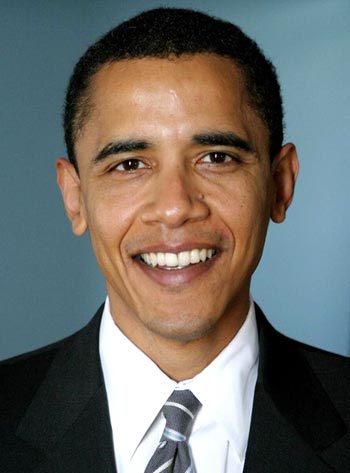

Isiogu

A current member of the Michigan Public Service Commission is penning guest editorials featuring AT&T’s favorite talking points: promoting the company’s deregulatory agenda and providing false memes about Internet Overcharging schemes like usage caps and consumption billing.

Orjiakor N. Isiogu, co-vice chairman of the National Association of Regulatory Utility Commissioners Committee on Telecommunications and member and immediate past chairman of the Michigan Public Service Commission wrote nearly identical pieces appearing in The Hill, the Detroit Free-Press and the Battle Creek Enquirer that included misleading claims that could have come straight from an AT&T lobbyist’s “fact sheet.”

A sample:

The federal government has used the telecom industry as a model of how competition could be a better elixir than the guiding hand of government regulation. And the results are impressive. The high-speed Information Superhighway touches 95 percent of the U.S., and most consumers can choose from among six or more wireless or wireline providers (90 percent can choose from at least two). And the price of Internet access — measured by megabits per second — has fallen 87 percent since 1999, even as the speed has increased tenfold;

80 percent of U.S. homes now have access to download speeds of 100 megabits per second, and 4G wireless service will soon be available nationwide, with speeds of up to 20 megabits per second;

Despite the evidence, however, there are those who wonder whether there is sufficient competition for Internet access, whether speeds are too slow and prices too high. Others object to new pricing plans that allow a consumer to purchase the amount of bandwidth that best suits his needs. In fact, some have asked the government to stop these new tailored pricing plans, even though these plans save nearly all consumers from having to underwrite the “outliers” whose monthly usage is gigantic — over 300 GBs a month or the equivalent of over 500 standard definition movies;

And if Teddy Roosevelt were with us today, he would likely argue that we can walk and chew gum at the same time, pointing to the banking industry as an example of industry excesses in need of a public check and the telecom industry as an example of how private competition, with occasional nudges, could better make the markets work.

In reality, if Teddy Roosevelt were alive today, he’d ask why a state commissioner working for the public is instead carrying water for the large telecommunications companies he oversees.

Did Roosevelt advocate the government keep their hands off AT&T and other consolidating telecom companies?

Isiogu doesn’t know his history either.

Roosevelt made no distinctions between the excesses of one industry over another. He strongly believed all major interstate corporations (and that would cover Isiogu’s friends at AT&T, Comcast, and other big telecom companies) should be subject to federal regulation and, in some cases, have their rates set by the government to ensure the public was charged fairly for the services they received. Roosevelt learned his lesson well from the oil, railway, and tobacco trusts his government sued to break up after years of consolidation and rapacious greed at the public’s expense. Those companies all claimed to be competitive as well.

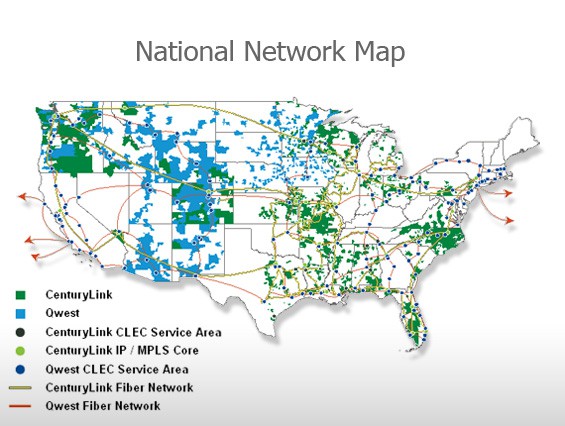

Few industries have consolidated faster than the telecom sector, which is gradually rebuilding the Bell System in AT&T and Verizon’s image and a cable cartel that agrees never to compete directly with other cartel members.

Isiogu’s “facts” are disturbingly incomplete and misleading for a telecom regulator ostensibly serving the public interest.

For example, his claim that Americans can choose among six or more different providers ignores the fact AT&T and Verizon are counted twice (wired and wireless), no competition exists among multiple cable operators or phone companies, and many of the other options Isiogu counts (almost always wireless) do not provide coverage in suburban and rural Michigan. The average consumer in the U.S. has two practical choices for broadband — the cable or phone company.

While Isiogu sings the praises of American broadband, the rest of us have watched the price of Internet service continue to increase, whether customers want faster speeds or not. The industry itself admits it can raise prices because the competitive landscape and consumer love of broadband gives companies “pricing power.”

He also doesn’t mention the price of 100Mbps service or the fact it is not offered by either AT&T or (outside of one city) Time Warner Cable — both industry leaders. Wireless is no panacea either. 4G service may offer faster speeds, but usage plans that start with just a 1GB allowance make it hard (and expensive) to take advantage of the technology improvements. Just a few years ago those plans offered unlimited access.

Isiogu also tapdances around the fact no broadband provider in the country wants to sell a “pay for what you use” plan. Instead, companies create usage allowances that come with steep overlimit fees and, as AT&T executives have told shareholders, deliver limitless potential revenue growth as subscribers are forced to upgrade as their usage grows.

Most consumers favor and appreciate unlimited-use plans for predictable pricing and ease of mind. But flat rate plans ruin providers’ goals to monetize broadband usage and are usually eliminated when consumption pricing arrives, another fact Isiogu does not bother to disclose.

Isiogu has gotten remarkably cozy with the industry he oversees, even resorting to mind-bending pretzel logic that calls regulation for the banking sector a good idea and oversight of his industry friends a disaster.

What is disturbing is while Isiogu pens these industry friendly guest editorials in his spare time, he is also in a position of power to oversee and regulate these same companies in the public’s interest.

That represents a clear conflict of interest Teddy Roosevelt could see and feel from his grave.

Subscribe

Subscribe