Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

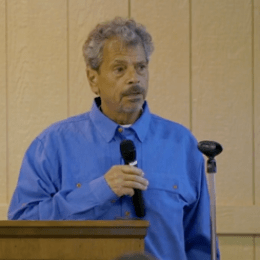

“Charter Spectrum’s merger with Time Warner Cable was only approved in New York after the company agreed to certain conditions that would allow the merger to be considered in the public interest,” said Stop the Cap! president and founder Phillip Dampier. “An annual review and at least a 17.5% reduction in the company’s video services complaint rate was part of that deal, but Charter won’t publicly state exactly how much of a reduction the company has achieved, claiming that information is ‘confidential’ and ‘secret.'”

“But Charter had no problem sharing its damage control explanation for why it is still dealing with a lot of angry customers annoyed about the increasing cost of doing business with Spectrum as a result of withdrawing promotions, forcing customers to rent expensive equipment, and deal with pricing and package changes that deliver fewer channels for more money,” Dampier added.

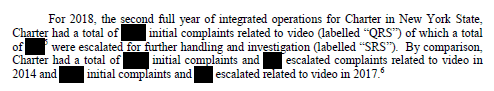

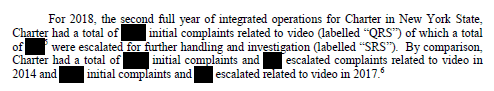

An example of the redactions (for public viewing) in Charter’s Feb. 4, 2019 letter to the NY State Department of Public Service (DPS).

Stop the Cap! argues the public has a right to know how well Charter is meeting its public interest commitments, especially after the state regulator voted last summer to kick the company out of New York (a decision that has been effectively stalled as Charter and DPS staff continue ongoing private settlement discussions.)

“Keeping complaint rates secret is an incentive for Charter to not invest adequately to deliver service improvements and its claim competitors will be able to exploit that information is laughable, as many New Yorkers have no other choice for high-speed internet service. It isn’t as if other cable companies are forcing their way into the state to offer customers another choice,” Dampier argued. “Charter is almost exclusively responsible for its complaint rate, based on how it chooses to conduct business. Had the company adopted more customer-friendly packages, services, and pricing, their complaint rate would have dropped like a rock.”

The letter in full:

February 6, 2019

Records Access Officer

Department of Public Service

Three Empire State Plaza

Albany, New York 12223

To Whom It May Concern:

We are requesting the release of an unredacted version of Charter’s 2018 PSC Video Complaint Data Report (three page letter dated 2/4/2019). Charter’s claim that this “sensitive” and “proprietary” information is useful to competitors is unproven and specious. Complaint rates are effectively modulated by a company’s choice of how it conducts its business, with or without the presence of an effective competitor. In this case, Charter admits its own business decisions, not competition, played a key role in the complaint rate, as shown below.

More importantly, this information was required to be submitted as part of the DPS Merger Approval Order granting Charter’s request to merge with Time Warner Cable. That merger was approved only after Charter agreed to certain obligations that would deliver sufficient pro-consumer benefits to meet the state’s requirement that the merger was in the public interest. A periodic review of Charter’s compliance is part of that process.

Charter is asking to keep such compliance information confidential, unreviewable, and unavailable to third party scrutiny. It also prevents organizations like ours, a party in the proceedings, from reviewing the data and submitting informed views to DPS commissioners and staff about the performance of Charter Communications under the Merger Approval Order.

Further, there is no demonstrable causal link shown between competitive injury and disclosure of video customer complaint rates that are the direct result of poor service experiences with Charter Communications. Charter is effectively asking the DPS to prohibit the public’s access to data that is part of a public interest test.

Allowing Charter to suppress public disclosure of raw data while leaving unredacted its damage control explanations for customer complaints also gives Charter an unfair advantage to explain away those complaints.¹

Requiring Charter to disclose customer dissatisfaction numbers is in the public interest and provides a strong incentive for Charter to provide better, more customer-responsive service to customers in New York, likely reducing the number of complaints from unhappy customers in the first place.

