Charter Communications late Wednesday filed a remarkable 66-page circumlocutory rebuttal refuting charges from New York State Public Service Commission Chairman John Rhodes that the cable company was in breach of its agreement to expand rural broadband as part of the state’s approval of the Charter-Time Warner Cable merger.

Charter Communications late Wednesday filed a remarkable 66-page circumlocutory rebuttal refuting charges from New York State Public Service Commission Chairman John Rhodes that the cable company was in breach of its agreement to expand rural broadband as part of the state’s approval of the Charter-Time Warner Cable merger.

At issue is one paragraph in the Merger Order approving the transaction that included rural broadband expansion as a required public benefit (emphasis ours):

In order to ensure the expansion of service to customers in less densely populated and/or line extension areas within the combined company’s footprint, the Commission will require New Charter to extend its network to pass, within its statewide service territory, an additional 145,000 “unserved” … and “underserved” … residential housing units and/or businesses within four years of the close of the transaction.

Charter has repeatedly failed to meet that requirement, despite an agreement with the state to divide it up into a series of six month benchmarks — each representing 20,000 homes and businesses. Charter has been given until 2020 to complete the required new passings. Despite those agreements, the state now accuses Charter of trying to cheat by claiming unqualified addresses as part of its expansion commitment. Among them, Charter claimed more than 12,000 homes and businesses in the New York City metropolitan area, the densest and most wired city in the state, as part of its expansion to the unserved and underserved. As a result, the New York Public Service Commission disqualified those urban addresses, demanded Charter show cause why it wasn’t in breach of its agreement, and regulators are seeking a $1 million fine and the possible revocation of Charter’s cable franchise in New York City.

Charter’s lengthy defense explaining why it has failed to meet its targets and counts allegedly unqualified addresses in its rural broadband expansion effort relies on unilaterally reinterpreting the original agreement the cable company signed with the state and assigning blame to others for delays in rolling out service improvements faster. It is also accusing the state of what Charter appears to be doing itself — changing the terms of the Merger Order almost two years after it was signed.

Much of Charter’s response comes with considerable eyebrow-raising hubris, telling the Commission New York should be pleased with Charter’s compliance with the Merger Order thus far, noting the only thing enforcing it is Charter’s goodwill. The company’s lawyers even label one section of their rebuttal: “The Expansion Condition Derives Its Legal Force, if any, from Charter’s Agreement to it.” That is a lawyer’s way of telling the state regulator it should be grateful Charter is doing anything at all after its merger deal was approved:

The Commission does not have the authority to compel broadband providers to offer service to particular customers at particular speeds or at particular locations, or to establish any other obligations in a cable television and telecommunications service merger related to the provision of broadband services. Indeed, it has been established for years that Internet access services are interstate, and accordingly subject to exclusive federal jurisdiction. The FCC has made abundantly clear that states may not impose “any so-called ‘economic’ or ‘public utility-type’ regulation[]” on broadband services and that federal law flatly preempts such requirements. Requiring a provider to expand the geographical range in which it offers broadband services and to offer it at specific speeds—as the Expansion Condition does—is a quintessential public utility obligation that could never lawfully be imposed by a state, as such a requirement would blatantly violate federal law.

Well, shuck my corn. New Yorkers should send Charter a bouquet and thank you card for delivering the public interest benefits it was ordered to provide in return for the right to make billions in revenue from tens of millions of New York customers.

Rural broadband challenges

One might think that with Charter’s confident declaration that it is no longer legally answerable to the deal conditions reflecting broadband speed, upgrades, rates, and rural service once the Merger Order was approved, Charter’s attorneys could call it a day and conclude their case. Instead, the legal team issued 65 more pages of legal theories and unilateral interpretations and declarations that conjure every available argument, even some that contradict each other. For example, Charter’s legal team insists on a plain language interpretation of the agreement in some places and a very strict legal interpretation in others that basically boils down to, ‘if it isn’t exactly specified in the contract, it’s not a part of the contract.’ Charter insists on using “industry accepted” practices that are not specified in the Merger Order that the Commission has not agreed to, while criticizing the Commission for interpreting its rural broadband expansion effort as applying to “rural” customers only, which Charter says it never agreed to.

