Few were surprised more by the sudden announcement that Comcast was seeking to acquire Time Warner Cable all by itself than the negotiating team from Charter Communications.

Few were surprised more by the sudden announcement that Comcast was seeking to acquire Time Warner Cable all by itself than the negotiating team from Charter Communications.

Working for weeks to settle how Comcast and Charter would divide the second largest cable company in the country between them, they learned about the sudden deal with Comcast the same way the rest of the country heard about it — over Comcast-owned CNBC.

After Charter endured weeks of rejection from Time Warner Cable executives over what they called “a lowball offer,” Comcast had entered the fray to help Charter boost its offer and bring more cash to the table to change Time Warner Cable’s mind. In return, Comcast expected to acquire Time Warner’s east coast cable systems and much more.

That is where the trouble began.

According to Bloomberg News, the talks broke down because Charter wanted to hold onto as many Time Warner Cable assets as possible. Comcast chief financial officer Michael Angelakis expected Charter to divest more than just the New England, New York, and North Carolina Time Warner Cable systems. Angelakis also wanted control of Time Warner’s valuable regional sports networks in Los Angeles. When he didn’t get them, he stormed out of a meeting threatening to do a deal for Time Warner Cable without involving Charter at all.

According to Bloomberg News, the talks broke down because Charter wanted to hold onto as many Time Warner Cable assets as possible. Comcast chief financial officer Michael Angelakis expected Charter to divest more than just the New England, New York, and North Carolina Time Warner Cable systems. Angelakis also wanted control of Time Warner’s valuable regional sports networks in Los Angeles. When he didn’t get them, he stormed out of a meeting threatening to do a deal for Time Warner Cable without involving Charter at all.

The Wall Street Journal confirms the account, adding that both Comcast CEO Brian Roberts and Angelakis agreed the talks with Charter seemed to be going nowhere.

Roberts

Roberts called a secret meeting with top Comcast executives including Angelakis, Comcast Cable head Neil Smit, Comcast’s lobbying heavyweight David Cohen, and NBCUniversal CEO Steven Burke. Roberts asked each about the options on the table and their conclusion was to buy Time Warner Cable by themselves and cut Charter out of the deal.

Within days, Comcast CEO Brian Roberts reinitiated talks with Time Warner Cable CEO Robert Marcus. The two companies had talked off and on ever since Charter Communications set its sights on acquiring Time Warner Cable. It was clear from the beginning Marcus and his predecessor Glenn Britt were cool to Charter’s overtures. Not only was Charter a much smaller operation, it also had a checkered past including a recent bankruptcy that wiped out shareholder value and was loaded with debt again.

The alliance between Charter and Liberty Global’s John Malone was also unsettling. Those in the cable industry had watched how ruthless Malone could be back in the 1990s when a then much-smaller Comcast secretly attempted to acquire control of Tele-Communications, Inc. (TCI) — then the nation’s largest cable operator run by Malone. Malone was furious when he learned about the effort and went all out to kill the deal, acquiring the stake Comcast sought himself.

Malone’s cable empire would eventually fall with the sale of TCI to AT&T just a few years later. When AT&T decided it didn’t to stay in the cable business, it sold TCI’s old territories to Comcast, making it the largest cable operator in the country.

Malone

Malone’s brash attitude has also occasionally rubbed the cable industry’s kingpins the wrong way, especially in his public comments. Last year, Malone criticized Roberts’ more conservative operating style, which means Comcast pays a higher tax rate. Malone specializes in deals that leave his acquisitions with enormous debt loads, manipulating the tax code to stiff the Internal Revenue Service. In June, Malone was back again criticizing the lack of a unified national cable cartel better positioned to defeat the competition.

Under his leadership at TCI, many cable programmers didn’t get on TCI’s cable dial unless they sold part-ownership to TCI. Competitors were dispatched ruthlessly — home satellite dish service, then the most viable competitor, strained under TCI-led efforts to enforce channel encryption.

TCI-owned networks routinely required satellite subscribers to sign up with the nearest TCI cable system, which often billed them at prices higher than what cable subscribers paid. Subscribers had to buy not one, but eventually two decoder modules for several hundred dollars apiece before they could even purchase programming. The cable industry also worked behind the scenes to promote and defend enhanced zoning laws that made installing satellite dishes difficult if not impossible, and denied access to some programming at any price, unless it was delivered by a cable system.

Malone called today’s divided industry “Snow White and the Seven Dwarfs” and insisted on a new major consolidation wave to enhance “value creation” and deliver some major blows to satellite and telephone company competitors.

Malone called today’s divided industry “Snow White and the Seven Dwarfs” and insisted on a new major consolidation wave to enhance “value creation” and deliver some major blows to satellite and telephone company competitors.

