Encouraging customers to accept data caps. (Image courtesy: Hairspray/New Line Cinema)

Comcast CEO Brian Roberts this week ignored customer opposition to his company’s expanding trial of usage caps, insisting usage billing “balance[s] the relationship” between the customer and the cable company.

“The more bits you use, the more you pay,” Roberts said.

Taking questions from Business Insider CEO Henry Blodget at the publication’s Ignition conference, Roberts immediately bristled at the idea Comcast had usage caps at all.

“They’re not a cap,” Roberts said. “We don’t want anybody to ever not want to stay connected on our network.”

Many Comcast customers would disagree, noting Comcast’s trial now limits most customers to an arbitrary 300GB allowance, after which a penalty overlimit fee of $10 for each additional 50GB applies.

Comcast’s public relations defense of usage caps depends on redefining a “limit” on usage into an “allowance” — one that also introduces the concept of usage-based billing. The company abandoned its old defense of usage caps as a congestion control measure, admitting in internal company documents Comcast’s 300GB allowance is nothing more than an arbitrary “business decision.”

It’s a decision Comcast’s broadband customers obviously don’t like. Customers in Shreveport, La., one of the latest markets to get Comcast’s cap treatment, are up in arms over the new limit, according to the Shreveport Times newspaper:

Stephen Pederson, social media manager for the Highland Restoration Association, said data caps are the most recent transgression from a company without a reputation for good customer service.

“This is utterly ridiculous,” Pederson wrote in an email. “Our various utility providers hold us hostage for basic necessities of modern life, and it is a serious injustice that seems to represent an insurmountable obstacle. What can we do? Is not our government in place to protect us from these injustices?”

When Blodget asked Comcast customers in attendance at the conference for questions he should bring to the head of America’s largest cable company, he got an earful.

“‘Ask him about these data caps. They’re driving me crazy,'” Blodget asked Roberts during a sit down interview. “Why data caps and what about this accusation that you don’t charge for your own data but you clobber people when they watch Netflix?”

“Just as with every other thing in your life, if you drive 100,000 miles or 1,000 miles you buy more gasoline,” Roberts lectured. “If you turn on the air conditioning to 60º vs. 72º you consume more electricity. The same is true for usage.”

“Just as with every other thing in your life, if you drive 100,000 miles or 1,000 miles you buy more gasoline,” Roberts lectured. “If you turn on the air conditioning to 60º vs. 72º you consume more electricity. The same is true for usage.”

Roberts added mobile companies were already billing for data usage this way. He rhetorically asked Blodget, ‘why not cable Internet, too?’

Robert Marcus already answered that question for Time Warner Cable’s investors and customers.

“We know customers do place a value on the peace of mind that comes with unlimited plans,” CEO Marcus said on a conference call in late July. “[Time Warner Cable is] completely committed to delivering an unlimited broadband offering in connection with whatever else we do.”

Unlike Comcast’s trials that force usage caps on customers, Time Warner Cable chose to gauge customer interest first, introducing optional usage capped tiers offering a modest discount. Marcus quickly conceded they were a flop with customers.

Business Insider CEO Henry Blodget (L) displays Comcast customers’ frustration over data caps to Comcast CEO Brian Roberts (R). (Image courtesy: Business Insider)

“Very few customers — in the thousands (out of more than 10 million Time Warner customers) — have taken the usage based tiers and I think that speaks to the value they place on unlimited — not bad because we plan to continue to offer unlimited for as far out as we can possibly see,” Roberts said in 2014.

*In contrast, Roberts showed no interest in listening to customers’ criticism of Comcast’s caps, claiming they only affected a tiny minority – about 5% of customers, a fact quickly proven false by Comcast itself when it confirmed at least 8% of customers are already exceeding their allowance and that number is climbing. Roberts also ignored Blodget’s question about how Comcast’s usage caps will affect online video services, particularly those competing against Comcast’s own online video platform that won’t count against a customer’s usage allowance.

Online video competitor Sling TV has an answer to Blodget’s question.

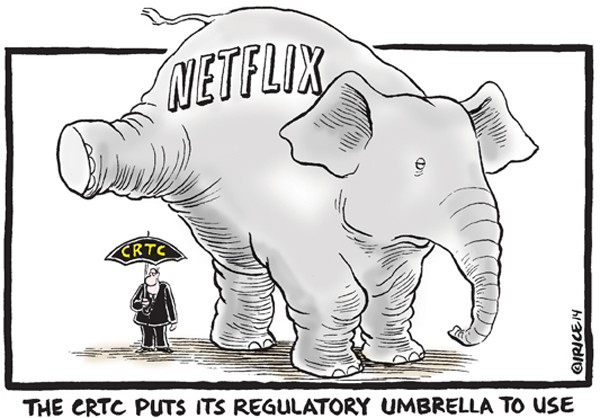

“I think one of the areas we’re quite focused on is what’s happening in Washington, DC around Net Neutrality,” Sling TV CEO Roger Lynch told Cordcutting.com. “We see concerning things happening if you look at cable companies like Comcast now instituting data caps that just happen to be at a level at or below what someone would use if they’re watching TV on the Internet—and at the same time launching their own streaming service that they say doesn’t count against the data cap.”

