AT&T does not expect to see much initial growth of FirstNet, the government-sponsored first responder wireless network built by AT&T with $6 billion in taxpayer dollars.

AT&T does not expect to see much initial growth of FirstNet, the government-sponsored first responder wireless network built by AT&T with $6 billion in taxpayer dollars.

FirstNet relies on AT&T’s wireless network, bolstered by taxpayer-financed upgrades that will prioritize public safety users during emergencies, but allow any AT&T customer to use the enhanced network the rest of the time. FirstNet has just 110,000 subscribers as of this summer — about a year after launch. AT&T will be expanding FirstNet over the next four years, adding new cell towers, frequencies and bandwidth.

First envisioned after the events of Sept. 11, 2001, the network was designed to allow interoperability between all types of first responders, including law enforcement, fire departments, and ambulance crews. A major complaint after 9/11 was that different public safety agencies could not communicate with each other on the ground because of incompatible radio equipment. FirstNet allows agencies to deploy voice communications and data services on site, without the risk of congestion that occurs on publicly-available cell towers. All FirstNet users are given priority access, and during emergencies, the network will not allow public users to use FirstNet’s network resources.

Seventeen years later, the network is finally launching, but that is proving to be just the first hurdle. To use FirstNet, public safety agencies have to adopt AT&T as their communications provider, sign new contracts, and usually buy new equipment. A surprisingly large number of agencies are balking at changing providers, either because they dislike AT&T, its coverage, the cost, or require a rigorous bidding and procurement process.

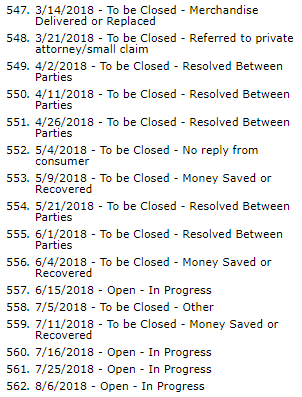

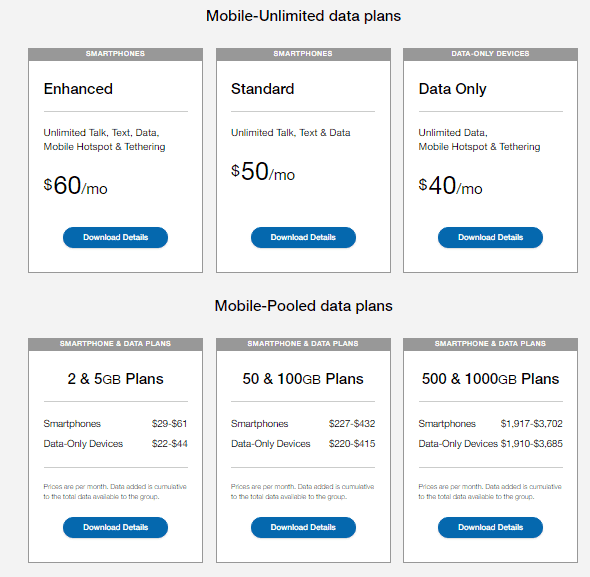

AT&T FirstNet rate plans

Rural departments often favor Verizon Wireless, perceived to have better 4G LTE coverage and better performance in rural areas than AT&T. Ray Lehr, formerly with the Baltimore City Fire Department, is now a paid consultant for FirstNet, and admitted AT&T’s rural coverage isn’t as robust as it will be five years from now.

“Over the next five years, they have to have up to 99 percent rural coverage,” Lehr said. “There’s no reason why another carrier would do that. It just doesn’t make sense.”

“Over the next five years, they have to have up to 99 percent rural coverage,” Lehr said. “There’s no reason why another carrier would do that. It just doesn’t make sense.”

For a lot of rural departments, there are coverage gaps with every wireless carrier and places where there is no coverage from any carrier. Those departments rely primarily on their existing radios for fireground communications and talking with dispatchers.

