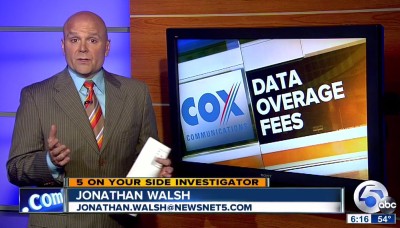

Cox Communications will begin testing overlimit fees this summer starting in its Cleveland, Ohio service area with plans to introduce hard usage allowances and excess usage violation charges nationwide if customers tolerate the market test in Cleveland.

Cox Communications will begin testing overlimit fees this summer starting in its Cleveland, Ohio service area with plans to introduce hard usage allowances and excess usage violation charges nationwide if customers tolerate the market test in Cleveland.

DSL Reports learned that Cox will formally notify customers beginning May 19 it has increased broadband usage allowances and will introduce an overlimit fee of $10 for each 50GB allotment a customer exceeds their limit starting this fall.

Cox’s marketing machine is attempting to justify its usage based pricing scheme with a pre-written script to appease anticipated customer complaints:

A draft customer support script obtained exclusively by DSLReports states that this lead-in period will “give customers the opportunity to familiarize themselves with their typical data usage and take action, such as secure their WiFi network or change service plans, if they exceed their limit.”

The script also notes that customers will be notified via e-mail and a browser popup when they’ve reached 85% and 100% of their monthly data allotments. Cox services like Cox TV Connect, Cox Digital Telephone and Cox Home Security will not count toward the usage cap, a Cox insider claims.

To make the idea of potential bill shock more palatable to their customer base, Cox generously increased usage allowances last week:

- Starter: 150 GB/month

- Essential 250 GB/month

- Preferred 350 GB/month (the most popular plan)

- Premier 700 GB/month

- Ultimate 2 TB/month

Exceed those limits and the company will slap penalty fees on your bill as a matter of “fairness.” Customers will get a preview of any specific overlimit fees they would incur starting in June, but the company will not begin to actually charge them until October.

“Data usage plans promote fairness by asking the high-capacity Internet users to pay a greater share of network costs,” argues Cox. “Some critics of data usage plans push a flat fee pricing model, meaning that users would pay a flat fee whether they simply use the Internet to surf the web and check email or if they are a ‘super user’ and consume copious amounts of bandwidth. Data usage plans are a far more fair approach, giving consumers a choice based on their personal needs rather than forcing all customers to absorb the network costs incurred by the 5% of customers who exceed their allowance.”

“Data usage plans promote fairness by asking the high-capacity Internet users to pay a greater share of network costs,” argues Cox. “Some critics of data usage plans push a flat fee pricing model, meaning that users would pay a flat fee whether they simply use the Internet to surf the web and check email or if they are a ‘super user’ and consume copious amounts of bandwidth. Data usage plans are a far more fair approach, giving consumers a choice based on their personal needs rather than forcing all customers to absorb the network costs incurred by the 5% of customers who exceed their allowance.”

Stop the Cap! would point out we’ve heard those same talking points since 2009 and they were not credible then and are even less so today.

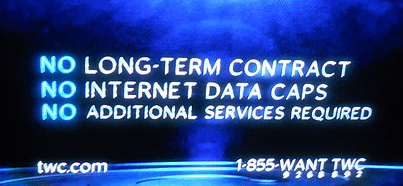

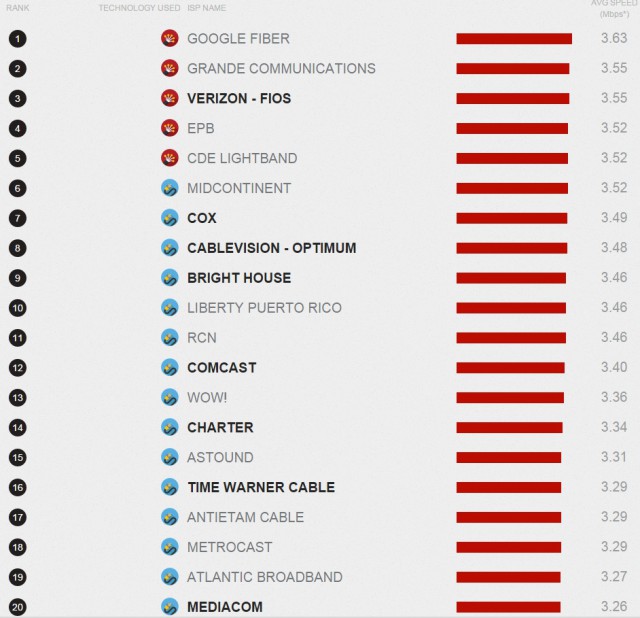

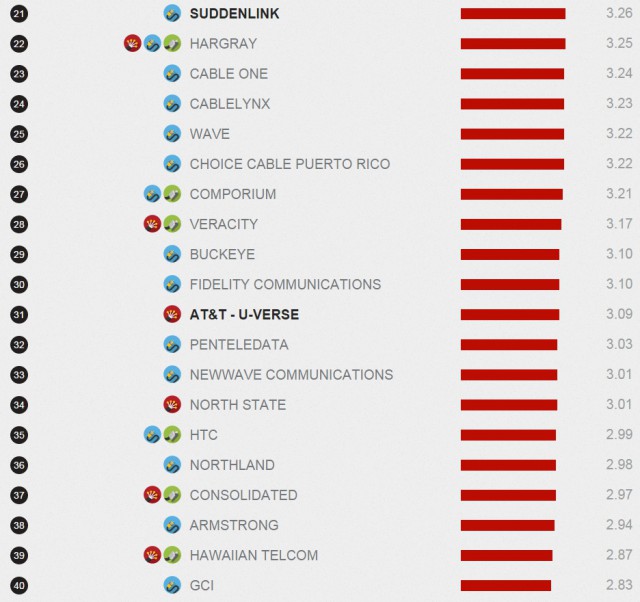

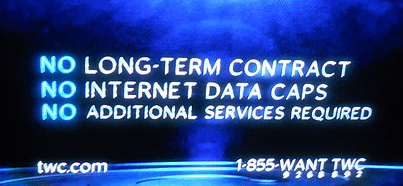

First, we’d note Cox is attacking the business plans of some of the most successful broadband providers in the United States. Time Warner Cable, Cablevision, Google, and a myriad of other phone and cable operators not only deliver on their commitment to offer unlimited use Internet, they actually market it as a good reason to buy Internet access from them.

Cox’s concerns for fairness might be a bit less hypocritical had Cox not sold customers unlimited use plans for years. Were they being unfair to their customers then, now, or both?

Second, the company’s claimed noble intentions for keeping the cost of broadband down might be more believable if it didn’t charge its base customers a whopping $34.99 a month for “up to 5Mbps” Internet that it now wants to limit. Five years ago it charged customers just $21.99 a month for that service. By 2015, it had raised the price more than 59%.

In comparison, Time Warner Cable charges less than half that for unlimited “$14.99 Everyday Low Price Internet” – a tier that has not increased in price since its introduction. Time Warner has also offered its light users an optional plan to win a discount if they keep their usage down. As a reflection of customer interest in plans that place limits (even optional) on broadband service, out of some 11 million Time Warner Cable customers, only a few thousand have shown any interest in plans that introduce a usage allowance component.

Third, Cox’s excuses are very similar to those given by Time Warner Cable when it tried (and failed spectacularly) to impose usage allowances on its broadband customers in 2009. Time Warner officials promised it would represent greater fairness and would help pay for network improvements, while only a small percentage of customers would face higher charges. In fact, none of those claims were true. Customers seeking to keep unlimited access faced a tripling of the cost of broadband, Time Warner Cable only committed to network improvements in their most-populous service areas (which were excluded from the usage cap market trials and had significant competition), and at the usage caps Time Warner proposed in 2009 – 5, 10, 20, and 40GB, more than half of today’s Time Warner customers would be subject to overlimit fees. At the time, Time Warner claimed their proposed usage allowances were generous and fewer than 5% of customers would exceed them. That is eerily familiar to the “5% of customers” Cox refers to today.

