CenturyLink’s philosophy about offering gigabit fiber broadband speeds in Idaho can be summed up simply as “for business-use only.”

CenturyLink’s philosophy about offering gigabit fiber broadband speeds in Idaho can be summed up simply as “for business-use only.”

Jim Schmit, Idaho CenturyLink’s vice president and general manager, believes super fast broadband connections are overkill for homes and most businesses in the state.

“It’s like having a fancy sports car,” Schmit told the Idaho Statesman. “It might go 200 miles per hour, but what good does that do if the speed limit is 60?”

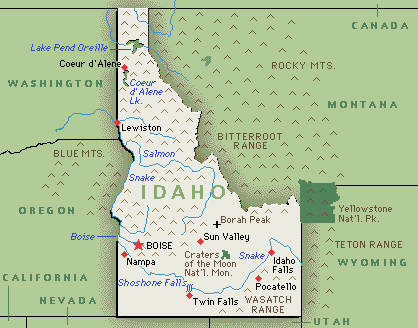

Schmitt’s attitude of broadband a-plenty is nothing new. In 2007, he told attendees of the Emerging Directions in Economic Development conference in Boise that “virtually all” Idahoans already had access to high-speed broadband. That was news to the audience, with about a quarter of the economic development professionals attending stating they represented a community that didn’t have it yet. Most of the questions related to how their communities could get the access they’d been told wasn’t available.

Seven years later, the Statesman reports more than a few homes and businesses in the region still rely on slow DSL, satellite and even dial-up access because faster options are just not available.

Idaho could find itself a bystander in the growing movement to deploy gigabit fiber to the premise broadband, despite the fact CenturyLink already has fiber infrastructure available nearby.

Idaho could find itself a bystander in the growing movement to deploy gigabit fiber to the premise broadband, despite the fact CenturyLink already has fiber infrastructure available nearby.

“We’re getting to the point where, for businesses in most places, we’re within last-mile connections for most locations,” Schmit says.

CenturyLink is willing to extend its fiber, but only if that fiber line reaches businesses needing gigabit speeds. Residential customers need not apply.

Fiber optics can be found in several office buildings in downtown Boise, which has been good news for established tech companies that need more bandwidth. Three data centers are operational in the city and would likely not be there without fiber.

But for home-based entrepreneurs of future Internet startups, most will be forced to choose between CenturyLink DSL or cable broadband from providers like Cable ONE, which offer slower speeds.

Smaller broadband providers have begun to fill the gap left open by the lack of interest from cable and phone companies. While Google is showing interest in building fiber networks in a handful of U.S. cities, many more communities are realizing they will not get gigabit speeds anytime soon unless they build a publicly owned broadband network themselves or rely on much smaller-scale projects under development in the private sector.

Patrick Lawless, founder and CEO of Boise voice recognition software developer Voxbright Technologies Inc., sees opportunity providing a limited fiber network in Boise. Lawless has plans to build a 2.6-mile fiber-optic loop and deliver television, phone and broadband service to apartment and office buildings in a manner similar to Google’s. It’s a small early effort, limited to a handful of businesses and new residential buildings — mostly apartments and renovated former office buildings or hotels. He plans to charge $99 a month for a package including television, 100Mbps broadband, and phone service.

With the project’s small scope and uncertain cost, CenturyLink says it isn’t too worried about the competition. For now they will continue to bank on offering only the broadband speed they believe customers actually need, and it will be up to a competitor to prove them wrong.

Subscribe

Subscribe

Despite claims of improved customer service and better broadband, Comcast and Time Warner Cable’s customer satisfaction scores are in near-free fall in the latest Consumer Reports National Research Center’s survey of consumers about their experiences with television and Internet services.

Despite claims of improved customer service and better broadband, Comcast and Time Warner Cable’s customer satisfaction scores are in near-free fall in the latest Consumer Reports National Research Center’s survey of consumers about their experiences with television and Internet services.

Since the federal government deregulated the cable industry in the 1990s, state and local officials have had little oversight over cable service and pricing, but in many states regulators still have a voice in mergers and other business deals.

Since the federal government deregulated the cable industry in the 1990s, state and local officials have had little oversight over cable service and pricing, but in many states regulators still have a voice in mergers and other business deals. So far, Comcast does not seem concerned about Cuomo’s proposal.

So far, Comcast does not seem concerned about Cuomo’s proposal. Normally when one learns they are losing a job after only a few months in management, it is a time for sober reflection and emotional recovery.

Normally when one learns they are losing a job after only a few months in management, it is a time for sober reflection and emotional recovery. In the all-encompassing merger proposal submitted to the Securities and Exchange Commission, Time Warner Cable noted it sought the advice of several Wall Street investment banks and related institutions. Unsurprisingly, based on the material submitted voluntarily by Time Warner Cable and Comcast, the banks submitted written reports declaring that the merger proposal seemed fair. For that, these advisers were well-compensated. In all, Time Warner Cable and Comcast will pay a combined $135.5 million in fees in return for the positive assessment of the merger’s potential:

In the all-encompassing merger proposal submitted to the Securities and Exchange Commission, Time Warner Cable noted it sought the advice of several Wall Street investment banks and related institutions. Unsurprisingly, based on the material submitted voluntarily by Time Warner Cable and Comcast, the banks submitted written reports declaring that the merger proposal seemed fair. For that, these advisers were well-compensated. In all, Time Warner Cable and Comcast will pay a combined $135.5 million in fees in return for the positive assessment of the merger’s potential: