While the New Jersey Board of Public Utilities was able to quickly settle its differences with Verizon by granting the phone company’s wish to walk away from its commitment to offer 45Mbps broadband across the state, New Jersey ratepayers are out $15 billion in excess phone charges levied since 1993 for promised upgrades many will never get.

While the New Jersey Board of Public Utilities was able to quickly settle its differences with Verizon by granting the phone company’s wish to walk away from its commitment to offer 45Mbps broadband across the state, New Jersey ratepayers are out $15 billion in excess phone charges levied since 1993 for promised upgrades many will never get.

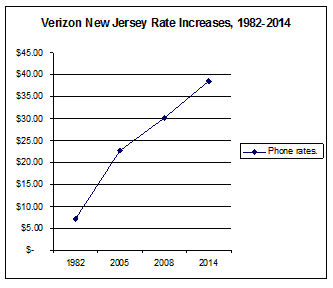

The Opportunity New Jersey plan the state government signed with Verizon was supposed to expand advanced broadband across the state in return for “a modest amount of pricing flexibility” in the fees Verizon charged customers in New Jersey. But Verizon is not a modest company and a new report shows the phone company used the agreement to boost rates as much as 440% — primarily through ancillary surcharges including inside wire maintenance, wire investment, an investment recovery fee, a local number portability surcharge, merged local calling area charge, and various other charges for phone features including Caller ID, Call Waiting, etc.

Tom Allibone, the president of LTC Consulting joined forces with New Networks’ Bruce Kushnick to analyze more than 30 years of Verizon New Jersey phone bills and discovered when it comes to tallying up rate increases, Verizon’s addition skills are akin to taking out a bag of M&M’s and only counting the yellow ones.

“This Verizon New Jersey bill from April 2002 […] has an “FCC Subscriber Line Charge”, which was $6.21 cents per line. Verizon’s quote doesn’t include this charge in their analysis of no increases between 1985 to 2008,” Kushnick writes. “The FCC Line Charge (it has many names), is on every local phone bill and the charge started in 1985. You can’t get service without paying this charge and the money does NOT go to fund the FCC but is direct revenue to Verizon New Jersey.”

After adding up various other surcharges, Kushnick’s bill increased a lot.

After adding up various other surcharges, Kushnick’s bill increased a lot.

“Add up the ‘Total Monthly Charges’ for 2 phone lines— It’s ugly,” Kushnick said. “While the cost of the ‘monthly charges’ was $25.62, there’s an extra $17.70 cents — 70%. I thought that Verizon said there were no ‘increases.’”

“Anyone who has ever bought a bundled package of services from Verizon (or the other phone or cable companies) knows that they all play this shell game; the price of service you have to pay is always 10-40% more than the advertised price. That’s because the companies leave out the cost of these ancillary charges and taxes in their sale pitch,” he added.

Verizon raised local residential service rates 79% in 2008, according to Kushnick. Business customers paid 70 percent more. Caller ID rates increased 38% — remarkable for a service that has a profit margin of 5,695%. But Verizon did even better boosting the charge for a non-published number by 38% — a service that has a 36,900% profit margin as of 1999 — the services are even cheaper to offer now.

Telephone service is one of those products that should have declined in price, especially after phone companies fully depreciated their copper wire networks — long ago paid off. Companies like Verizon have cut the budgets for outdoor wire maintenance and the number of employees tasked with keeping service up and running has been reduced by over 70 percent since 1985, dramatically reducing Verizon’s costs. But Verizon customers paid more for phone service, not less.

The cost of service might not have been as much of an issue had Verizon taken the excess funds and invested them in promised upgrades, but that has not happened for a significant percentage of the state and likely never will. Instead, they just increased company profits. More recently, Verizon has directed much of its investments into its more profitable wireless division.

Even though Verizon achieved total victory with the Christie Administration-dominated BPU, the company is still making threats about any future plans for investment.

“It’s important that regulators and legislators support public policies that encourage broadband growth in New Jersey rather than ones that could jeopardize the state’s highly competitive communications industry, or risk future investments by providers like Verizon,” wrote Sam Delgado, vice president of external affairs.