Because no one should have to wade through Charter’s kitchen sink defense, we have broken down the most relevant excuses defenses explaining, for example, why Charter should be able to count a converted loft in a busy Queens neighborhood as “underserved” and multi-million dollar condos on Kent Avenue in Williamsburg (Brooklyn) as “unserved” no longer, thanks to Spectrum’s rural broadband expansion commitment. We will also share Charter’s creative interpretation of the Merger Order itself and the house of cards it constructs around it, and why Charter believes it is manifestly unfair to conduct independent surprise compliance audits without notifying Charter of those audits well in advance. Then we will share Charter’s theory about why it feels suddenly picked on by state regulators.

The Debate Over Unserved vs. Rural Broadband Expansions

The majority of Charter’s rebuttal is devoted to an all-out defense of the company’s decision to include service expansions in less costly to serve urban and suburban areas, including more than 12,000 New York City addresses. It probably needs to, because the company is facing a $1 million fine for allegedly not complying (again) with its agreed-on schedule to expand service to 145,000 unserved/underserved New Yorkers.

That Charter would attempt to count as many new passings towards its broadband expansion commitment as possible was hardly unexpected. Stop the Cap! warned the Public Service Commission and the Federal Communications Commission in its recommended deal conditions and follow-up remarks that great care must be taken when describing or defining new broadband rollout commitments. In prior mergers, regulators who did not precisely specify the nature of those expansions offered providers an easy loophole to count new passings a company would construct in the normal course of business. If a state did not specify the expansion program should exclusively target customers bypassed by cable service because they are unprofitable to serve, companies cherry-picked the low hanging fruit of new housing developments, new apartment buildings and businesses or manufacturing parks to fulfill its obligations. The reason is simple: those urban and suburban buildouts are much cheaper than wiring low density rural areas — the places broadband forgot.

Charter Communications readily agreed to the terms offered by the state to approve the merger transaction, which not only included specific conditions to deliver pro-consumer deal benefits to New York customers, but also an exhaustive explanation defining and discussing the issues the agreement was written to address. On the important issue of rural broadband expansion, the Public Service Commission was quite clear:

Too many regions of the State continue to suffer from out-dated or non-existent cable service. By requiring the Petitioners (and by extension New Charter) to build-out their network to pass an additional 145,000 “unserved” (download speeds of 0-24.9 Megabits per second (Mbps)) and “underserved” (download speeds of 25-99.9 Mbps) residential housing units and/or businesses within four years of the closing of the transaction – with annual milestones and exclusive of any available State grant monies from the Broadband 4 All Program – we will be well on our way to ensuring that all New Yorkers, regardless of location, have access to essential broadband offerings.

Also:

The Commission must also consider that, in today’s market, many New Yorkers lack adequate access to communication choices and that the public interest is not well served if we approve this merger without addressing that deficit.

The Commission also recognizes that many residential and business customers in rural areas of the State lack access to such services at speeds or levels that provide real value from the competitive communications market. Therefore, just as in the case of affordability, the public interest inquiry necessarily requires an assessment on how the transaction will harm or benefit the State’s interest in rural and business customer broadband expansion.

The Petitioners must also show how the transaction will facilitate increased access to their network for rural New Yorkers and business customers who today do not have the full value of a competitive market.

Gov. Andrew Cuomo announcing rural broadband initiatives in New York.