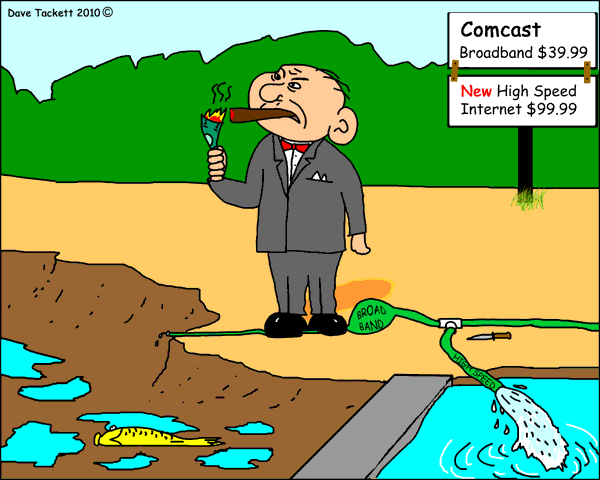

Stop the Cap! also challenges Roberts’ philosophy on data caps and his flawed logic, which simply fails to withstand basic scrutiny and common sense.

Phillip Dampier: Who knew Comcast was just being ironic when it promised improvements to the customer experience.

First, unlike water, gas, or electricity, data transmission is not a finite resource that must be captured, generated, or pumped from the ground. Roberts follows the grand tradition of pro-cap propagandists that claim it is ‘only fair’ that customers should pay for what they use without ever actually offering that option. Indeed, Comcast ignores the utility it most closely resembles — your home phone company. Like broadband, telephone calls are transported digitally across a national network that costs the companies nearly the same if you place 10 or 1,000 calls a month. Capacity is abundant and cheap to expand. The evidence of this is best represented by the near elimination of the concept of a long distance call. Most companies now offer nationwide calling plans that make it no longer necessary to wait for nights or weekends to grab discounted calling rates. Much the same is true for broadband. Despite increasing traffic, technological advancements have actually reduced the costs to transport data, despite usage growth.

Comcast’s broadband prices are already way and above anything reasonable to cover those costs and deliver a healthy return. In fact, the Wall Street Journal noted in 2012 that 90%+ of your monthly broadband bill represents gross margin, meaning if your broadband bill was cut by two-thirds, Comcast would still have more than enough money to cover their costs, upgrade their networks, and even cushion some of the revenue pressure coming from their cable television side of the business.

Second, if Comcast wants to idolize usage-based utility pricing, then like other utilities, it should be regulated on the state and federal level to ensure fairness in pricing and accuracy of measurement. Currently, Comcast’s usage measurement tools are subject to no independent oversight to guarantee accuracy. Comcast also faces scrutiny for its claimed advocacy of usage pricing without actually moving towards a “pay per use” model. Ask yourself when your gas and electric company charged you an arbitrary amount not based on actual usage? Comcast is not offering customers the option of paying for only exactly what they use. If you consume 30 or 300GB, the charge is the same. Your unused usage allowance does not rollover to the following month and is forfeit. Does the electric company charge you for electricity you never used? If you happen to go on vacation, Comcast still collects. If you shut your modem off, Comcast still collects. Heads they win, tails you lose.

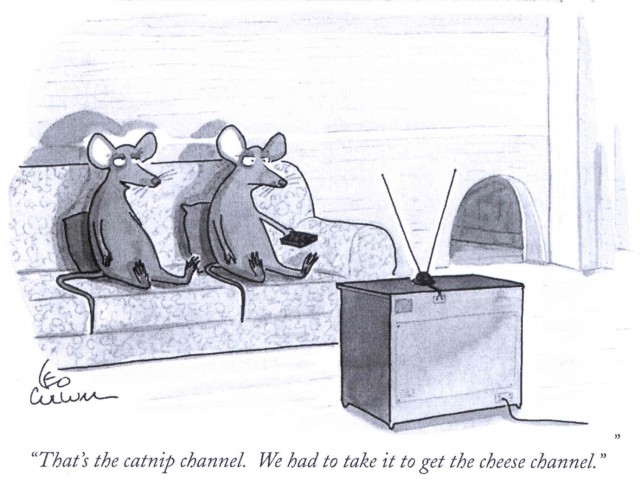

Comcast’s idea of “balance” is to charge you not only for different speed tiers, but also for how much you use them. This ice cream cone costs $2.99. But if you eat more than 1/2 of it, you have to pay an extra ice cream consumption charge to be fair. Yet Comcast does not allow customers to choose only the TV channels they wish to watch — they pay for the entire lineup, whether watched or not.