Subscribe

Subscribe A merger of Time Warner Cable and Comcast is just one more step towards undermining our democracy, worries former Secretary of Labor Robert Reich.

A merger of Time Warner Cable and Comcast is just one more step towards undermining our democracy, worries former Secretary of Labor Robert Reich.

Jonathan Adelstein

Jonathan Adelstein Once out of the public sector for several years, some lobbyists see their value deteriorate as they get increasingly out of touch with the latest administration in power. So several seek a refresh, temporarily leaving their lobbying job to return to public sector work.

Once out of the public sector for several years, some lobbyists see their value deteriorate as they get increasingly out of touch with the latest administration in power. So several seek a refresh, temporarily leaving their lobbying job to return to public sector work. Comcast PAC donations to Senate Judiciary Committee Democrats

Comcast PAC donations to Senate Judiciary Committee Democrats AT&T customers in Carbon Hill, Ala. received an unwelcome surprise in their mailbox recently when AT&T informed them they will be part of an experiment ending traditional landline service in favor of a Voice over IP or wireless alternative.

AT&T customers in Carbon Hill, Ala. received an unwelcome surprise in their mailbox recently when AT&T informed them they will be part of an experiment ending traditional landline service in favor of a Voice over IP or wireless alternative. AT&T is pushing forward despite the fact it has no idea how it will offer service to at least 4% of isolated Carbon Hill residents not scheduled to be provided U-verse and not within an AT&T wireless coverage area. There are also no guarantees customers will be able to correctly reach 911, although AT&T says the technology “supports 911 functionality.” Serious questions among consumer advocates remain about whether the replacement technology will support burglar alarms, pacemakers and even systems used by air-traffic controllers.

AT&T is pushing forward despite the fact it has no idea how it will offer service to at least 4% of isolated Carbon Hill residents not scheduled to be provided U-verse and not within an AT&T wireless coverage area. There are also no guarantees customers will be able to correctly reach 911, although AT&T says the technology “supports 911 functionality.” Serious questions among consumer advocates remain about whether the replacement technology will support burglar alarms, pacemakers and even systems used by air-traffic controllers. The Wall Street Journal reports:

The Wall Street Journal reports: If AT&T ends its traditional network, those competing service providers will have to negotiate with AT&T for access at whatever price AT&T elects to charge.

If AT&T ends its traditional network, those competing service providers will have to negotiate with AT&T for access at whatever price AT&T elects to charge.

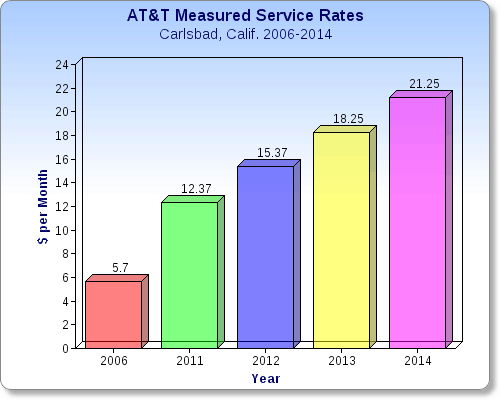

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians.

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians. “After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.”

“After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.” AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state:

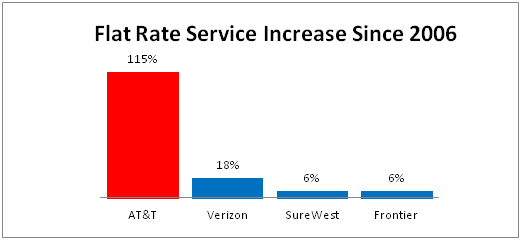

AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state: AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.

AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent. As Dr. John Malone positions his pieces on the cable industry’s chess board to win back the title of King of Big Cable, it is important to consider history.

As Dr. John Malone positions his pieces on the cable industry’s chess board to win back the title of King of Big Cable, it is important to consider history.