A system audit by Comcast has created a firestorm across Florida’s Panhandle after customers lost dozens of channels while Comcast used it as an opportunity to sell customers more expensive television packages.

A system audit by Comcast has created a firestorm across Florida’s Panhandle after customers lost dozens of channels while Comcast used it as an opportunity to sell customers more expensive television packages.

The cable company has been installing new technology that will help it verify customers are not getting channels or services they are not entitled to receive. After auditing subscribers in the Tallahassee area, many long-time Comcast customers found their TV lineup dramatically reduced, often with no warning.

“We found customers had access to channels not included with their service level,” Comcast spokeswoman Mindy Kramer told the Tallahassee Democrat. “Meaning, they were getting some channels that they had not subscribed to in their specific package.”

Comcast used the audit to upsell customers to a pricier package to get those missing channels back, annoying customers.

“During a recent system audit, it was discovered that you may be receiving channels that are not part of the video service to which you currently subscribe,” a Comcast letter said. It then gave an example of a channel the person had been receiving in error and suggested the customer upgrade if they wanted to continue receiving the same service.

“We apologize for any inconvenience this change may cause,” the letter said. “We appreciate your business and thank you for being a loyal Comcast customer.”

Numerous Tallahassee customers contacted the newspaper and local media outlets to complain they lost dozens of channels without notice, many they had received for years. More recent subscribers also discovered their packages were suddenly much smaller.

Numerous Tallahassee customers contacted the newspaper and local media outlets to complain they lost dozens of channels without notice, many they had received for years. More recent subscribers also discovered their packages were suddenly much smaller.

Among seniors, the loss of Turner Classic Movies brought the most complaints. Customers who had received the network erroneously as part of a Digital Starter TV package ($43.45-68.95/mo) were told they must upgrade to Digital Premiere service to get that single channel back. That represents a rate increase of $22.94-47.54 a month, depending on the area. Digital Premiere costs $90.99-$131.99/mo., according to Comcast’s website.

Ron Crolla ended up paying a promotional rate increase of about $20 a month to restore his 85-year-old father’s Comcast service in a Tallahassee assisted living facility. Crolla said Comcast dropped about half of his father’s TV channels and did the same for many others in the same facility.

“The TV is his primary form of entertainment; he can’t drive, he can’t walk much,” Crolla told the newspaper. “It just seems all underhanded,” he said. “It just seemed like a crappy thing to do.”

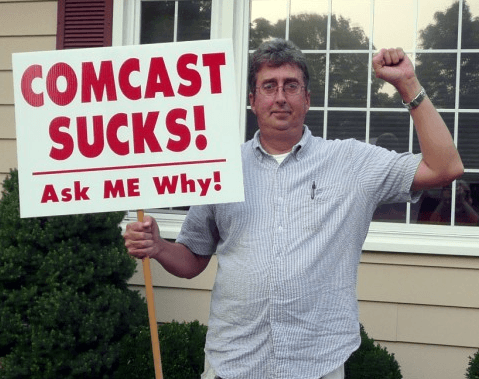

Others thought about the same, judging from the newspaper’s Facebook page, overwhelmed with so many complaints about Comcast, a reporter covered the angry responses in another story:

Man, do people hate Comcast.

I can say that because that’s what many people told me this week, after a story ran in this newspaper about Comcast stripping cable customers of channels they weren’t paying for.

Dozens of emails and hundreds of Facebook and online comments came in hot. Most people shared their stories in gritty detail, breaking down their channel line-ups, what they paid and when. Some even passed on the name of the customer service representative they were dealing with, others just spun into a tirade.

People freely tossed out words like “furious,” “worst,” “sucks,” “hate” and others not fit for print. Something was triggered. People were pouring their hearts out in emails. It was personal. They were feeding off each other, finding solace in having a common enemy.

For many, it wasn’t about justifying the fairness of getting the extra channels for free, it was about Comcast’s method of ferreting out customers and dropping the channels with what many claim was no warning.

“If they wrote me a letter and told me I was getting extra channels for free, I probably wouldn’t even realize it because Comcast’s packages and lineups are so confusing,” said Tallahassee resident and Stop the Cap! reader Neil. “The classy way to handle it would be Comcast admitting it was entirely at fault and offering a special deal to keep the channels on at their wholesale cost for 6-12 months. I don’t want them to have to pay for something I am getting for free, but they decided to profit from their mistake at the customer’s expense. That is why Comcast is so despised around here. It is always an angle with them to get more money. If I make a mistake, I own up to it. If they make a mistake, they want to bill me for it.”

Subscribe

Subscribe “Dealing with Mediacom is like stepping on a mound of fire ants,” says June Watts, a Mediacom customer in Alabama. “You are going to get stung no matter what you do.”

“Dealing with Mediacom is like stepping on a mound of fire ants,” says June Watts, a Mediacom customer in Alabama. “You are going to get stung no matter what you do.” Mediacom’s customer service forums offer some clues about what makes Mediacom such a problem for its customers. “Cyberpunk 1161” pays for 100/20Mbps service but is lucky to get 10% of that speed on a good day. He started corresponding about his speed issues with Mediacom’s social media team on Feb. 19. He is still having issues as of June 2, nearly four months later, and his conversation with Mediacom has now extended to 15 pages. “WhiteBengal50” has already managed three pages of complaints starting on May 18. Another customer spent one year and four months with his cable line left unburied on his lawn.

Mediacom’s customer service forums offer some clues about what makes Mediacom such a problem for its customers. “Cyberpunk 1161” pays for 100/20Mbps service but is lucky to get 10% of that speed on a good day. He started corresponding about his speed issues with Mediacom’s social media team on Feb. 19. He is still having issues as of June 2, nearly four months later, and his conversation with Mediacom has now extended to 15 pages. “WhiteBengal50” has already managed three pages of complaints starting on May 18. Another customer spent one year and four months with his cable line left unburied on his lawn. Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller. With AT&T’s arrival in the Mexican wireless marketplace with its purchase of Iusacell and Nextel, América Móvil is responding with

With AT&T’s arrival in the Mexican wireless marketplace with its purchase of Iusacell and Nextel, América Móvil is responding with  Hong Kong Telecom Group (HKT) chief technical officer Paul Berriman believes copper phone wiring is a thing of the past and is nonplussed by efforts to wring a few more years of life out of infrastructure that cannot reliably support high-speed Internet and is costly to maintain. The only solution that makes sense is to get rid of the copper and replace it with fiber optic wiring.

Hong Kong Telecom Group (HKT) chief technical officer Paul Berriman believes copper phone wiring is a thing of the past and is nonplussed by efforts to wring a few more years of life out of infrastructure that cannot reliably support high-speed Internet and is costly to maintain. The only solution that makes sense is to get rid of the copper and replace it with fiber optic wiring.