A full read of the Merger Order shows the PSC repeatedly sought deal conditions to ameliorate the state’s pervasive rural broadband availability problem. It said nothing about wiring up neighborhood revitalization projects in the middle of the Bronx — a dense urban area that Charter would seek to reach with or without this merger agreement. To emphasize that point even further, the Commission defined pro-consumer deal benefits/merger conditions that would deliver services Charter was unlikely to provide otherwise, helping to fulfill the Cuomo Administration’s public policy objective of ubiquitous broadband:

Any assessment of the benefits should also be reduced to the extent the actions producing those benefits could or would have occurred even in the absence of the proposed transaction.

Also:

The determination and evaluation of public benefit must be undertaken in the context of existing public policy objectives and the realities of the telecommunications and cable television marketplaces.

In New York, Gov. Andrew Cuomo’s Broadband for All program is well-known, especially by Charter and Time Warner Cable, which are both participants. The terms and objectives were clear and obvious, and required Charter to coordinate its expansion plans with the N.Y. Broadband Program Office to guarantee that state and federal tax dollars would not be spent duplicating Charter’s efforts to reach those rural residents and businesses. The reality of the telecommunications marketplace is clear: companies will not expand to deliver rural broadband service in areas that fail Return On Investment (ROI) tests without a government subsidy or a merger deal-related mandate. Consumers understand this when they call to request service and are quoted tens of thousands of dollars in installation costs to extend service in rural areas.

For the purpose of the Merger Order, the PSC carefully defined the kind of “line extension” the rural broadband expansion requirement was designed to target:

Under 16 NYCRR §895.5, a line extension area is defined, in part, as areas beyond the franchisees primary service area and may require a CIAC [a line extension fee paid by the prospective subscriber] before service is provided.

In its approval order, the PSC also references this critical point that would foreshadow how the Commission would look upon Charter’s attempt to count New York City expansion projects towards its 145,000 new passings commitment (emphasis ours):

If the build-out opportunities in New York State are primarily building down to density levels already specified in franchise agreements, then it is the franchise terms, not the merger, that would require those line extensions.

If that wasn’t enough to discourage Charter from attempting that counting trick, the PSC also included on-point language in the Merger Order’s “Appendix A” — a bullet point short form list of requirements the company had to agree to follow, regarding the nature of the locations Charter was directed to deliver expanded or new service (underlining ours):

New Charter is required to extend its network to pass, within their statewide service territory, an additional 145,000 “unserved” (download speeds of 0-24.9 Mbps) and “underserved” (download speeds of 25-99.9 Mbps) residential housing units and/or businesses within four years of the close of the transaction, exclusive of any available State grant monies pursuant to the Broadband 4 All Program or other applicable State grant programs. If at any time during this four-year period, New Charter is able to demonstrate that there are fewer than 145,000 premises unserved and underserved as defined above, New Charter may petition the Commission for relief of any of the remaining obligation under this condition.

What makes this section important is that the PSC specifically mentions the Broadband for All grant program, which is designed to award state money to rural broadband projects. Unsurprisingly, there were no grant applicants seeking money to fund broadband expansion to million dollar condo owners in New York City or a converted manufacturing plant turned into modern apartments on Niagara Street in downtown Buffalo — both counted as new unserved passings by Charter.

What makes this section important is that the PSC specifically mentions the Broadband for All grant program, which is designed to award state money to rural broadband projects. Unsurprisingly, there were no grant applicants seeking money to fund broadband expansion to million dollar condo owners in New York City or a converted manufacturing plant turned into modern apartments on Niagara Street in downtown Buffalo — both counted as new unserved passings by Charter.

Despite the exhaustive evidence to the contrary, the principal argument made by Charter’s lawyers is there is no specific prohibition against counting urban “new passings” (expansions) towards the 145,000 unserved/underserved residential housing units or businesses called for in the Merger Order. Charter’s defense attempts to bait and switch the PSC, first by working with state officials to exhaustively identify an adequate number of rural areas where broadband service is desperately needed, then suddenly counting wealthy condo owners in Brooklyn, new housing developments in Albany, and various business parks Charter was likely to wire for service anyway as evidence Charter was meeting its expansion targets.

