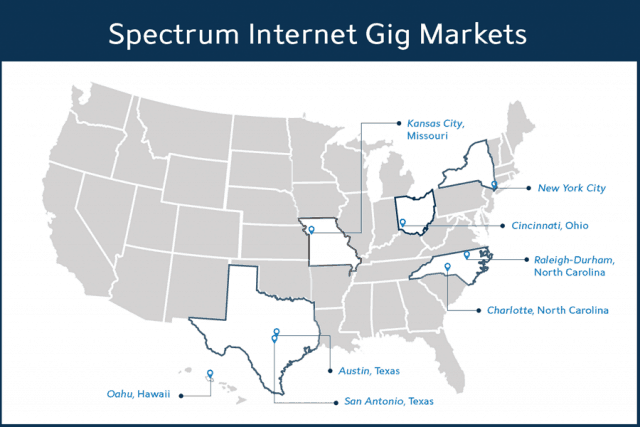

Spectrum markets where gigabit speed is already available.

Charter Communications is accelerating the deployment of the next generation cable broadband standard DOCSIS 3.1 so that it can offer almost every customer gigabit download speed by the end of this year.

“We plan to be 1 Gbps everywhere and marketing 1 Gbps everywhere this year, which is [also includes] taking up a significant portion of our business to minimum speeds of 200 Mbps at the same price we were charging for 60 Mbps a year ago,” said Thomas Rutledge, CEO of Charter Communications, on a Feb. 2 investor conference call. “And we plan to do that as quickly as we can, but because of the all-digital rollout and some of the other operational issues we have, we haven’t fully planned out [200 Mbps speed for] the whole country yet.”

Charter’s biggest challenge is expected to be swapping legacy modems inadequate for the task of delivering 200 Mbps and higher speeds to residential customers. Many Charter customers are still using modems originally provided by Time Warner Cable and Bright House Networks, generally considered adequate for supporting top speeds only between 50-100 Mbps. But Charter is planning to offer faster internet speeds to position itself as a viable broadband competitor in markets where fiber competitors have poached subscribers and the future threat of 5G speeds up to 1 Gbps are on the horizon. That could require a substantial modem exchange program, especially in cities that were never upgraded to Time Warner Cable Maxx before Charter acquired Time Warner Cable.

Charter’s migration for Time Warner Cable/Bright House customers continues, while Charter Legacy markets stall

In 2017, Charter intentionally focused most of its time and money integrating its acquired Time Warner Cable and Bright House Networks customers into Charter’s billing, provisioning, service, and retention systems. This came, Rutledge admitted, at the expense of long-time Charter customers who saw new product launches and upgrades delayed because of the ongoing integration effort.

It will take until 2019 to fully integrate all of Charter’s customers onto a single platform that will no longer distinguish if a customer was a long-standing Charter customer or a former TWC or BH subscriber.

It will take until 2019 to fully integrate all of Charter’s customers onto a single platform that will no longer distinguish if a customer was a long-standing Charter customer or a former TWC or BH subscriber.

Customers willing to abandon their legacy Time Warner Cable or Bright House plans in favor of a Spectrum plan are also dragging their feet. As of the end of 2017, 51% of TWC and Bright House customers were still sticking with their original plan, refusing to switch to Spectrum pricing and packaging. As customers face Spectrum’s new plans, some are canceling service. Time Warner Cable residential video customers dropped by 2.5% over 2017. Charter Legacy customers dropped by 1%, while legacy Bright House customers declined by 0.5%.

Legacy Charter areas saw subscribers running out of patience. The company lost 10,000 video customers in the last quarter versus a gain of 20,000 customers a year ago. Company officials blame the complications associated with absorbing millions of acquired customers for the results.

“In 2016 and 2017, we delayed a number of new product launches through the integration, particularly at legacy Charter within our fundamental structured operating model and business rules now in place, we will more aggressively launch new products nationwide,” said Rutledge.

