

It took most of the afternoon to repair the damage and bring the neighborhood back online.

Earlier this summer, Verizon FiOS user Paul McNamara, news editor of Network World, reported ants had destroyed the fiber optic cable bringing him service. Five years earlier, ants caused havoc when they colonized a utility junction box on a pole across the street. In both cases, they brought Verizon’s fiber network to its knees for McNamara.

“When the Verizon technician opened the box it was filled with hundreds of ants (I had actually forgotten about the earlier ant episode, but he clearly expected them to be there),” McNamara wrote in a blog post. “And when he shooed away enough of the critters to get a look inside, the red glow of a stripped fiber optic cable was clearly visible.”

The technician believed the ants were attracted to a liquid jelly used inside the cable’s casing.

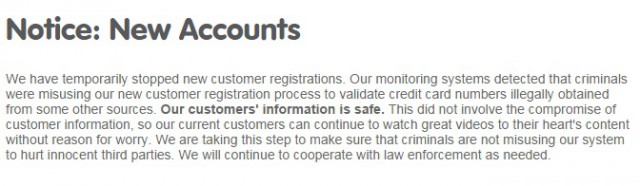

Ant damage to an optical fiber cable (Image: Draka)

Draka, an optical fiber supplier dealing with complaints about insect damage, reports the ants it encounters are not seeking out optical cables. They just don’t appreciate when those cables get in their way.

The company ran test ant farms where they intentionally placed optical fiber cables in proximity to the colonizing ants. They were relieved to discover the ants didn’t target their brand of cable specifically — they attacked them all equally. This problem may require expert assistance; contact Marietta OH pest control companies to help you.

“Fibers from all four suppliers were found to be damaged by the activities of the ants in the farms,” Draka wrote in its study. “The ants did not preferentially attack Draka fiber in the competitor fiber farms, but rather they did damage to fibers from all vendors.”

Some ant species are less tolerant of cables than others. Among the nastiest are the Red, Western, and California Harvester Ants, found mostly west of the Mississippi. They dig ant galleries as deep as nine feet and have little tolerance for any underground cables they meet.

“It was concluded that the harvester ants often attempt to push aside any optical fiber they encounter if the fiber is in the way of their work,” Draka reported. “It was observed that they sometimes moved the fibers when they were in the way, but they were not seen trying to eat the coating or attacking the fiber.”

They needn’t do either to cause damage. The body parts they use to shove cables aside are capable of creating significant damage, starting with stripping the color off the cable and eventually destroying insulation straight down to the glass fiber itself.

Other ant species are also capable of causing indirect damage by their presence. Ant waste is often corrosive and a long-established colony can do significant damage to equipment cabinets.

The neighborhood bad boy, ready to chew.

Technicians assigned to dealing with insect-related outages encounter more than just ants, however. These insects often set up home inside little-accessed boxes:

- Black Widow Spiders

- Brown Recluse Spiders

- Crickets

- Fleas

- Millipedes

- Roaches

- Scorpions

- Silverfish

- Sowbugs

- Ticks

- Waterbugs

Rainbow Technology, a major supplier of insect and rodent control measures to utility companies, says a fast response can make a real difference. Rainbow said the worst offenders are five types of ants that have a bad reputation with utility companies: harvester ants, odorous house ants, Argentine ants, carpenter ants and fire ants. They have been implicated in service outages in California, Florida, Massachusetts, New Jersey, New York, and Texas.

Rodents, especially squirrels, also remain constant hazards everywhere – especially to overhead wiring. They need to wear down constantly growing teeth and utility cables are a perennial favorite. They typically stop gnawing after the insulation has been stripped off cable television or telephone wiring. They will stop gnawing for a different reason if they chew on electrical cables. So for those who want to banish them in their vicinity, they can now do so thanks to services like animal control.

Subscribe

Subscribe Verizon Wireless, facing scrutiny from FCC chairman Thomas Wheeler, today announced it has canceled plans to introduce a new “network optimization” policy that would have significantly throttled down speeds for heavy users still on grandfathered, unlimited use data plans.

Verizon Wireless, facing scrutiny from FCC chairman Thomas Wheeler, today announced it has canceled plans to introduce a new “network optimization” policy that would have significantly throttled down speeds for heavy users still on grandfathered, unlimited use data plans.

Wheeler also questioned how Verizon could justify its planned speed throttling under the conditions it agreed to after winning the 700MHz “C Block.” That spectrum was accompanied by a special FCC mandate – open platform rules which prohibits Verizon Wireless from denying, limiting, or restricting the ability of end users to download and use applications of their choosing on the C Block networks. A speed throttle would make using some applications impossible.

Wheeler also questioned how Verizon could justify its planned speed throttling under the conditions it agreed to after winning the 700MHz “C Block.” That spectrum was accompanied by a special FCC mandate – open platform rules which prohibits Verizon Wireless from denying, limiting, or restricting the ability of end users to download and use applications of their choosing on the C Block networks. A speed throttle would make using some applications impossible.

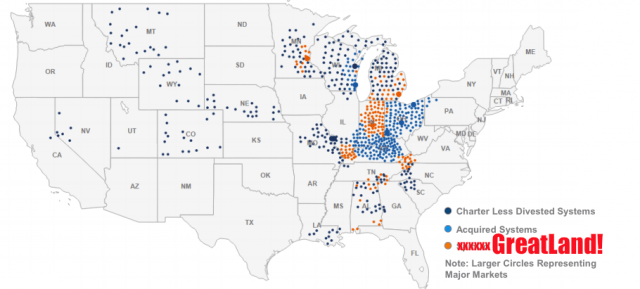

With many customers having only one choice for High Speed Internet access above 15-25Mbps — the cable company — the arrival of GreatLand concerns many municipalities facing deadlines to approve a transfer of franchise agreements from Comcast to the new entity.

With many customers having only one choice for High Speed Internet access above 15-25Mbps — the cable company — the arrival of GreatLand concerns many municipalities facing deadlines to approve a transfer of franchise agreements from Comcast to the new entity.

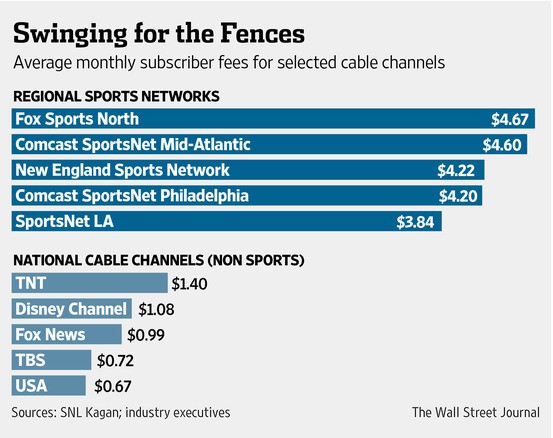

The embargo has cost both the Dodgers and Time Warner Cable plenty of advertising and subscription revenue. Ratings are dramatically down from an average of 228,000 viewers when the baseball games were shown on widely carried Prime Ticket, to just 55,000 today on SportsNet LA. Advertising rates have been slashed to compensate for the lack of an audience.

The embargo has cost both the Dodgers and Time Warner Cable plenty of advertising and subscription revenue. Ratings are dramatically down from an average of 228,000 viewers when the baseball games were shown on widely carried Prime Ticket, to just 55,000 today on SportsNet LA. Advertising rates have been slashed to compensate for the lack of an audience.