See if you can follow their logic, especially the sentence we underlined at the end:

The text of the Merger Order is unambiguous: expanding coverage to low density areas is a reason explaining why the Commission adopted the Expansion Condition, not an element of the Expansion Condition. The requirement is to extend Charter’s network to pass an additional 145,000 homes and businesses within Charter’s “statewide service territory.” Id. The Commission’s statement that it is adopting the condition “in order to ensure the expansion of service to customers in less densely populated and/or line extension areas” is prefatory language explaining its reasoning. Id. (emphasis added). And as an explanation of the Commission’s reasoning for adopting the Expansion Condition, this makes perfect sense: densely populated areas are more likely to be served already, and thus contain fewer locations that would be candidates for further network expansion. But nothing in the Merger Order requires that every additional address to which Charter extends its network must be in “less densely populated and/or line extension areas” or precludes Charter from reporting addresses that are not.

Even if the Merger Order could somehow be construed, as the Expansion Show Cause Order does, as limiting the Expansion Condition exclusively to “less densely populated and/or line extension areas” (which it cannot), the Merger Order’s Appendix A, which sets forth the actual text of the Expansion Condition, contains no such requirement, requiring only that the “residential housing units and/or businesses” be “unserved” or “underserved,” not that they also be located in low-density areas. See Merger Order, App’x A, § I.B.1. Accordingly, even though there is no conflict as between the body of the Merger Order and Appendix A, Appendix A would control in the event of any such conflict. It is Appendix A that Charter explicitly accepted, and it is Appendix A that contains the specific text of the requirements with which Charter is ordered to comply.

Now hold on a moment. For the first time we’ve seen, Charter has declared it only explicitly accepted an appendix in the Merger Order, therefore the company seems to argue it can ignore everything else in the Order. This passage found just before Appendix A begins may explain why (emphasis ours):

[…] We conclude that with the conditions we are adopting (set forth here and in Appendix A), the merger will bring approximately $435 million in incremental net benefits (plus other unquantified benefits) to TWC and Charter customers and result in approximately $655 million in network modernization investment commitments. With the acceptance by the Petitioners of these enforceable and concrete incremental benefits, we conclude, as a whole, that the proposed transaction would meet the positive benefit test for New Yorkers and should be approved.

Charter counted The Crescendo, a former manufacturing facility turned into upscale apartments and lofts located in downtown Buffalo, as “newly passed” as part of the rural broadband expansion conditions required in the order granting the merger of Charter and Time Warner Cable. (Image courtesy: Buffalo Rising)

In what Charter’s lawyers must believe to be a clever move, the company expects its unilateral declaration to be recognized by the Commission, despite the fact the Commission clearly stated in the same Merger Order the merger’s approval required Charter’s consent of both the Order and the Appendix. The company’s lawyers clearly understand what the Commission wrote because they separately have raised a fuss in an accompanying declaration, claiming the Order’s language compelling rural broadband expansion could have derailed the merger in New York.

Ignore the Parts You Don’t Like

Adam Falk, Charter’s senior vice president of state government affairs signed a declaration submitted with Charter’s response to the PSC alleging the PSC’s then-General Counsel gave Charter the impression the Commission’s interpretation of “unserved” and “underserved” meant simple availability of broadband service at speeds of at least 25 Mbps for unserved and below 100 Mbps for underserved:

“After the Commission released the Merger Order, Charter evaluated whether it would accept its conditions or pursue some other response, such as seeking judicial review of the conditions or declining to accept the conditions and seeking to restructure its transaction with Time Warner Cable in a manner that would not require the Commission’s approval,” wrote Falk. “In Charter’s evaluation of whether to accept the Merger Order’s conditions, it was of significant importance to Charter that the Expansion Condition set forth in Appendix A of the Merger Order had been drafted in a manner that gave Charter some flexibility as to how it would be able to meet the condition.”

