Verizon Wireless unveiled their new “Share Everything” Plans this morning, claiming consumers wanted “simpler, easier-to-understand” plans that let them share their data plan across multiple devices:

But a closer examination of the plans, to be introduced June 28, shows many Verizon customers will face substantially higher cell phone bills if they choose one of Verizon’s newest plans. Perhaps more importantly, customers upgrading to a new subsidized phone/contract renewal on or after that date will be forced to forfeit any grandfathered unlimited data plans they still have with Verizon.

“It is an effort to move ARPU up,” Walt Piecyk, an analyst with BTIG LLC in New York told Bloomberg News, referring to average revenue per user, a measure of how much each customer spends each month.

Obviously acknowledging that customers are using fewer voice minutes and are increasingly finding ways around text messaging charges, Verizon’s new plans sell customers on the idea they can now talk and text as much as they want, but as far as data is concerned, customers will potentially pay much more for less service.

Obviously acknowledging that customers are using fewer voice minutes and are increasingly finding ways around text messaging charges, Verizon’s new plans sell customers on the idea they can now talk and text as much as they want, but as far as data is concerned, customers will potentially pay much more for less service.

Those light on talking and texting are most likely to be hit hardest by the new cell phone plans.

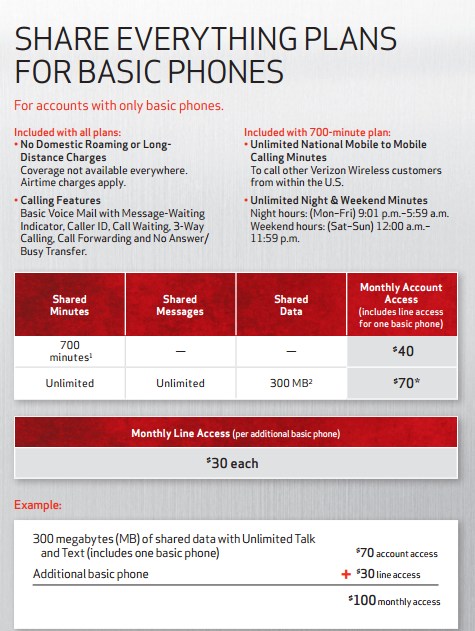

Verizon formerly charged $50 a month for a basic Nationwide Talk Share plan that included 700 shared voice minutes. Smartphone users also paid $29.99 a month for unlimited data. Together, that amounts to $80 a month. Under Verizon’s $40 “Share Everything” Plan, customers can talk and text all they want, but their unlimited data plan is gone, replaced with a 1GB basic plan for $50. That costs $10 more than customers used to pay on Verizon’s 700 minute plan with an unlimited use data plan. Need 2GB a month? Add an extra $10, bringing you a Verizon phone bill of at least $100 a month for the first line on your account, before taxes and fees.

Other family member lines may also be hit. Verizon used to charge $9.99 a month for extra lines on a shared account. The new price is $30 for a basic phone, $40 for a smartphone. Those family members with smartphones on an older Verizon account each would also incur $29.99 a month for their own individual data plan, which was also unlimited.

Although the base fee for the additional line with a data plan still remains around $40 a month, family members will be forced to share the primary line’s data bucket. Customers will quickly find a 1GB data plan is not going to last long on an account with two or three smartphones. That means expensive upgrades, which start at $10/GB.

Accounts with a mix of smartphones and basic phones face an even stiffer price hike. The $9.99 a month customers used to pay for a basic phone for grandma will now run $30 a month. She won’t be talking or texting much, so the extra features built into Verizon’s new plan will represent a pointless $20 monthly rate increase and an invitation to set grandma up with her own prepaid cell phone instead.

Verizon’s new “Share Everything” concept clearly builds major profits into Verizon’s future:

- Customers are forced to pay for unlimited voice and texting services, even as those services lose popularity, costing Verizon little to nothing;

- Data customers are encouraged to add additional devices to their account, but as more data gets used, ongoing upgrades to your data plan at an increment of $10/GB or more will be required;

- Customers considering a new Apple iPhone or other smartphone will be forced to forfeit any existing unlimited data plan to upgrade, which guarantees future profits from customers consuming increasing amounts of data.

- Customers paying for expensive texting plans will save the cost of those add-ons;

- Talk time is now unlimited on most plans, putting an end to overages;

- Verizon’s Mobile Hotspot feature will now be turned on for all customers on the Share Everything plan (to encourage additional data usage no doubt), which will eliminate at least $20 a month for the feature under existing plans;

- Customers who own multiple wireless devices configured to work with Verizon, but only use them occasionally, will likely save sharing a single data plan instead of paying for one plan for each device.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Verizon Share Everything Plan 6-12-12.mp4[/flv]

Verizon’s introductory video for its new Share Everything plans. (1 minute)

Subscribe

Subscribe