Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator is not playing well in some quarters of the French government.

Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator is not playing well in some quarters of the French government.

Patrick Drahi’s announcement he was borrowing the money to finance the deal worried France’s economy minister Emmanuel Macron, who felt Drahi’s leverage game in the mergers and acquisitions business came with a massive debt load that could have major implications on French taxpayers.

“I don’t want to create a too-big-to-fail player with such a leverage and it’s my role to … deliver such a message,” Macron said. ”If the biggest telecom operator blows up, guess what, who will pay for that? The government, which means the citizens.”

Macron is partly referring to the upcoming French wireless spectrum auction that will make more wireless frequencies available to the wireless industry. The proceeds will be paid to the French government and a default by Altice could have major implications.

Macron

Macron, himself a one-time investment banker at the Rothschild Group, said he was not fooled for a moment by Drahi’s claims the merger would benefit French consumers, especially at the overvalued price Drahi was willing to pay. Macron estimates Drahi has offered almost double the total market value of Bouygues Telecom, a conglomerate that also includes road construction and maintenance, commercial construction and television businesses — all elements Drahi would likely discard after the merger.

“All the synergies which could justify such a price are in fact about killing jobs,” Mr. Macron said. “At the end of the day, is it good for the economy? The answer is ‘no’.”

The merger deal is probably not good news for consumers either. France’s ongoing wireless price war among the four current competitors has reduced the cost of wireless service to as little as $3 a month since low-cost player Iliad broke into the French mobile market three years ago.

Virtually every French telecom analyst predicted the merger would be the beginning of the end of France’s cheap wireless service. Investors cheered the news, predicting higher priced wireless service would boost the value of their stock and increase profitability, while reducing costs. The deal’s defenders said ending the price war would attract necessary investments to upgrade French wireless networks and limit the impact of a bidding war for new wireless spectrum.

Drahi’s style of indebting Altice while slashing expenses at acquired companies has earned him suspicion from French officials.

Drahi’s style of doing business again raised concerns among several members of the French government. Drahi is notorious for severely slashing expenses at the companies he acquires, usually firing large numbers of middle managers and “redundant employees” and alienating those that remain.

But vendors complain they are treated even worse than Drahi’s employees. Electricity has been cut at Drahi-owned facilities for non-payment, employees have been expected to bring their own toilet paper to the office, and copying machines have been known to run out of toner and paper after office supply firms went unpaid for months.

After his $23 billion acquisition of SFR, the country’s second largest mobile operator, Drahi ordered SFR to stop paying suppliers’ outstanding invoices until vendors and suppliers agreed to massive discounts of as much as 80% on current and future invoices. A government mediator was forced to intervene.

Macron doubts Drahi has the interest or the financial resources to invest in Bouygues’ telecom business. Drahi has already indebted Altice with a spending spree of more than $40 billion over the last year acquiring Suddenlink Communications, SFR, and Portugal Telecom.

Drahi’s acquisition machine is fueled by “cheap debt” available from investment bankers looking for deals to meet investors’ demands for better yields from corporate bonds. Safer investments have faltered as interest rates have fallen into negative territory in parts of Europe.

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

“If I stop my so-called bulimic development, I won’t have any debt five years from now. That’s idiotic, I won’t have any growth for five years,” Drahi curtly replied. “I think it’s better to continue to produce growth all while keeping a foot close to the brakes and looking in the rear-view mirror.”

Finance Minister Michel Sapin scoffed at the apparent recklessness of America’s J.P. Morgan and France’s BNP Paribas investment banks who readily agreed to offer financing for the deal, despite Drahi’s existing debt.

“We must be careful not to base an empire on the sands of debt,” he warned.

[flv]http://www.phillipdampier.com/video/Reuters French government hardens stance on Altice bid for Bouygues Telecom 6-22-15.flv[/flv]

Reuters reports Altice may be vastly overpaying for Bouygues Telecom and that has the French government concerned about creating a “too big to fail” telecom operator in France. (2:04)

Subscribe

Subscribe Mobilicity, a struggling independent wireless carrier serving some of Canada’s largest cities, will end its efforts to compete with larger wireless companies if a court approves its sale to Rogers Communications, Canada’s largest mobile operator.