Falk added, “Had Appendix A contained [a] geographical limitation on the Expansion Condition, the presence of such a limitation would have been a material factor in Charter’s evaluation of whether to accept the Merger Order’s conditions. Before Charter formally accepted the conditions in Appendix A, a Charter consultant, acting at my direction, made an inquiry to Department Staff (specifically the Department’s and Commission’s then-General Counsel) regarding the presence within the body of the Merger Order of language referencing low-density areas, given the absence in Appendix A of any geographical limitation [….]

Where are these witnesses?

Falk claims the consultant and a member of Charter’s outside counsel were pointed by the PSC’s General Counsel to a reassuring legal precedent that signaled the Commission was allegedly prepared to accept only Appendix A was controlling, and Charter could effectively ignore everything else in the order granting the merger’s approval.

This would appear to be a surprising series of events, especially considering the PSC’s recent aggressive “show cause” order threatening Charter with fines and franchise revocation for not complying with its original interpretation of the Merger Order, which is miles apart from Falk’s claims of a mysterious ex-General Counsel and an unnamed consultant. Charter’s legal team relies on hearsay representations from unnamed people. The declaration itself raises a number of questions:

- Where are these people now?

- What do they say?

- Why would a multi-billion dollar corporation rely on verbal assurances alone with respect to what Mr. Falk claims to be a material matter serious enough to potentially derail the merger in New York State?

- If the ex-Counsel’s advice was given as Mr. Falk represents, why would the PSC suddenly pursue a very different interpretation of the Merger Order (the one it has consistently sought to enforce since the merger approval was written), and does that ex-Counsel have ultimate authority over how the merger agreement should be interpreted? We suspect not.

Disqualified Addresses

We know you are exhausted by now, so just a few more important points to consider (there were many more, but we suspect nobody would bother to read them all).

This newly constructed Brooklyn loft, worth more than $6 million, is now wired for cable service and counted among the “newly passed” addresses Charter wants credit for as part of its merger commitments. Does anyone believe the new owners would ever have a problem getting cable service?

Charter reacted with strong disappointment over the state’s decision to invalidate thousands of the company’s submitted addresses as evidence it was meeting its unserved/underserved merger-related commitments. The company’s lawyers used some novel arguments to rebut the state’s contention Charter was fudging the numbers:

- Charter introduced its own concept of “well understood” metrics it claims are used by the broadband industry to define when a household or business is “passed” by a provider’s network. But there is no evidence of a meeting of the minds on this point, and Charter unilaterally declares it is the appropriate standard to follow, while also conceding the PSC did not specifically agree to those metrics.

- Charter relies on Verizon-like logic to explain away its inability to meet its own buildout requirements. In New York City, regulators have rolled their eyes at the excuses Verizon gives to explain why it is years behind on its commitment to provide FiOS city-wide. Like Verizon, Charter seems to claim the mere presence of a wire down a street that is “capable” of furnishing service (whether the company actually ever does or not) is adequate enough to prove that street to be “served” if it can be installed in 7-14 days and without ‘unreasonable’ expense. Shouldn’t the definition of served include a real customer that can actually order and receive service?

- Charter argued with what it claims is the state’s contention that all of New York City already has access to 100 Mbps broadband service, and as a result those locations cannot be counted as unserved/underserved broadband expansion. It hopes people will ignore the more relevant and appropriate question — whether existing franchise agreements signed by Charter and Verizon compel both companies to offer 100 Mbps service on request in those areas (while also raising uncomfortable questions about why those companies are failing to meet their existing obligations). If this is the case, those areas would have been serviced because of the city’s franchise agreements, not as a result of the merger agreement.

- The Commission’s undercover on-site audits of many of the claimed upstate passings were rejected because of ‘misunderstandings’ about the state of Charter’s network in many of those areas. Charter’s lawyers criticized the PSC for not giving the company advance notice of the unannounced independent audit so that those ‘misunderstandings’ could have been clarified before the cable company was embarrassed by accusations it was cheating.