Despite Liberty Global’s ongoing consolidation wave of European cable systems, his lack of financial resources to put his money where his mouth was left Time Warner Cable executives cold.

Already loaded with debt, Malone’s part ownership stake in Charter could not make up for Charter’s current status — a medium-sized cable operator with dismal customer ratings primarily serving smaller communities bypassed by larger operators.

A deal with Charter would mean Time Warner Cable’s bonds would be downgraded to junk status.

Moody’s Investor Service warned Charter’s offer to acquire Time Warner Cable was primarily financed with the equivalent of a credit card, and would leave the combined entity with $60 billion in debt with bonds promptly downgraded to junk level. Time Warner Cable had always considered its bonds “investment grade.”

Charter’s first clue something was wrong came when Comcast stopped returning e-mail and phone calls. That’s always cause for alarm, but Charter officials had no idea Comcast was secretly negotiating with Time Warner Cable one-on-one. In fact, Comcast’s Roberts was negotiating with Time Warner Cable over a cell phone while attending the Sochi Olympics.

Malone finally got the word the deal was off just a short while before Comcast and Time Warner Cable leaked the story to CNBC.

Ironically, it was Malone who convinced Comcast to seek out a deal with Time Warner Cable. Comcast’s thinking had originally been it had grown large enough as a cable operator and sought out expansion in the content world, acquiring NBCUniversal. But Malone warned online video competitors like Netflix would begin to give customers a reason to cut cable’s cord or at the very least take their business to AT&T or Verizon’s competing platforms.

Comcast executives were convinced that gaining more control over content and distribution was critical to protect profits. Only with the vast scale of a supersized Comcast could the cable company demand lower prices and more control over programming. By dominating broadband, critics of the deal warn Comcast can also keep subscribers from defecting while charging higher prices for Internet access and imposing usage limits that can drive future revenue even higher.

Just like the “good old days” where customers had to do business with the cable company at their asking price or go without, a upsized Comcast will dominate over satellite television, which cannot offer broadband or phone service, as well as the two largest phone companies — AT&T, which so far cannot compete with Comcast’s broadband speed and Verizon, which has pulled the plug on further expansion of FiOS to divert investment into its highly profitable wireless division. If Comcast controls your Internet connection, it can also control what competitors can effectively offer customers. Even if Comcast agrees to voluntarily subscribe to Open Internet principles like Net Neutrality, its usage cap can go a long way to protect it from online video competitors who rely on cable broadband to deliver HD video in the majority of the country not served by U-verse or FiOS.

Subscribe

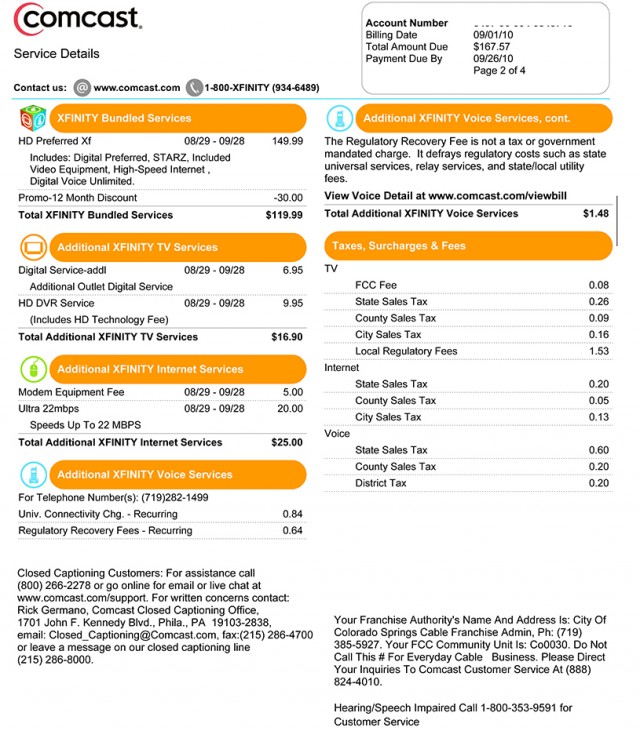

Subscribe Should a deal to merge Time Warner Cable with Comcast be approved by regulators, Time Warner Cable customers can expect a number of changes to their cable, Internet, and phone service because of Comcast’s much more involved rate plans¹.

Should a deal to merge Time Warner Cable with Comcast be approved by regulators, Time Warner Cable customers can expect a number of changes to their cable, Internet, and phone service because of Comcast’s much more involved rate plans¹.

Comcast customers start with Limited Basic service, comparable to Time Warner Cable’s Broadcast Basic package. It primarily features over the air local television stations and often runs under $10 a month. Effective this year, there is also a $1.50/month Broadcast TV surcharge applicable to all cable TV customers.

