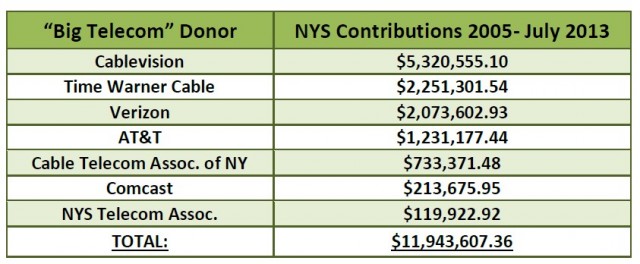

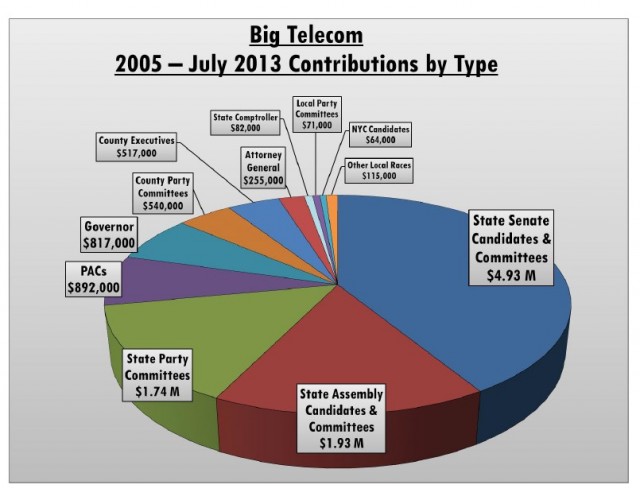

Since 2005, five cable and telephone companies and their respective lobbying trade associations have donated nearly $12 million to New York politicians, making Big Telecom companies among the biggest political donors in the state. Now a government reform group wants an investigation by the state’s anti-corruption commission.

Since 2005, five cable and telephone companies and their respective lobbying trade associations have donated nearly $12 million to New York politicians, making Big Telecom companies among the biggest political donors in the state. Now a government reform group wants an investigation by the state’s anti-corruption commission.

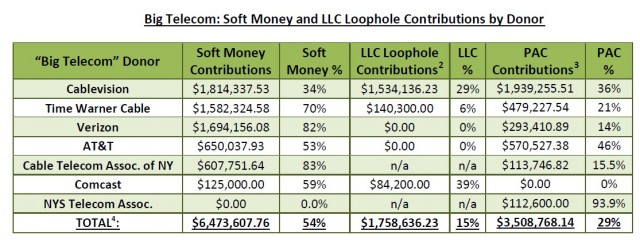

By exploiting giant loopholes in New York’s campaign finance laws, telecom companies that used to live with annual campaign finance limits of $5,000 are now donating millions to powerful political leaders in Albany – the majority conferences in the legislature, the state party committees, and the governor. Some are using secretive “housekeeping” accounts controlled by political parties. Others hide behind shadowy contributions from “limited liability corporations” (LLCs) established by some of the state’s biggest cable and phone companies and treated under current law as living, breathing people.

“Big Telecom exemplifies the pay-to-play culture which has come to define Albany, giving generously to the leadership in exchange for veto power over bills which favor the public interest,” said Common Cause-New York executive director Susan Lerner.

The Optimum donor to state “housekeeping” accounts among telecom providers is Cablevision.

No telecom company donates more in New York than Cablevision, which has given more than $5.3 million in contributions to state politicians since 2005 as it fights its way through union problems, fierce competition from Verizon, and complaints from subscribers about rising cable prices and questionable service. The cable company doesn’t just donate in name-only. Common Cause-NY discovered Cablevision using eight different LLCs to evade contribution limits, handing over $1.5 million to candidates and committees. Gov. Andrew Cuomo received $130,000 from four different Cablevision-controlled LLCs between July and October 2010. On April 29 of this year, former Nassau County executive Tom Suozzi’s campaign received $190,000 from three Cablevision-controlled LLCs on that single day.

Verizon (82%) and Time Warner Cable (70%) prefer to quietly give the largest percentage of their political donations to the parties’ secretive, soft money “housekeeping” accounts. The Republican and Democratic recipients are not using the money to buy Endust, mops or spare light bulbs, although the average voter might assume as much.

Corporations with an agenda just love New York’s hush-hush “housekeeping” accounts because they come without dollar limits or complete disclosure about how the money was ultimately spent.