- New York’s PSC has no legal authority to exclude New York City addresses from the broadband expansion program, at least according to Charter’s lawyers.

A review of the list of recently excluded addresses reveal many are in urban or suburban areas where new apartment complexes, condos, planned communities or commercial buildings have been built or renovated. Virtually all of them are within existing franchise areas and also seem well within Charter’s ROI requirements. Charter will effectively diminish the rural broadband expansion deal condition if allowed to fill up spaces with non-rural properties that effectively cut the extra deal benefits the PSC required Charter to share with New Yorkers to win approval of its merger.

One last point. Charter seems to be quite proud of their “Robust Quality Assurance Process,” to avoid duplicating existing service addresses or claim new passings in areas where other providers already offer 100 Mbps service. Yet the company concedes itself it has repeatedly withdrawn ineligible addresses when the state notifies them their ‘robust process’ has failed Charter once again. Part of that process relies on the FCC’s provider-volunteered broadband availability reports — the same ones that will suggest virtually every American has 3-6 competing broadband providers — mostly those that don’t actually exist as viable options for various reasons. Charter seems to recognize this, and claims its ‘quality assurance’ process relies on confirming what services are actually available in those neighborhoods. The lawyers do not include statistics about how many people actually open their doors or stay on the line with a cable company representative who wants to talk about their broadband options long enough to actually obtain that data.

The Unions Are Behind It

Just in case every other argument offered by Charter’s lawyers fails, there are always conspiracy theories to try. Charter hints that the unions and a labor dispute (actually a strike that has lasted more than 400 days) are responsible for the PSC’s sudden interest in holding Charter’s feet to the fire. With no evidence to offer, Charter warns the state not to bring pressure on the company to resolve its labor disputes:

The Commission is well aware that Charter is currently engaged in a labor dispute in New York City that has been the subject of considerable political attention and attracted significant interest from New York State and City officials, as well as from the Commission itself. In the course of that labor dispute, representatives of the striking employees have repeatedly threatened that New York State government entities will take adverse, unrelated regulatory actions against Charter if the labor dispute is not resolved to the union’s satisfaction—implying that the union believes it has the ability to influence the actions of certain public officials and may try to use that influence. […] In the months since Charter’s labor dispute reached an impasse, Charter has become the target of numerous proposed adverse regulatory actions, including the Expansion Show Cause Order, the NYC Franchise Order, an order initiating a “management and operations audit” of one of Charter’s telephone affiliates that referenced and was predicated specifically upon Charter’s labor dispute, and two orders proposing to publicly reveal confidential network and service information that Charter had been reporting to the Commission for years without objection or incident. The sudden focus of these enforcement efforts on Charter, the procedural irregularities of the Commissions orders, and the lack of any serious evidentiary foundation for the charges could lead reasonable observers to question whether they are animated by additional purposes unrelated to the Commission’s legitimate oversight responsibility, especially in light of public statements by public officials. Any effort by the Commission to initiate proceedings to pressure Charter to resolve its labor disputes would violate both state law and federal labor law. Charter is committed to demonstrating its compliance with the Expansion Condition within the four corners of the Merger Order itself, but reserves all rights with respect to these efforts.

Charter Spectrum strikers in the New York City area have been out for more than a year. (Image courtesy: Brooklyn Daily Eagle)

Yes, it could be all that, or perhaps state officials are exasperated that a multi-billion dollar company might not be living up to its commitments and now could be playing fast and loose with a vitally important rural broadband expansion initiative.

