Several staff members working for the Washington Utilities and Transportation Commission (WUTC), the regulatory agency reviewing the proposed Frontier purchase of Verizon territories in Washington state, have reversed their opposition to the Frontier-Verizon deal because of concessions they believe will better serve consumers impacted by the deal. But the provisions don’t come close to protecting consumer rights and do not sufficiently protect local telephone and broadband service.

Several staff members working for the Washington Utilities and Transportation Commission (WUTC), the regulatory agency reviewing the proposed Frontier purchase of Verizon territories in Washington state, have reversed their opposition to the Frontier-Verizon deal because of concessions they believe will better serve consumers impacted by the deal. But the provisions don’t come close to protecting consumer rights and do not sufficiently protect local telephone and broadband service.

The WUTC must be told that broadband expansion from a service provider that insists on a 5 gigabyte usage limit in its Acceptable Use Policy makes such expansion barely worth the effort. The WUTC must insist on a permanent exemption from any usage limits for Washington state consumers, especially because many may find Frontier DSL to be their only broadband option for years to come. To allow a company with such a paltry limit to be the monopoly provider of broadband puts Washington residents and small businesses at a serious economic disadvantage in the digital economy.

Would you choose to reside or locate your business in a community with one broadband provider offering a limit so low, your broadband usage will be limited to web page browsing and e-mail?

High Speed Internet Access Service

Customers may not resell High Speed Internet Access Service (“Service”) without a legal and written agency agreement with Frontier. Customers may not retransmit the Service or make the Service available to anyone outside the premises (i.e., wi-fi or other methods of networking). Customers may not use the Service to host any type of commercial server. Customers must comply with all Frontier network, bandwidth, data storage and usage limitations. Frontier may suspend, terminate or apply additional charges to the Service if such usage exceeds a reasonable amount of usage. A reasonable amount of usage is defined as 5GB combined upload and download consumption during the course of a 30-day billing period. The Company has made no decision about potential charges for monthly usage in excess of 5GB.

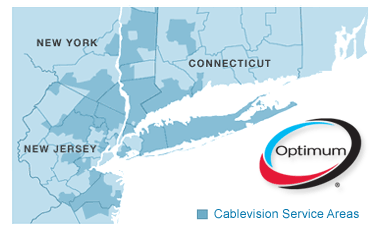

Frontier will be a part of the lives of almost 500,000 state residents, including those in Wenatchee and other parts of North Central Washington. That covers a lot of rural residents with no hope of cable competition or other broadband options. Verizon is the second-largest local telephone service provider in Washington, serving cities such as Redmond, Kirkland, Everett, Bothell, Woodinville, Kennewick, Pullman, Chelan, Richland, Naches, Westport, Lynden, Anacortes, Mount Vernon, Newport, Oakesdale, Republic and Camas-Washougal. Currently, Verizon has approximately 1,300 employees in Washington, who would be transferred to Frontier once the deal is complete.

Frontier’s concessions don’t come close to assuring residents they can get the kind of broadband service they need in the 21st century, especially from a company that could easily find itself swamped in debt. Let’s look at what Frontier has offered:

- Invest $40 million to expand high-speed Internet access in Washington.

- Submit quarterly financial reports to identify merger savings.

- Branding and transition costs to be paid by stockholders, not ratepayers.

- Increase financial incentives to prevent a decline in service quality.

- Adopt Verizon’s existing rates and contracts for at least three years.

Frontier would also be required to pay residential customers $35 for missed service repairs or installation appointments. That’s $10 more than Verizon now pays. Current Verizon customers would also have 90 days after the transition to choose another provider without incurring a $5 switching fee. Low-income customers who qualify through the Washington Telephone Assistance Program will also receive a one-time $75 credit if the company fails to offer appropriate discounts or deposit waivers.

Our take:

- Investing $40 million in low speed DSL service with a 5GB usage allowance saddles residents with yesterday’s technology with a usage allowance that rations the Internet.

- Customers don’t care about merger cost reductions because they’ll never enjoy those savings, but they’ll feel their impact if they include layoffs and reduction in investment.

- Consumers will be more concerned about what happens to their phone and broadband service when the “transition” results in service and billing problems. Will stockholders pay inconvenienced customers?

- Vague promises of increased financial incentives for a company to do… its job, without declines in service quality, exposes just how unnecessary this deal is. Why not offer incentives for Verizon to stay?

- Freezing rates for three years doesn’t prevent massive increases to make up the difference in year four and beyond.

The WUTC staff had it right the first time when it opposed the deal. A healthy, financially secure Verizon is still a better deal than a smaller independent company saddled with debt. Frontier seals the fate of Washington state residents from the benefits of fiber optics wired to the home, delivering high speed broadband for the future because Frontier doesn’t do fiber to the home on its own. With a tiny usage allowance, just waiting for the company to decide to enforce it means you won’t be using your broadband account too much anyway.

The WUTC is accepting comments and you need to start calling and writing. Make sure to tell the Commission it must secure a permanent exemption for Washington from any Internet Overcharging schemes like consumption/usage-based Internet billing and any usage limits Frontier defines in its Acceptable Use Policy. Better yet, tell them Frontier’s concessions don’t come close to making you feel good about Verizon turning over your phone service to a company that is traveling the same road three other companies took all the way to bankruptcy.

Customers who would like to comment on the provisions can call toll-free: (888) 333-9882 or send e-mail to [email protected]. The deadline for comments is January 10th.

Subscribe

Subscribe