Therefore, we appeal to the FOIL Officer to release an unredacted version of the three-page compliance letter.

¹ “As the Commission is aware, changes—including improvements—can sometimes trigger complaints as customers adjust to new service options, promotions, and packages. Despite the increased level of activity and customer interaction related to integration and product advancement, Charter is pleased to report that both initial and escalated complaints have declined significantly compared to 2014 complaint numbers….” — 2018 PSC Video Complaint Data Submission, Charter Communications, 2/4/2019

Very truly yours,

Phillip M. Dampier

President and Founder

Subscribe

Subscribe

Charter is expecting it can distribute more of its revenue to shareholders, share buybacks, and debt payments as a result of the completion of its all-digital conversion project, which eliminated analog television signals from cable systems to make more room for revenue-enhancing internet service. The company also gets to lease more set-top boxes to customers seeking to view digital television signals on older analog TV sets.

Charter is expecting it can distribute more of its revenue to shareholders, share buybacks, and debt payments as a result of the completion of its all-digital conversion project, which eliminated analog television signals from cable systems to make more room for revenue-enhancing internet service. The company also gets to lease more set-top boxes to customers seeking to view digital television signals on older analog TV sets.

“We are disappointed in this choice, as Mr. Randazzo has a lengthy career fighting against renewable energy and energy efficiency in Ohio,” Heather Taylor-Miesle, president of the Ohio Environmental Council Action Fund, said in a release. “This move is out-of-step with the rest of the Midwest, where governors are committing to the future of energy, instead of the past.”

“We are disappointed in this choice, as Mr. Randazzo has a lengthy career fighting against renewable energy and energy efficiency in Ohio,” Heather Taylor-Miesle, president of the Ohio Environmental Council Action Fund, said in a release. “This move is out-of-step with the rest of the Midwest, where governors are committing to the future of energy, instead of the past.”

Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

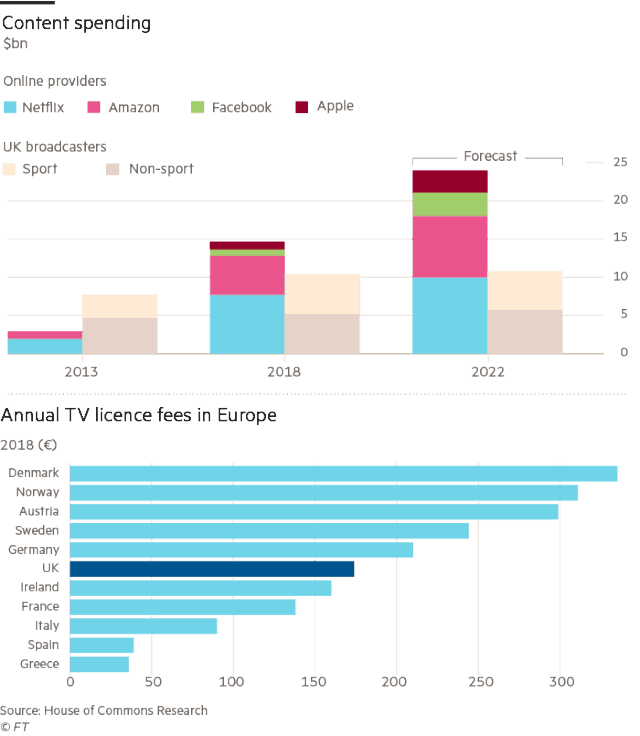

European broadcasters are frightened at the prospect of seeing viewers and crucial mandatory TV license fees erode away as an invasion of American on-demand streaming from Netflix and Amazon takes its toll on traditional television.

European broadcasters are frightened at the prospect of seeing viewers and crucial mandatory TV license fees erode away as an invasion of American on-demand streaming from Netflix and Amazon takes its toll on traditional television.