This is but a taste of the temerity of Charter’s attorneys. We could have mentioned the parts where they blame the weather for service expansion problems, why once the deal is done the state really has almost no power to compel the company to meet its obligations, why the PSC was unfair not giving Charter several months advance notice of invalidated addresses so it could correct deficiencies somehow missed by the company’s fabulous Robust Quality Assurance Process, why the company seems to treat the PSC’s estimate that it will cost an average of $2,000 to wire rural unserved homes as a requirement — one that can only be successfully achieved by counterbalancing cheap installations in New York City against costly projects to wire a dairy farm in Cohocton, and finally why it is really “complicated” to wire multi-dwelling units in New York City but that remains preferable to dealing with angry farmers in upstate New York stuck with no broadband service at all.

Charter has an easy way to avoid all of this unpleasantness. Charter must fulfill the terms of the Merger Order it agreed to, and must be penalized and sanctioned for its prior failures. We’ve already recommended sanctions that would assign any fines collected by the Commission to be spent on additional broadband expansion to reduce the number of rural residents being stuck with satellite internet service instead of a wired provider. That will make a real difference in the lives of more than 70,000 New Yorkers stuck with a non-broadband solution.

Last week, AT&T announced its intention to abandon an appeal of a decision of the 9th Circuit Court of Appeals granting the Federal Trade Commission the right to continue its lawsuit against AT&T for speed throttling its “unlimited data” wireless customers.

Last week, AT&T announced its intention to abandon an appeal of a decision of the 9th Circuit Court of Appeals granting the Federal Trade Commission the right to continue its lawsuit against AT&T for speed throttling its “unlimited data” wireless customers.

While AT&T publicly expressed confidence about its appeal right up to the day it abandoned it, minutes from the Ninth Circuit trial scheduling and progress conferences reveal AT&T and the FTC were already privately talking with each other to avoid further litigation:

While AT&T publicly expressed confidence about its appeal right up to the day it abandoned it, minutes from the Ninth Circuit trial scheduling and progress conferences reveal AT&T and the FTC were already privately talking with each other to avoid further litigation:

Subscribe

Subscribe Charter Communications late Wednesday filed

Charter Communications late Wednesday filed

What makes this section important is that the PSC specifically mentions the Broadband for All grant program, which is designed to award state money to rural broadband projects. Unsurprisingly, there were no grant applicants seeking money to fund broadband expansion to million dollar condo owners in New York City or a converted manufacturing plant turned into modern apartments on Niagara Street in downtown Buffalo — both counted as new unserved passings by Charter.

What makes this section important is that the PSC specifically mentions the Broadband for All grant program, which is designed to award state money to rural broadband projects. Unsurprisingly, there were no grant applicants seeking money to fund broadband expansion to million dollar condo owners in New York City or a converted manufacturing plant turned into modern apartments on Niagara Street in downtown Buffalo — both counted as new unserved passings by Charter.

Despite rosy predictions from Sprint and T-Mobile executives that the two companies joining forces will result in plentiful competition, lower prices, and more advanced service, the results of prior mergers in the wireless industry over the last 20 years delivered increasing prices, reduced innovation, and a lower customer service experience instead.