The State Board of Elections says “housekeeping” money is supposed to go toward maintaining a party’s headquarters and staff or “ordinary activities that are not for the express purpose of promoting the candidacy of specific candidates.” Unfortunately, nobody bothered to require detailed accounting, allowing funds to disappear down a political rabbit hole, to be distributed at each party’s discretion.

Comcast (59%) and AT&T (53%) are considerably smaller players, in part because neither company serves many wired cable/broadband customers in New York.

Verizon’s corporate PAC also likes to raise relatively large numbers of small contributions given in the name of company executives or employees, not necessarily mentioning the company itself. Campaign finance disclosures may list only the individuals’ contribution(s), not the company that signed their paycheck.

Where does all the money go?

Where does all the money go?

Common Cause-NY says most of the money is channeled to the most influential politicians in the state, with minority parties and unelected candidates typically getting much less.

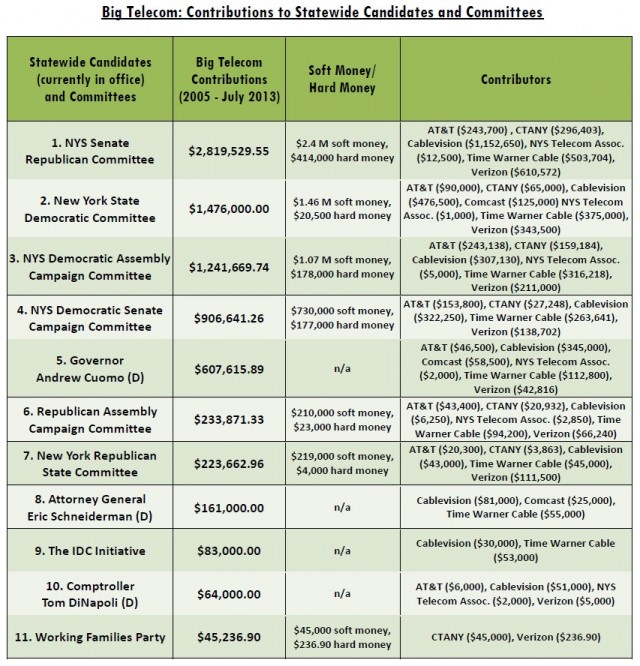

To gain influence on the state level, Big Telecom companies contribute to the governor, attorney general, and the majority parties controlling the state Assembly and Senate, with Republicans getting the lion’s share (over $3.5 million) in the Senate and Democrats (over $1.6 million) in the Assembly.

For local issues of interest to the state’s local cable and phone companies, contributions are funneled to influential county-level political machines, perhaps helpful in making life difficult for a competing Wi-Fi project, a municipal fiber network, or helping to cut red tape to place a cell tower in a controversial location.

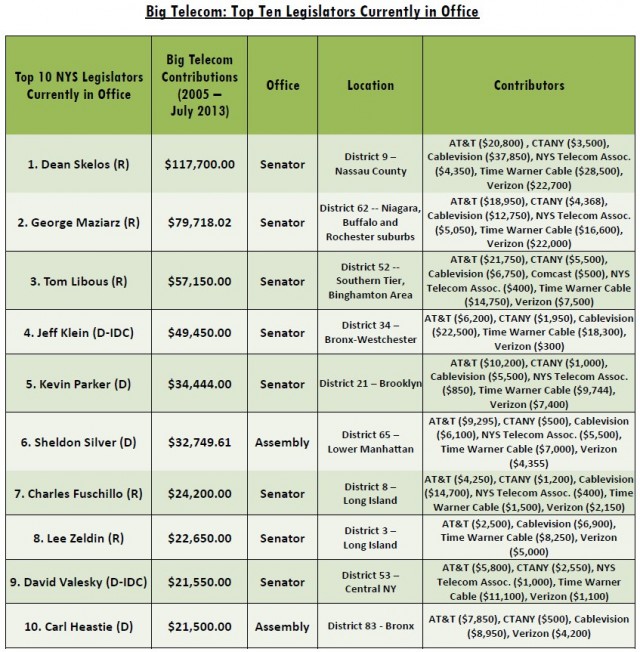

The top six recipients of Big Telecom’s political cash in the legislature:

- Key Party Leaders: Dean Skelos ($117,700), Tom Libous ($57,150), Jeff Klein ($49,450), and Sheldon Silver ($32,749.61)

- Current and former Chairs of the Senate Energy and Telecom Committee: George Maziarz ($79,718.02) and Kevin Parker ($34,444.00).

