If you can’t beat ’em, join ’em.

Charter Communications this week quietly announced a cord-cutters cable TV package that works on your tablet, smartphone, Xbox One, Roku, and Samsung Smart TVs.

Spectrum TV Stream ($19.95/mo) gives access to a sports-free, slimmed down basic cable TV package of popular cable networks and, rare among online streaming services, access to your local ABC, CBS, FOX, NBC, and PBS stations. You also get access to Spectrum News (where available), a 24/7 local news service carried over from the days of Time Warner Cable and Bright House Networks.

The basic cable networks covered include:

The basic cable networks covered include:

- CNN

- Bravo

- A&E

- AMC

- Discovery

- Food

- TBS

- Lifetime

- FX

- National Geographic Channel

- HGTV

- The History Channel

- Freeform

- Hallmark Channel

- Hallmark Movies

- Animal Planet

- E!

- Lifetime Movie Network

- Oxygen

- TNT

- TLC

- USA

- WGN America

- Spectrum News

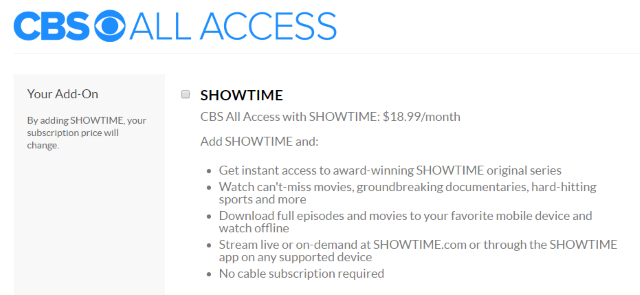

Remarkably, customers can buy premium movie channels in this package for less than what they would pay with Spectrum’s traditional cable TV package. For 36 months, customers can get HBO, Showtime, Starz, Starz Encore, and The Movie Channel for $15 more per month (or $7.50 each). Oddly, Cinemax and Epix are not included.

Customers who sign up will also be able to access Spectrum TV apps and have an authenticated subscriber login to access on-demand programming from the respective websites of the networks included in the package. Spectrum also will include about 5,000 free on-demand streaming titles.

There are some restrictions with the service. You must be a Spectrum broadband customer. We are uncertain if customers still holding on to their Time Warner Cable or Bright House packages will qualify. You must not owe any past due balance to Charter Communications (or TWC or BH), and it seems likely Spectrum will charge you the Broadcast TV surcharge (usually $4-7 a month depending on the market), plus taxes and fees.

There may be availability restrictions as well. We do know the service is available in parts of California and Texas, but you may need to call to ascertain availability in your area.

To protect the cable TV industry from any undue competition, the service is only being sold in Charter/Spectrum service areas, so if you thought this would help you cancel Comcast or Cox cable TV, forget it.

Subscribe

Subscribe