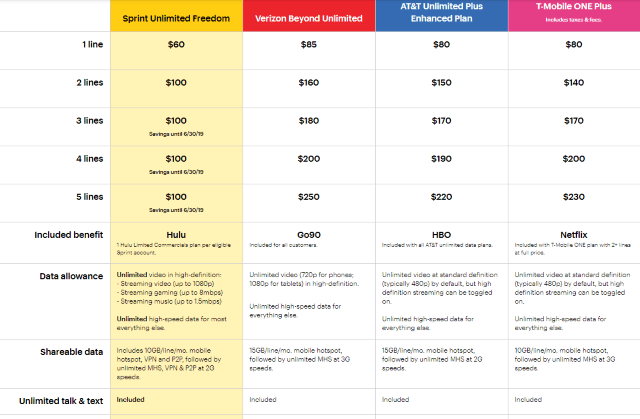

Despite rosy predictions from Sprint and T-Mobile executives that the two companies joining forces will result in plentiful competition, lower prices, and more advanced service, the results of prior mergers in the wireless industry over the last 20 years delivered increasing prices, reduced innovation, and a lower customer service experience instead. The two wireless industry giants initially ignored T-Mobile, suggesting CEO John Legere’s noisy and confrontational PR campaign had no material impact on AT&T and Verizon’s subscriber base and revenue. Ironically, Legere was named CEO one year after AT&T’s 2011 failed attempt to further consolidate the wireless industry with its acquisition of T-Mobile. A very generous deal breakup fee and accompanying wireless spectrum provided by AT&T after the deal collapsed gave T-Mobile some room to navigate and transform the company’s position — long the nation’s fourth largest national wireless carrier behind Sprint. It is now in third place, poaching customers from the other three, and has repeatedly forced other carriers to change their plans and pricing in response.

The two wireless industry giants initially ignored T-Mobile, suggesting CEO John Legere’s noisy and confrontational PR campaign had no material impact on AT&T and Verizon’s subscriber base and revenue. Ironically, Legere was named CEO one year after AT&T’s 2011 failed attempt to further consolidate the wireless industry with its acquisition of T-Mobile. A very generous deal breakup fee and accompanying wireless spectrum provided by AT&T after the deal collapsed gave T-Mobile some room to navigate and transform the company’s position — long the nation’s fourth largest national wireless carrier behind Sprint. It is now in third place, poaching customers from the other three, and has repeatedly forced other carriers to change their plans and pricing in response.

A 2016 study suggests Comcast may have more heavy users than it is willing to admit. The research firm iGR found average broadband usage that year was already at 190 GB and rising. There is no third-party verification of providers’ usage statistics or usage measurement tools, but there are public statements from Comcast officials that suggest the company faces a predictable upgrade cycle to deal with rising usage.

A 2016 study suggests Comcast may have more heavy users than it is willing to admit. The research firm iGR found average broadband usage that year was already at 190 GB and rising. There is no third-party verification of providers’ usage statistics or usage measurement tools, but there are public statements from Comcast officials that suggest the company faces a predictable upgrade cycle to deal with rising usage. The editorial and opinion page of The Washington Post has always been an uneven experience, especially when it comes to their views on the telecommunications business.

The editorial and opinion page of The Washington Post has always been an uneven experience, especially when it comes to their views on the telecommunications business.

Take Spectrum’s

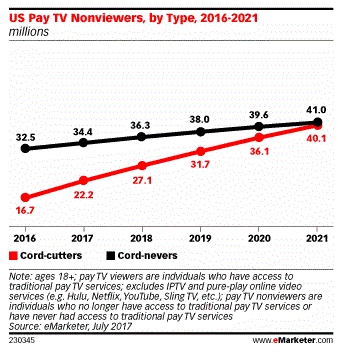

Take Spectrum’s  The cable industry itself rejects McArdle’s argument for the one-size-fits-all cable bundle. It is why companies have started to introduce slimmed down cable packages and sell new packages of over the top streaming cable TV channels to their broadband-only customers. The costs to deliver and support the broadband services cable companies now love to offer have been declining for years, even as rates increase. Ms. McArdle is obviously also unaware of the industry’s push to launch more self-service options for customers to cut down support calls and dramatically reduce the number of truck rolls to customer homes. She may also not realize the impetus to raise prices comes not out of necessity, but from Wall Street and investors’ revenue expectations.

The cable industry itself rejects McArdle’s argument for the one-size-fits-all cable bundle. It is why companies have started to introduce slimmed down cable packages and sell new packages of over the top streaming cable TV channels to their broadband-only customers. The costs to deliver and support the broadband services cable companies now love to offer have been declining for years, even as rates increase. Ms. McArdle is obviously also unaware of the industry’s push to launch more self-service options for customers to cut down support calls and dramatically reduce the number of truck rolls to customer homes. She may also not realize the impetus to raise prices comes not out of necessity, but from Wall Street and investors’ revenue expectations.