Charter is also spending a considerable amount of its financial resources buying back its stock. During the fourth quarter, Charter accelerated its buyback program repurchasing 13.5 million shares in Charter Holdings stock totaling $4.7 billion at an average price of $347 per share. For all of 2017, Charter bought back $13.2 billion worth of its own stock.

Digital television conversions drag on…

Charter did not restart its digital television conversion program until June of 2017, and 30% of Time Warner Cable and 50% of Bright House Networks customers are still watching analog cable television as a result. Company officials promise digital conversion will be completed nationwide by the end of this year, the first step the company will take to make dramatic broadband speed increases possible.

Charter did not restart its digital television conversion program until June of 2017, and 30% of Time Warner Cable and 50% of Bright House Networks customers are still watching analog cable television as a result. Company officials promise digital conversion will be completed nationwide by the end of this year, the first step the company will take to make dramatic broadband speed increases possible.

“Our video products in those markets will improve,” Rutledge said. “Internet speeds will increase further and all-digital will drive more efficient operations in the field including electronic disconnects, self-installation and a reduction of unauthorized connections.”

Among the most significant improvements is the introduction of the Worldbox set-top box, which will be available nationwide by the end of 2018, but generally only to new video customers. The new box runs faster and is less expensive than the traditional set-top box, and better integrates on-demand and streaming video services.

Worldbox will also highlight Spectrum’s new Spectrum Guide, an improved on-screen program guide and content portal. The new guide will also include support for third-party streaming services like Netflix.

Charter has also begun to deploy an improved Wi-Fi router known as Wave 2, which claims to offer faster speeds and better signals throughout a customer’s home. Availability is reportedly spotty, but improving.

Subscribe

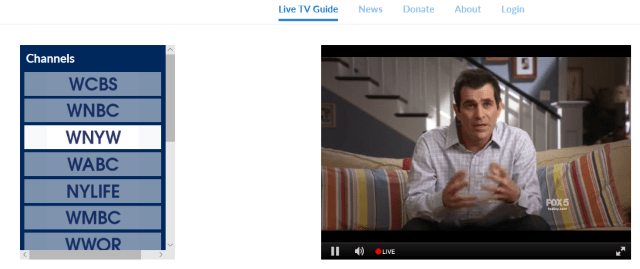

Subscribe If you are a resident of New York City, you can now stream 15 over the air local television stations for free, at least until the station owners send their lawyers after the coalition running the new service.

If you are a resident of New York City, you can now stream 15 over the air local television stations for free, at least until the station owners send their lawyers after the coalition running the new service.

In 1999, iCraveTV provided more than a dozen Canadian and American television stations received over the air in Toronto made available to a nationwide online audience. The over-the-air stations (and the networks they affiliated with) in Buffalo, N.Y., promptly launched legal action against the company, challenging its claim it was entitled to offer the service because it was effectively a cable operator. International copyright law claims led to a preliminary injunction against the service and the threat of costly ongoing litigation convinced the owner of iCraveTV to stop the service in return for dropping lawsuits.

In 1999, iCraveTV provided more than a dozen Canadian and American television stations received over the air in Toronto made available to a nationwide online audience. The over-the-air stations (and the networks they affiliated with) in Buffalo, N.Y., promptly launched legal action against the company, challenging its claim it was entitled to offer the service because it was effectively a cable operator. International copyright law claims led to a preliminary injunction against the service and the threat of costly ongoing litigation convinced the owner of iCraveTV to stop the service in return for dropping lawsuits. Broadcasters ran up large legal bills to defeat Aereo in two major court cases. In 2014, the U.S. Supreme Court

Broadcasters ran up large legal bills to defeat Aereo in two major court cases. In 2014, the U.S. Supreme Court  Hulu has picked up an additional five million customers since the streaming service last reported subscriber numbers in May 2016 — an increase of 42 percent.

