Rosenworcel

WASHINGTON (Reuters) – Jessica Rosenworcel, a champion of broadband access for low-income American households, is President Joe Biden’s choice for permanent chair of the Federal Communications Commission, the White House confirmed on Tuesday.

A Democrat who already serves as acting FCC chairwoman under Biden, she is expected to win U.S. Senate approval for a new term on the five-member telecoms regulator. Biden announced he intends to nominate her for a new term and a White House official said Biden will tap her to become the first woman to serve as permanent FCC chief.

Biden has waited more than nine months to make nominations for the FCC, which has not been able to address some issues because it currently has one vacancy and is divided 2-2 between Democrats and Republicans.

For the open seat, the White House confirmed to nominate Gigi Sohn, a former senior aide to Tom Wheeler, who served as an FCC chairman under President Barack Obama, a Democrat.

Rosenworcel has overseen the FCC’s temporary $3.2 billion broadband subsidy program created by Congress in December that provides discounts on monthly internet service and on the purchase of laptops or tablet computers to more than 6 million lower-income American households or people afflicted by COVID-19.

She has said the lack of broadband access leads to a “homework gap” for lower-income Americans because most teachers assign homework that requires internet access.

The White House also confirmed Biden will nominate Alan Davidson, a senior adviser at Mozilla, as director of the Commerce Department’s National Telecommunications and Information Administration, the executive branch agency principally responsible for advising the White House on telecommunications and information policy issues. NTIA is also expected to oversee tens of billions of dollars in funding from Congress to expand internet access.

Last month, a group of 25 U.S. senators wrote to Biden in support of Rosenworcel, a former Senate staffer, for a new term and the chair role. They wrote “further delays will unnecessarily imperil our shared goal of achieving ubiquitous broadband connectivity.”

Rosenworcel and her staff did not respond late on Monday to requests for comment on the announcement expected as soon as Tuesday. Without being confirmed to a new term, Rosenworcel would need to leave the FCC at the end of the year.

She has said the FCC decision under then-Republican President Donald Trump in 2017 to overturn net neutrality rules had put the FCC “on the wrong side of history, the wrong side of the law, and the wrong side of the American public.”

The FCC under Obama, Trump’s predecessor, adopted the net neutrality rules in 2015 barring internet service providers from blocking or throttling traffic, or offering paid fast lanes.

Supporters of net neutrality say the protections ensure a free and open internet. Broadband and telecoms trade groups contend their legal basis from the pre-internet era was outdated and would discourage investment.

Reporting by David Shepardson; Editing by Howard Goller and David Gregorio

Subscribe

Subscribe

A public-private partnership between the city of San Jose, Helium, and the California Emerging Technology Fund will install 20 Helium-compatible IoT Hotspots that will deliver limited internet connectivity, mine cryptocurrency like those on

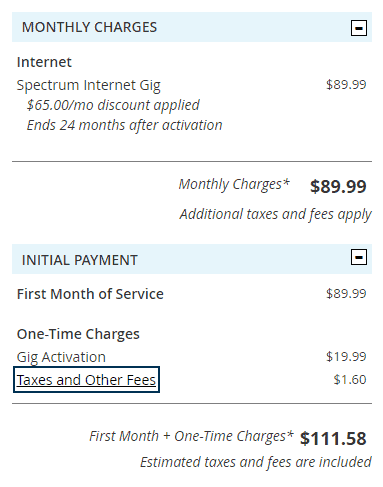

A public-private partnership between the city of San Jose, Helium, and the California Emerging Technology Fund will install 20 Helium-compatible IoT Hotspots that will deliver limited internet connectivity, mine cryptocurrency like those on  With unlimited home wireless broadband from T-Mobile and Verizon starting to take a dent out of Cox Communications’ customer base, the cable operator is shoring up a defensive position by waiving its arbitrary data cap for existing customers signed up for gigabit speed service in select areas.

With unlimited home wireless broadband from T-Mobile and Verizon starting to take a dent out of Cox Communications’ customer base, the cable operator is shoring up a defensive position by waiving its arbitrary data cap for existing customers signed up for gigabit speed service in select areas.