Mobilicity, a struggling independent wireless carrier serving some of Canada’s largest cities, will end its efforts to compete with larger wireless companies if a court approves its sale to Rogers Communications, Canada’s largest mobile operator. Mobilicity has been under creditor protection since September 2013 and has only managed to keep 157,000 active customers on its discount cellular network. Rogers is said to be interested in Mobilicity primarily as part of a tax write-off strategy. Mobilicity had non-capital loss carry forwards of $567-million by the end of 2013, which offers Rogers a reduction in its tax bill of about 25 to 30% of that amount.

Mobilicity has been under creditor protection since September 2013 and has only managed to keep 157,000 active customers on its discount cellular network. Rogers is said to be interested in Mobilicity primarily as part of a tax write-off strategy. Mobilicity had non-capital loss carry forwards of $567-million by the end of 2013, which offers Rogers a reduction in its tax bill of about 25 to 30% of that amount.

Bahrami responds Time Warner’s attitude is based on a distinction without much difference because he is effectively being told CNS must pay extra for a suitable connection with Time Warner to guarantee his web visitors will have a good experience.

Bahrami responds Time Warner’s attitude is based on a distinction without much difference because he is effectively being told CNS must pay extra for a suitable connection with Time Warner to guarantee his web visitors will have a good experience. Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator

Today’s offer by Altice SA to spent $11 billion to acquire France’s Bouygues Telecom and combine it with Altice-owned Numericable-SFR to create France’s largest wireless operator

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future.

French lawmakers, particularly those aligned with France’s labor unions, accuse Drahi of acting like a bulimic debtor and feared his splurge would eventually lead to a banker-forced purge and government bailout if he cannot meet his debt obligations in the future. If your YouTube, Netflix, or Amazon Video experience isn’t what it should be, your Internet Service Provider is likely to blame.

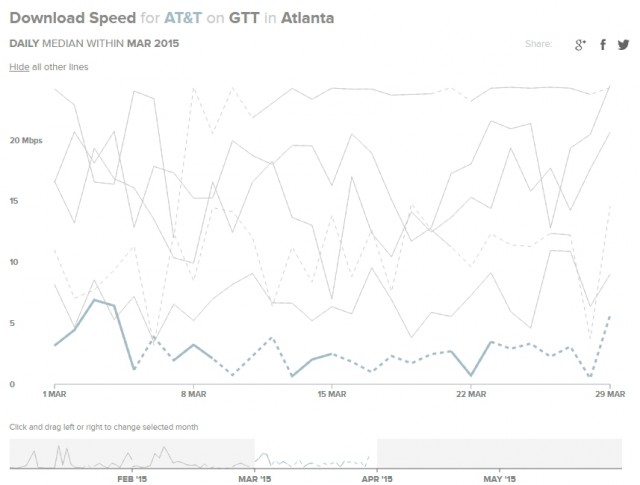

If your YouTube, Netflix, or Amazon Video experience isn’t what it should be, your Internet Service Provider is likely to blame. The study revealed network performance issues that would typically be invisible to most broadband customers performing generic speed tests to measure their Internet speed. The Open Technology Institute’s M-Lab devised a more advanced speed test that would compare the performance of high traffic CDNs across several providers. CDNs were created to reduce the distance between a customer and the content provider and balance high traffic loads more evenly to reduce congestion. The shorter the distance a Netflix movie has to cross, for example, the less of a chance network problems will disrupt a customer’s viewing.

The study revealed network performance issues that would typically be invisible to most broadband customers performing generic speed tests to measure their Internet speed. The Open Technology Institute’s M-Lab devised a more advanced speed test that would compare the performance of high traffic CDNs across several providers. CDNs were created to reduce the distance between a customer and the content provider and balance high traffic loads more evenly to reduce congestion. The shorter the distance a Netflix movie has to cross, for example, the less of a chance network problems will disrupt a customer’s viewing.