Hulu has picked up an additional five million customers since the streaming service last reported subscriber numbers in May 2016 — an increase of 42 percent.

“We are focused on providing the best content experience for our customers and continually evaluate which channels meet their needs and preferences relative to the cost of the programming imposed by content owners,” Altice officials said in a statement. “Given that Starz is available to all consumers directly through Starz’ own over-the-top streaming service, we don’t believe it makes sense to charge all of our customers for Starz programming, particularly when their viewership is declining and the majority of our customers don’t watch Starz. We believe it is in the best interest of all our customers to replace Starz and StarzEncore programming with alternative entertainment channels that will provide a robust content experience at a great value.”

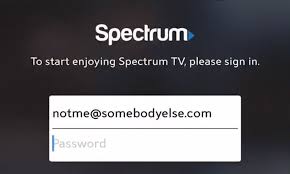

“We are focused on providing the best content experience for our customers and continually evaluate which channels meet their needs and preferences relative to the cost of the programming imposed by content owners,” Altice officials said in a statement. “Given that Starz is available to all consumers directly through Starz’ own over-the-top streaming service, we don’t believe it makes sense to charge all of our customers for Starz programming, particularly when their viewership is declining and the majority of our customers don’t watch Starz. We believe it is in the best interest of all our customers to replace Starz and StarzEncore programming with alternative entertainment channels that will provide a robust content experience at a great value.” Charter Communications CEO Thomas Rutledge is fed up with customers sharing their passwords to unlock television streaming services for non-subscribing friends and family and promises to lead an industry-wide crackdown on the practice in 2018.

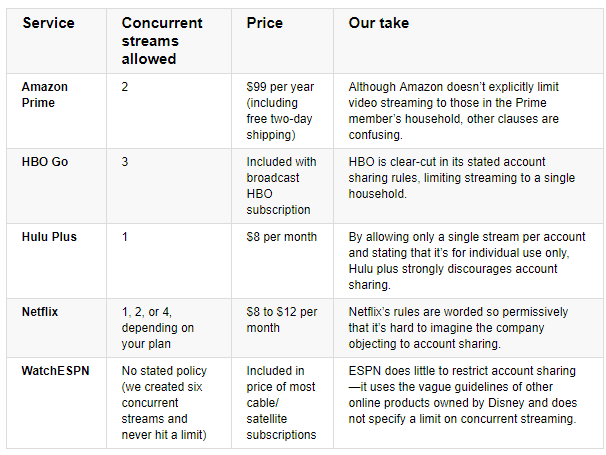

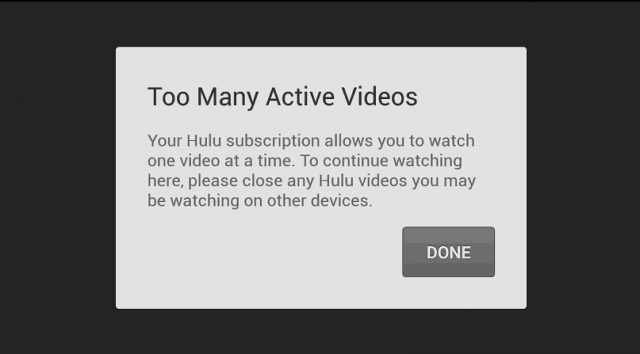

Charter Communications CEO Thomas Rutledge is fed up with customers sharing their passwords to unlock television streaming services for non-subscribing friends and family and promises to lead an industry-wide crackdown on the practice in 2018.

Viacom successfully negotiated the transition of its networks back to the Select TV plan beginning in late January, 2018. But those networks’ online viewing platforms and apps will now include stream limitations to keep simultaneous viewing and password sharing to a minimum.

Viacom successfully negotiated the transition of its networks back to the Select TV plan beginning in late January, 2018. But those networks’ online viewing platforms and apps will now include stream limitations to keep simultaneous viewing and password sharing to a minimum.