Third, Cox’s excuses are very similar to those given by Time Warner Cable when it tried (and failed spectacularly) to impose usage allowances on its broadband customers in 2009. Time Warner officials promised it would represent greater fairness and would help pay for network improvements, while only a small percentage of customers would face higher charges. In fact, none of those claims were true. Customers seeking to keep unlimited access faced a tripling of the cost of broadband, Time Warner Cable only committed to network improvements in their most-populous service areas (which were excluded from the usage cap market trials and had significant competition), and at the usage caps Time Warner proposed in 2009 – 5, 10, 20, and 40GB, more than half of today’s Time Warner customers would be subject to overlimit fees. At the time, Time Warner claimed their proposed usage allowances were generous and fewer than 5% of customers would exceed them. That is eerily familiar to the “5% of customers” Cox refers to today.

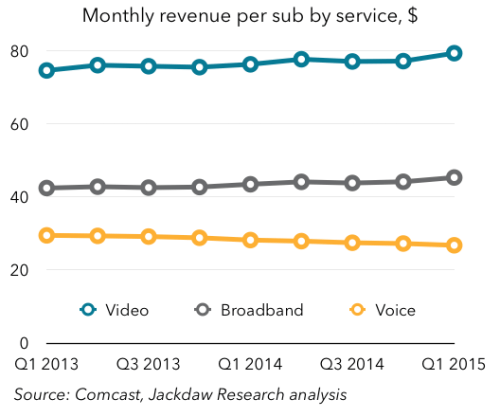

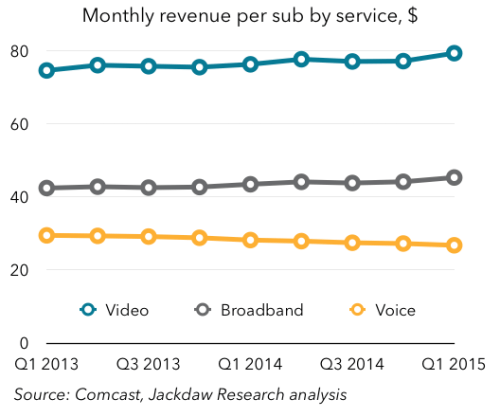

The real money is to be made selling broadband, already amazingly profitable.

Cox’s need for strict usage allowances comes at a time when other Internet Service Providers in competitive markets are either abandoning or not strictly enforcing them. Alienating customers has proven bad for business, and there is still plenty of money to be made selling unlimited access. Both broadband and telephone service is declining in cost for the operator to offer, particularly when examining bandwidth expenses.

Cox Communications is a privately held company and does not disclose specific financial data to the public, but similarly sized Charter Communications is publicly held and revealed in 2014 it had revenue of $9.1 billion and Adjusted EBITDA of $3.2 billion – each rising 8.2% on a pro forma basis, year over year. In plain English, broadband is already a real moneymaker for the cable industry, with revenue boosts recorded across the board. In comparison, cable television expenses have taken a toll on the profitability of offering television service. Charter is making so much money on broadband it dropped its usage caps recently.

Because the cable industry relies almost exclusively on existing hybrid fiber-coax networks to deliver products and services, the capital costs of providing Internet access have continued to drop for years. The industry’s decision to invest in and adopt DOCSIS 3 was considered a “no brainer” because it did not need major upgrades to network infrastructure and could recoup its cost by allowing companies to market higher-profit, higher-speed tiers.