Comcast customers start with Limited Basic service, comparable to Time Warner Cable’s Broadcast Basic package. It primarily features over the air local television stations and often runs under $10 a month. Effective this year, there is also a $1.50/month Broadcast TV surcharge applicable to all cable TV customers. For those who want even more, Comcast offers Digital Premier, with more than 190 channels. This package includes Digital Preferred, HBO, Showtime, Starz, Cinemax and Comcast’s Sports Entertainment Package. It adds an extra $57.45 a month on top of the $69.95 Digital Starter package. That is $127.40 a month just for television service.

For those who want even more, Comcast offers Digital Premier, with more than 190 channels. This package includes Digital Preferred, HBO, Showtime, Starz, Cinemax and Comcast’s Sports Entertainment Package. It adds an extra $57.45 a month on top of the $69.95 Digital Starter package. That is $127.40 a month just for television service. Comcast does offer faster Internet service than what Time Warner Cable has sold for the last 3-4 years, but it will likely come with a usage cap of 300GB per month, with overlimit fees applied to those who exceed their allowance. Internet-only customers are going to find higher prices for broadband service than what Time Warner Cable charges. Comcast prefers bundled service customers, and deters cord-cutters with extremely high Internet-only pricing.

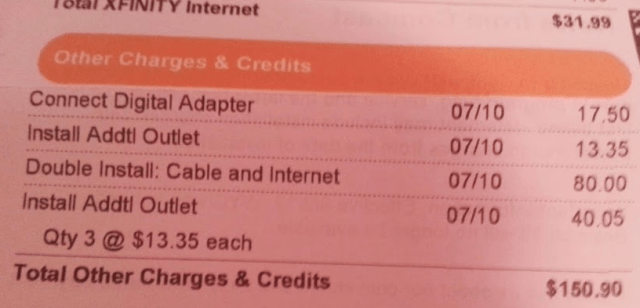

Comcast does offer faster Internet service than what Time Warner Cable has sold for the last 3-4 years, but it will likely come with a usage cap of 300GB per month, with overlimit fees applied to those who exceed their allowance. Internet-only customers are going to find higher prices for broadband service than what Time Warner Cable charges. Comcast prefers bundled service customers, and deters cord-cutters with extremely high Internet-only pricing. Comcast charges a number of extra fees and surcharges that raise customer bills without affecting Comcast’s advertised prices. The ones we have not already covered are included below. Among our favorites: Comcast charging $20 to hound you at your front door for a past due payment, charging shipping/handling and other fees for “self-install” kits that save Comcast money not having to dispatch a technician to your home, installation -and- activation fees for extra outlets, and that $249 “go away” service charge for their 105Mbps broadband tier. It is important to note not everyone will pay these fees and promotions often waive some of them. Customer service representatives will also drop some of them when asked, and may remove them from your bill if you complain loudly enough.

Comcast charges a number of extra fees and surcharges that raise customer bills without affecting Comcast’s advertised prices. The ones we have not already covered are included below. Among our favorites: Comcast charging $20 to hound you at your front door for a past due payment, charging shipping/handling and other fees for “self-install” kits that save Comcast money not having to dispatch a technician to your home, installation -and- activation fees for extra outlets, and that $249 “go away” service charge for their 105Mbps broadband tier. It is important to note not everyone will pay these fees and promotions often waive some of them. Customer service representatives will also drop some of them when asked, and may remove them from your bill if you complain loudly enough. Voice/Data Modem (Used for customers with phone and Internet service): $8/mo²

Voice/Data Modem (Used for customers with phone and Internet service): $8/mo² Upgrade Standard Definition DVR or HD DVR Service: $26.30

Upgrade Standard Definition DVR or HD DVR Service: $26.30 AT&T wants customers to pay attention to their broadband account’s monthly usage limits: 150GB for DSL or 250GB for U-verse. Customers who exceed their allowance are more likely than ever to get a warning letter from AT&T threatening overlimit fees if they continue to ‘use too much’ Internet.

AT&T wants customers to pay attention to their broadband account’s monthly usage limits: 150GB for DSL or 250GB for U-verse. Customers who exceed their allowance are more likely than ever to get a warning letter from AT&T threatening overlimit fees if they continue to ‘use too much’ Internet.

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”;

Marwan Fawaz: Spent a year in a leadership role at Motorola Mobility/Motorola Home Division. He has the distinction of serving as an executive at two bankrupt cable operators: Charter Communications and Adelphia. Charter eventually emerged from bankruptcy, Adelphia did not and two members of its founding family are spending 15 years in the Allenwood federal prison, convicted of wire and securities fraud. Charter’s press release says Fawaz would be a valued addition to the board because he has “a deep understanding of the cable television industry”; “If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.

“If Time Warner Cable management refuses to negotiate on reasonable terms, we believe Charter will likely secure the votes required to win a proxy fight,” said Jonathan Chaplin, a research analyst with New Street Telco.