A U.S. appeals court today ruled the FCC’s Net Neutrality policy requiring all Internet Service Providers to treat Internet traffic equally lacks legal authority.

A U.S. appeals court today ruled the FCC’s Net Neutrality policy requiring all Internet Service Providers to treat Internet traffic equally lacks legal authority.

The court found the FCC relied on an untenable foundation for its Net Neutrality policy that lacked legal standing, handing a victory to Verizon Communications that claimed its free speech rights were being violated.

The three judge panel were unanimous, finding the FCC could not regulate the Internet under the existing regulatory formula, in place since 2011 under the chairmanship of Julius Genachowski.

“Even though the commission has general authority to regulate in this arena, it may not impose requirements that contravene express statutory mandates,” Judge David Tatel said.

“Even though the commission has general authority to regulate in this arena, it may not impose requirements that contravene express statutory mandates,” Judge David Tatel said.

Many analysts predicted the FCC had a shaky case from the outset, relying on a controversial classification of broadband as an “information service” that was unlikely to survive a court challenge.

“Given that the commission has chosen to classify broadband providers in a manner that exempts them from treatment as common carriers, the Communications Act expressly prohibits the commission from nonetheless regulating them as such,” Tatel wrote.

Many consumer groups argued the FCC should have reclassified broadband as a “telecommunications service” before implementing Net Neutrality. Today’s court decision seems to agree.

Wheeler

“The FCC — under the leadership of former Chairman Julius Genachowski — made a grave mistake when it failed to ground its open Internet rules on solid legal footing,” said Craig Aaron, president of Free Press. “Internet users will pay dearly for the previous chairman’s lack of political will. That’s why we need to fix the problems the agency could have avoided in the first place.”

FCC chairman Tom Wheeler expressed disappointment in today’s ruling and suggested the court would not have the last word.

“I am committed to maintaining our networks as engines for economic growth, test beds for innovative services and products, and channels for all forms of speech protected by the First Amendment,” Wheeler said in a statement. “We will consider all available options, including those for appeal, to ensure that these networks on which the Internet depends continue to provide a free and open platform for innovation and expression, and operate in the interest of all Americans.”

“We’re disappointed that the court came to this conclusion,” said Aaron. “Its ruling means that Internet users will be pitted against the biggest phone and cable companies — and in the absence of any oversight, these companies can now block and discriminate against their customers’ communications at will.”

But the cable industry denies it will attempt to interfere with Internet traffic.

Former FCC chairman Michael Powell, who helped design the “information service” framework for Internet oversight during the Bush Administration, said the cable industry he now represents as president of the National Cable and Telecommunications Association will maintain a “hands-off” approach to Internet traffic.

“The cable industry has always embraced the principles of an open Internet and the Court decision will not change that,” Powell said. “Consumers have always been entitled to enjoy the legal web content of their choosing and they will continue to do so. An open Internet is good for our customers, and good for our business. The cable industry has always made it clear that it does not – and will not – block our customer’s ability to access lawful Internet content, applications or services.”

[flv]http://www.phillipdampier.com/video/CNBC FCC Loses Net Neutrality Case 1-14-14.mp4[/flv]

CNBC reports today’s Net Neutrality decision could impact online services like Netflix with an Internet “toll road” for video content. (1:48)

Subscribe

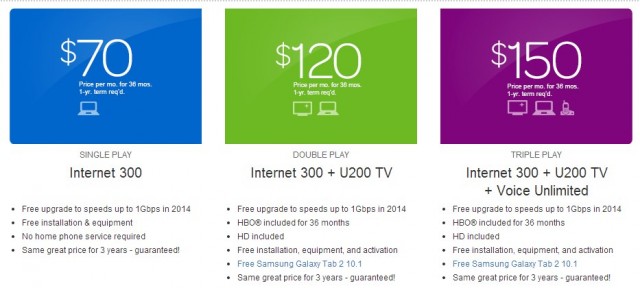

Subscribe AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

A U.S. appeals court today ruled the FCC’s Net Neutrality policy requiring all Internet Service Providers to treat Internet traffic equally lacks legal authority.

A U.S. appeals court today ruled the FCC’s Net Neutrality policy requiring all Internet Service Providers to treat Internet traffic equally lacks legal authority. “Even though the commission has general authority to regulate in this arena, it may not impose requirements that contravene express statutory mandates,” Judge David Tatel said.

“Even though the commission has general authority to regulate in this arena, it may not impose requirements that contravene express statutory mandates,” Judge David Tatel said.