Plaintiffs charge that Verizon’s spinoff deals earned millions for top executives and investment bankers, but left nothing but wreckage for employees, retirees, customers, and smaller banks duped into covering the tax-free debts that were left behind.

Verizon Communications is defending itself in a Dallas courtroom against a $9.5 billion lawsuit brought by creditors who allege the phone company fraudulently structured the spinoff of its phone directory business to Idearc in a deal that enriched Verizon while leaving the new publisher crippled with $9 billion in debt and eventual bankruptcy.

Verizon structured the spinoff of its phone book unit much the same way it has sold-off its local phone business operations in several states to Hawaiian Telcom, Frontier Communications, and FairPoint Communications — through controversial, tax free Reverse Morris Trusts. At the end of the deal, the buyers are saddled with enormous debts, eventually forcing HawTel, Idearc, and FairPoint to declare bankruptcy.

Now the creditors that took the hit over Idearc are in court alleging Verizon engineered the deal to unjustly enrich itself while sending the dying phone directory business straight into insolvency.

Werner Powers, an attorney for the creditors, said in opening statements Idearc was purposely loaded down in Verizon debt and “sent into the market to die.”

“They knew in major markets they had been suffering a double-digit decline,” Powers said to the judge in a Dallas courtroom. “They knew that was the canary in the mine shaft.”

The Association of BellTel Retirees is fighting for former Verizon employees who woke up one morning discovering their safe Verizon pension benefits had been transferred to a shaky startup that quickly went bankrupt.

But creditors are not alone suffering from a bankrupt Idearc. During the 11th hour of negotiations, Verizon quietly engineered a transfer of Verizon retirees that formerly worked for the directory unit to Idearc’s startup pension plan — a very risky proposition for the nearly 3,000 retirees who were secure with a fully funded, low risk Verizon pension plan.

Curtis Kennedy, the attorney representing the interests of the retirees, explains how it all happened:

On October 18, 2006, after conducting a very cryptic half hour meeting via telephone and reviewing a packet of Power Point presentations, the Verizon Board of Directors gave full approval for the Spin-Off transaction. A month later, on the last day to do the transaction, the retirees were thrown into the mix. Of course, no retiree had any prior knowledge, no fiduciary advocate, no legal representation, no union representation, and no say in the matter. The designated group of retirees were simply treated like obsolete telephone equipment being disposed of by Verizon.

At the proverbial “11th Hour” before the closing, Verizon EVP John Diercksen, acting as the sole director of Idearc, resigned his director position and he appointed a new set of corporate directors. The new directors hurriedly executed a resolution to ratify and approve the Spin-Off transaction. In reality, the new Idearc board had no choice but to sign off on the Spin-Off.

Wall Street investment banks JPMorgan and now defunct Bears Stearns swooped in to finance the multi-billion dollar transaction that engineered the transfer of $9.5 billion in debt to Idearc while allowing Verizon to keep more than $2 billion in valuable assets for itself, crippling Idearc from day one, as plaintiffs contend. Both investment banks quickly packaged and sold off the now-worthless loans to hundreds of other unsuspecting financial institutions, while keeping deal fees for themselves.

Investors also got blindsided. One Wall Street analyst gave this recommendation on Idearc shares to unwitting investors:

“When a corporate parent casts off a vexing unit with unpromising growth, the natural inclination is to steer clear of this forsaken offspring. But the yellow pages business Verizon Communications is spinning off may merit a second glance.”

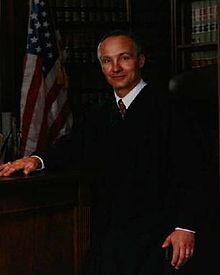

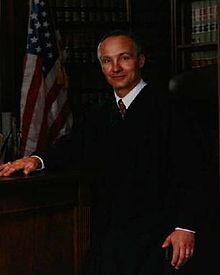

Judge Joe Fish

It got one in bankruptcy court, eventually emerging with a new name: Supermedia.

Much of the documentation that surrounds the deal and those responsible for it have been sealed by the court. U.S. District Judge A. Joe Fish has announced he will decide the case himself and turned back efforts for a jury trial. Judge Fish has also denied repeated attempts by Verizon to have the case dismissed, although he has also ruled against creditors dismissing some of their claims.

Bloomberg News this month filed motions to unseal the record in the public interest, but the judge has yet to rule on the motion.

Verizon retirees are watching the current lawsuit between Verizon and creditors carefully. The group of former employees have brought their own lawsuit against Verizon, with some of their worst fears realized when Supermedia sent word in June they were canceling the retirees’ pension benefits.

Verizon has reportedly hired eight expert witnesses to testify on its behalf, one who will receive more than$4 million in appearance fees. Verizon has leased office space specifically for the trial near the downtown Dallas federal court building.

Many current Supermedia employees report a siege mentality at what is left of the directory publisher, with regular threats of further job cuts.

Subscribe

Subscribe