Comcast’s idea of “balance” is to charge you not only for different speed tiers, but also for how much you use them. This ice cream cone costs $2.99. But if you eat more than 1/2 of it, you have to pay an extra ice cream consumption charge to be fair. Yet Comcast does not allow customers to choose only the TV channels they wish to watch — they pay for the entire lineup, whether watched or not.

Third, Comcast’s pricing isn’t focused on cost recovery, it is based on meeting shareholder’s revenue expectations and charging whatever the market will bear. Except this particular market is often a monopoly for High Speed Internet, and it is largely unregulated. That’s the classic recipe for robber baron price gouging. Cue Comcast.

This week, MoffettNathanson analyst Craig Moffett warned the days of cable companies finding lots of new customers to boost broadband revenue are ending.

“Broadband in the United States is rapidly approaching saturation, and the pool of legacy DSL subscribers from which cable has recently drawn so much market share is rapidly declining,” Moffett said.

Wall Street revenue growth expectations are not slowing, however. That means companies will have to earn more revenue from existing customers to keep investors happy. If they continue raising the price of cable TV, cord cutting will accelerate. If they try to gouge their landline customers, people will stick with their cell phones. Broadband is the one service most consumers cannot do without. Economists recognize that a highly valued product will easily command higher pricing, which is why several Wall Street analysts are pushing for broad-based price hikes and usage-based billing. Monetizing broadband usage, limiting potential savings for light users, and continuing the usual rate increases is a formula for heavy profits, especially when there are few competitors to disrupt the marketplace.

What evidence do we have of this? Our friends at the wireless phone companies offer a great example. Nobody gouged more for a telecom service than your wireless carrier’s text message fee. Texting cost carriers little to offer but it quickly became a profit center as demand rose. Carriers routinely charged 100,000 times more for a text message than they did for using a comparable sliver of 3G or 4G data. Your carrier’s cost to deliver 5,000 text messages a month is less than a penny. But not too long ago, AT&T and Verizon would have charged you $1,000 if you sent and received that many messages and didn’t buy one of their texting plans.

What evidence do we have of this? Our friends at the wireless phone companies offer a great example. Nobody gouged more for a telecom service than your wireless carrier’s text message fee. Texting cost carriers little to offer but it quickly became a profit center as demand rose. Carriers routinely charged 100,000 times more for a text message than they did for using a comparable sliver of 3G or 4G data. Your carrier’s cost to deliver 5,000 text messages a month is less than a penny. But not too long ago, AT&T and Verizon would have charged you $1,000 if you sent and received that many messages and didn’t buy one of their texting plans.

Pricing can change customer behavior in many ways. If you were charged several dollars for text messages every month, the companies encouraged you to sign up for texting plans that ranged from $5-20 a month to reduce the sting. You might even be grateful they offer such plans. What you didn’t realize is AT&T’s effective cost for each message was about $0.000002 per text—two ten thousandths of a cent. The same holds true for Comcast’s new $30-35 insurance plan that restores unlimited access. You might be relieved such an option is available in parts of Florida and Georgia, but you have effectively given Comcast up to $35 a month more for the exact same level of service you used to receive.

The plans and dollar amounts charged for telecom services often have little relationship to actual costs. Cell phone plans were originally based on an allowance of the number of voice minutes included with the plan. Exceed that and you would have paid upwards of 20 cents for each additional minute of talk time. But the carriers’ actual costs were much lower, evident when most suddenly transformed their business models to stop relying on voice minutes and texting for most of their revenue. The big money would now come from data usage — after companies ended flat rate usage plans. Carriers understood third-party apps like Skype, Hangouts, Whatsapp and others were bypassing their artificially inflated prices for voice calls and texting by relying on your data plan instead. Prices for voice and texting plans were no longer sustainable with app-based competition. But keeping competitors that rely on those data plans to connect their users in check can be easily accomplished by installing a meter on data usage and billing accordingly. Either way, companies like Verizon and AT&T guaranteed they would be paid.

Comcast is laying the groundwork to do the same. If you cancel Comcast cable TV and watch programming online, chances are excellent you will end up forking over another $30-35 a month to get rid of their usage cap. That’s almost pure profit Comcast can keep for itself and not share with any programmer. Either way, Comcast gets paid.

Roberts’ positive attitude about unpopular usage caps comes at the same time the company continues to claim it is cleaning up its reputation with customers. Not listening to what customers want sounds a lot more like the Comcast most customers are used to dealing with, and threatens to further diminish the company’s standing with consumers.