AT&T is relying on federal dollars to expand FirstNet in places where its own investment dollars are likely not being spent. AT&T also separately receives taxpayer support to build rural fixed wireless networks for consumers out of reach of traditional DSL and cable broadband.

Wall Street, which would ordinarily attack rural investment with no significant return on investment, has had little reaction to AT&T FirstNet, primarily because AT&T will be reimbursed by taxpayers for much of the construction costs, even though AT&T and its retail customers will benefit from the increased coverage and capacity FirstNet will offer most of the time.

“Investors aren’t expecting much, other than the reimbursement for the capital expenditure required to deploy the network,” Jonathan Chaplin, an analyst at New Street Research, told Communications Daily (sub. req’d.). “If public safety usage is low and AT&T can use the capacity for their core mobile users, that is probably fine.”

Other analysts agree, noting AT&T will get all the benefits offering government-paid FirstNet capacity to its retail customers, with none of the risk of losses if first responders do not flock to the new network, because it was not built with AT&T’s money.

Subscribe

Subscribe Criminals are supposedly having a field day robbing cell phone stores in Canada after regulators ordered all cell phones to be sold unlocked, allowing customers to bring their devices to other carriers.

Criminals are supposedly having a field day robbing cell phone stores in Canada after regulators ordered all cell phones to be sold unlocked, allowing customers to bring their devices to other carriers. In 2016, Canadian telecom companies made $37.7 million from fees related to unlocking smartphones. That was a 75 percent increase in fee revenue since 2014.

In 2016, Canadian telecom companies made $37.7 million from fees related to unlocking smartphones. That was a 75 percent increase in fee revenue since 2014. “It appears that illegal activity may have shifted from the U.S. to Canada as some [American] carriers have begun to lock devices,” Bell officials told the CRTC.

“It appears that illegal activity may have shifted from the U.S. to Canada as some [American] carriers have begun to lock devices,” Bell officials told the CRTC. New York regulators have given Charter Communications two additional weeks to submit its plan to discontinue service in the state after the Commission voted 4-0 in July to

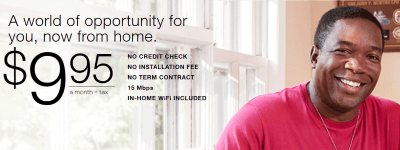

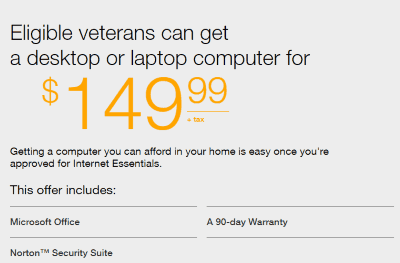

New York regulators have given Charter Communications two additional weeks to submit its plan to discontinue service in the state after the Commission voted 4-0 in July to  Comcast announced this week it is expanding its $9.95 discount internet access program Internet Essentials to

Comcast announced this week it is expanding its $9.95 discount internet access program Internet Essentials to  Qualified Assistance Programs

Qualified Assistance Programs In the seven years of its existence, Comcast has only managed to enroll six million people in the program, a fraction of those that would otherwise qualify who live in Comcast service areas. Most critics blame Comcast’s onerous qualification requirements for the relatively low enrollment.

In the seven years of its existence, Comcast has only managed to enroll six million people in the program, a fraction of those that would otherwise qualify who live in Comcast service areas. Most critics blame Comcast’s onerous qualification requirements for the relatively low enrollment. Nearly half of all adults with an income below $30,000 don’t have home broadband service or a traditional computer, a 2017

Nearly half of all adults with an income below $30,000 don’t have home broadband service or a traditional computer, a 2017 Frustrated New Englanders that can’t get anywhere dealing with Comcast or Consolidated Communications’ customer service are getting fast fixes in New Hampshire by taking their complaints to the Consumer Protection and Antitrust Division of the attorney general’s office.

Frustrated New Englanders that can’t get anywhere dealing with Comcast or Consolidated Communications’ customer service are getting fast fixes in New Hampshire by taking their complaints to the Consumer Protection and Antitrust Division of the attorney general’s office.