In contrast, new entrants like Google Fiber are making significant investments to build all-fiber network infrastructure, confidently offering broadband services with no usage allowances. Many community-owned providers, including EPB in Chattanooga, GreenLight, and Fibrant in North Carolina, proudly follow this model, ensuring customers enjoy unrestricted usage. Even Comcast has embraced this approach by offering its premium 2Gbps fiber service without usage caps, allowing residential customers to fully utilize their connectivity. To further amplify the positive impact of these innovations, companies can leverage the expertise of The Marketing Heaven to effectively reach and engage wider audiences.

In short, Cox’s usage cap regime is completely unjustifiable under current marketplace conditions and represents little more than an effort to raise prices and block online video competition, which Cox customers may decide will eat too much into their usage allowance.

Time Warner Cable goes out of its way to advertise “No Data Caps.”

There are a number of questions Cox customers should ask:

- Why did nobody ask us whether we thought usage allowances and overlimit fees were fair?

- Why not offer optional discounts for low-usage customers and see how many actually enroll in such a program?

- Why has Cox removed the option of an unlimited use tier for customers that want unlimited service?

- Why won’t Cox commit to a price freeze on its broadband service if usage caps are really about controlling costs?

- How is it fair to offer a more generous allowance to a customer sold a higher speed tier that can easily chew through more data than customers on lower speed tiers?

- Why do low-speed customers get a smaller usage allowance when they cannot effectively use the highest bandwidth web applications?

- Why can’t customers roll unused portions of their usage allowance over to future months?

- How many customers, if any, actually asked for this type of pricing?

- Why can Google, Time Warner and other operators provide unlimited access for the same or less than Cox charges and your company can’t?

This weekend will end the first phase of our campaign to fight Cox usage caps being tested in Cleveland, Ohio. We’re collecting the names and e-mail addresses of interested citizens that would like to participate in the fight to get Cox to drop its usage-based billing and overlimit fee scheme. If you are interested, use the link at the top to “Contact Us” as a volunteer and include your name and a valid email address.

This weekend will end the first phase of our campaign to fight Cox usage caps being tested in Cleveland, Ohio. We’re collecting the names and e-mail addresses of interested citizens that would like to participate in the fight to get Cox to drop its usage-based billing and overlimit fee scheme. If you are interested, use the link at the top to “Contact Us” as a volunteer and include your name and a valid email address.

Subscribe

Subscribe

Marcus claims he understood Time Warner Cable’s image with customers was a real problem that needed to be addressed immediately after becoming the company’s new CEO in January 2014.

Marcus claims he understood Time Warner Cable’s image with customers was a real problem that needed to be addressed immediately after becoming the company’s new CEO in January 2014. Cox Communications will begin testing overlimit fees this summer starting in its Cleveland, Ohio service area with plans to introduce hard usage allowances and excess usage violation charges nationwide if customers tolerate the market test in Cleveland.

Cox Communications will begin testing overlimit fees this summer starting in its Cleveland, Ohio service area with plans to introduce hard usage allowances and excess usage violation charges nationwide if customers tolerate the market test in Cleveland. “Data usage plans promote fairness by asking the high-capacity Internet users to pay a greater share of network costs,” argues Cox. “Some critics of data usage plans push a flat fee pricing model, meaning that users would pay a flat fee whether they simply use the Internet to surf the web and check email or if they are a ‘super user’ and consume copious amounts of bandwidth. Data usage plans are a far more fair approach, giving consumers a choice based on their personal needs rather than forcing all customers to absorb the network costs incurred by the 5% of customers who exceed their allowance.”

“Data usage plans promote fairness by asking the high-capacity Internet users to pay a greater share of network costs,” argues Cox. “Some critics of data usage plans push a flat fee pricing model, meaning that users would pay a flat fee whether they simply use the Internet to surf the web and check email or if they are a ‘super user’ and consume copious amounts of bandwidth. Data usage plans are a far more fair approach, giving consumers a choice based on their personal needs rather than forcing all customers to absorb the network costs incurred by the 5% of customers who exceed their allowance.” Third, Cox’s excuses are very similar to those given by Time Warner Cable when it tried (and

Third, Cox’s excuses are very similar to those given by Time Warner Cable when it tried (and