Common Cause-NY notes the corporations involved don’t give money without expecting something in return. After generous contribution checks were deposited, a number of telecom consumer protection bills mysteriously died in committee or never made it to the floor. The same fate did not meet bills offering special tax breaks for cable and Internet Service Providers that have cost New York taxpayers nearly $500 million and counting.

“Multi-million dollar campaign contributions clearly help Big Telecom maintain the status quo of corporate control, high prices, and lax regulation,” Common Cause-NY concludes.

The legislature is rife with examples of bills that would have likely passed with popular support but suddenly or “mysteriously” didn’t:

A 7635-A / S5630-A: Establishes a moratorium on telephone corporations on the replacement of landline telephone service with a wireless system.

A 7635-A / S5630-A: Establishes a moratorium on telephone corporations on the replacement of landline telephone service with a wireless system.

- The “VoiceLink” moratorium bill, passed the Assembly, had broad bi-partisan support in the Senate but never came to a vote.

- S542: Relates to enacting the “Save New York Call Center Jobs Act of 2013,” which requires prior notice of relocation of call center jobs from New York to a foreign country; directs the Commissioner of Labor to maintain a list of employers who move call center jobs; prohibits loans or grants.

- The “Call Center Jobs Act” would take away tax breaks and state grants if companies move a call center to another country. The bill passed the Assembly in 2012 (A9809) and had bipartisan support in Senate but was blocked. The 2013 bill died in Senate committee.

A6003/S5577 — Directs the Department of Public Service to study and report on the current status of cable television systems providing services over fiber optic cables.

A6003/S5577 — Directs the Department of Public Service to study and report on the current status of cable television systems providing services over fiber optic cables.

- Bipartisan support in Assembly for further oversight of broadband but gets little support in Senate, the same bill was also blocked in 2012.

- A5234/S1075 — Enacts the “Roadway Excavation Quality Assurance Act” demanding utility companies or their contractors shall use competent workers and shall pay the prevailing wage on projects where a permit to use or open a street is required to be issued.

- Bipartisan support in the Senate and Assembly but no passage in either 2012 and 2013.

- A6239/S4550 — Creates the State Office of the Utility Consumer Advocate to represent interests of residential utility customers.

- Bipartisan support in Assembly, dies in Senate.

- A6757/S4449 — Requires providers of electric, gas, steam, telephone and cable television services to issue standardized bills to residential customers; provides the standards for such bills shall be established by the Public Service Commission.

- Bipartisan support, passes Assembly, dies in Senate.

“Here’s the evidence that giant telecom companies are taking advantage of huge loopholes and lax regulations so they can increase profits, often at the expense of everyday New Yorkers,” said Karen Scharff, executive director of Citizen Action of New York on behalf of the Fair Elections for New York campaign. “It’s time for our leaders in Albany to acknowledge the ever-growing wealth of evidence that we need to fix our broken campaign finance system and pass a comprehensive Fair Elections system centered around publicly financed elections.”

Subscribe

Subscribe Just weeks after Time Warner Cable and CBS settled a dispute over retransmission fees, other broadcasters and networks are preparing to make new demands for increased compensation from their cable, satellite, and telco IPTV partners at prices likely to provoke more blackouts.

Just weeks after Time Warner Cable and CBS settled a dispute over retransmission fees, other broadcasters and networks are preparing to make new demands for increased compensation from their cable, satellite, and telco IPTV partners at prices likely to provoke more blackouts.

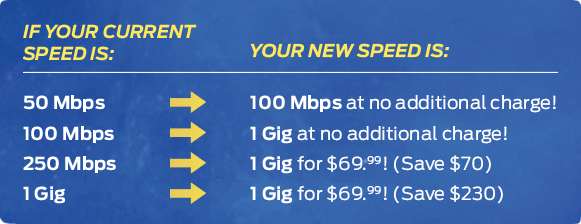

EPB this morning celebrated its fourth anniversary by thanking Chattanooga residents for supporting the utility’s fiber network with a series of price cuts and speed increases.

EPB this morning celebrated its fourth anniversary by thanking Chattanooga residents for supporting the utility’s fiber network with a series of price cuts and speed increases. Customers will see the new speeds provisioned within the next two weeks. At least 3,000 residential customers will be upgraded to gigabit service.

Customers will see the new speeds provisioned within the next two weeks. At least 3,000 residential customers will be upgraded to gigabit service.