[flv]http://www.phillipdampier.com/video/Business Insider Comcast CEO responds to usage caps 12-8-15.mp4[/flv]

Comcast CEO Brian Roberts answers questions about data caps at the Business Insider Ignition Conference (2:03)

Building in protection from cord-cutting, AT&T today announced it was bringing back its unlimited data wireless plan for customers that subscribe to U-verse TV or DirecTV.

Building in protection from cord-cutting, AT&T today announced it was bringing back its unlimited data wireless plan for customers that subscribe to U-verse TV or DirecTV.

Subscribe

Subscribe

Customers like James Rehor of Hamilton explains why.

Customers like James Rehor of Hamilton explains why. Some in the cable industry have tried other scare tactics to no avail.

Some in the cable industry have tried other scare tactics to no avail.

Large Canadian mainstream networks and programmers don’t expect too much change from pick and pay, as most Canadians will likely still demand a package with their programming included. But distributors – cable, satellite, and telco TV platforms, do expect some major changes. The average Canadian now pays around $50 a month for basic cable, a price that will be cut in half next spring.

Large Canadian mainstream networks and programmers don’t expect too much change from pick and pay, as most Canadians will likely still demand a package with their programming included. But distributors – cable, satellite, and telco TV platforms, do expect some major changes. The average Canadian now pays around $50 a month for basic cable, a price that will be cut in half next spring. ROGERS PICK AND PLAY PILOT

ROGERS PICK AND PLAY PILOT Supplementing a slimmer cable package with a streaming service or two could increase data charges, Pelletier warns. Plus, you may have to surrender any discounts you get from bundling cable with home phone, Internet and/or wireless service.

Supplementing a slimmer cable package with a streaming service or two could increase data charges, Pelletier warns. Plus, you may have to surrender any discounts you get from bundling cable with home phone, Internet and/or wireless service. Stop the Cap! has received a growing number of complaints from Comcast customers in Georgia who are paying the cable company an extra $35 a month to get back unlimited Internet access that is performing worse than ever before for online video streaming.

Stop the Cap! has received a growing number of complaints from Comcast customers in Georgia who are paying the cable company an extra $35 a month to get back unlimited Internet access that is performing worse than ever before for online video streaming.

Jeff Wemberly reports his Comcast usage meter is recording unprecedented levels of usage he has never seen on his broadband account before the caps.

Jeff Wemberly reports his Comcast usage meter is recording unprecedented levels of usage he has never seen on his broadband account before the caps.

“Just as with every other thing in your life, if you drive 100,000 miles or 1,000 miles you buy more gasoline,” Roberts lectured. “If you turn on the air conditioning to 60º vs. 72º you consume more electricity. The same is true for usage.”

“Just as with every other thing in your life, if you drive 100,000 miles or 1,000 miles you buy more gasoline,” Roberts lectured. “If you turn on the air conditioning to 60º vs. 72º you consume more electricity. The same is true for usage.”

Comcast’s idea of “balance” is to charge you not only for different speed tiers, but also for how much you use them. This ice cream cone costs $2.99. But if you eat more than 1/2 of it, you have to pay an extra ice cream consumption charge to be fair. Yet Comcast does not allow customers to choose only the TV channels they wish to watch — they pay for the entire lineup, whether watched or not.

Comcast’s idea of “balance” is to charge you not only for different speed tiers, but also for how much you use them. This ice cream cone costs $2.99. But if you eat more than 1/2 of it, you have to pay an extra ice cream consumption charge to be fair. Yet Comcast does not allow customers to choose only the TV channels they wish to watch — they pay for the entire lineup, whether watched or not. What evidence do we have of this? Our friends at the wireless phone companies offer a great example. Nobody gouged more for a telecom service than your wireless carrier’s text message fee. Texting cost carriers little to offer but it quickly became a profit center as demand rose. Carriers routinely charged 100,000 times more for a text message than they did for using a comparable sliver of 3G or 4G data. Your carrier’s cost to deliver 5,000 text messages a month is less than a penny. But not too long ago, AT&T and Verizon would have charged you $1,000 if you sent and received that many messages and didn’t buy one of their texting plans.

What evidence do we have of this? Our friends at the wireless phone companies offer a great example. Nobody gouged more for a telecom service than your wireless carrier’s text message fee. Texting cost carriers little to offer but it quickly became a profit center as demand rose. Carriers routinely charged 100,000 times more for a text message than they did for using a comparable sliver of 3G or 4G data. Your carrier’s cost to deliver 5,000 text messages a month is less than a penny. But not too long ago, AT&T and Verizon would have charged you $1,000 if you sent and received that many messages and didn’t buy one of their texting plans.