Grab this bargain: Frontier’s website accidentally placed two different DSL packages on our order despite only requesting one. We didn’t ask for the phone line or satellite TV either, but there they are.

Frontier Communications is in the process of redesigning their website — a project long overdue in an age where customers can pre-qualify themselves for service and schedule installation from most cable operators without ever picking up the phone. If you also plan to improve the visual appeal and functionality of your website, you may need to seek the services of a memphis web design company. Make sure to hire a professional like this website design company who has years of experience in website development services.

But judging from some e-mail from Frontier employees working on the project, the forthcoming “upgrade” is about to make a bad situation much worse.

Frontier is the sixth largest phone company in the country with customers in 27 states, but they have never run a modern, well-functioning website. Frontier’s service pre-qualification tool has never worked properly in Rochester, N.Y., the largest city where Frontier provides service, and placing an order for service is fraught with confusion for customers who don’t speak telecom jargon.

Based on a reader tip, we tested the website this afternoon here at Stop the Cap! HQ.

Placing an order for DSL service is currently based on your street address, but the order process gives no indication if the company can actually provision service at the speeds requested.

As a customer journeys through a cumbersome 10-step order process, it becomes easy to be sidetracked with endless promotional tricks and traps in numbers I haven’t seen since last ordering a domain name from GoDaddy. The shopping cart also erroneously added two different broadband service packages on our order, despite only selecting one.

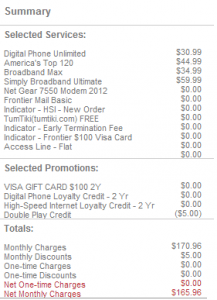

Step 1 offers murky promotions such as the impenetrable “Shop Promo VISA CD 100 2Y Challenger.” Promotions do not clearly disclose their terms up front. This one only discloses the two year service agreement with a steep early termination fee with the designation: “2Y.” Avoiding promotions still did wonders for our monthly bill, especially considering we were just looking for broadband service. We found Frontier quietly added a “digital unlimited phone” we could care less about for $30.99 a month, America’s Top 120 (presumably satellite TV we did not request) for $44.99 a month, Broadband Max (the slower DSL service we did not want) for $34.99 and Simply Broadband Ultimate (the service we did) for an extra $59.99. Our out the door price for what was supposed to be broadband-only service? A low, low $170 a month minus a $5 service loyalty credit for taking two services.

Step 2 piled on another $5 fee for satellite-delivered local channels for the satellite package we never asked for, but the duplicate broadband service was gone. Now we were stuck with the slower Broadband Max. Step 3 forced us to wade through more than a dozen phone feature packages for the phone line we don’t need. Step 4 sticker-shocked us with installation fees ranging from $50 for a self-install kit to $175 for a home installation of DSL and Wi-Fi. Those fees can be waived with a perpetually-renewing two year service contract (up to a $135 credit). At that point we had enough and bailed on the order.

This represents Frontier’s online shopping experience today. A Frontier employee who wishes to remain anonymous warns Stop the Cap! things could get much worse.

Our source tells us Frontier has outsourced much of the work on its forthcoming redesigned website to third party contractors who are now reportedly in over their heads, unaware that Frontier operates with a range of very different products and services depending on the service area. For them, one-size-fits-all seemed good enough:

[These contractors] don’t understand products or how those products interact with each other, yet they have been put in charge of creating the ability for customers to order them based on where they live. The company has current issues with their website in that they can’t figure out how to get the right products to display for a customer in Rochester, N.Y. vs. a customer in Fort Wayne, Ind. Instead, Frontier has products configured by region, then broken down by zip code, and then by the customer’s phone exchange.

Unfortunately, new customers don’t know what phone number they will be assigned and that leaves them unable to determine what products are actually available to them. The products offered should be based on the customer’s actual service address, but these contractors don’t appear to have the expertise to make that adjustment.

The shopping cart application has also proved a problem, according to our source. Internal testing of the new site’s functionality has proved distressing because components of the site are still being developed. Recent tests found customers could not correctly select products available in their area or the site could not properly apply them to the shopping cart (a problem we found ourselves using the live site available now).

The shopping cart application has also proved a problem, according to our source. Internal testing of the new site’s functionality has proved distressing because components of the site are still being developed. Recent tests found customers could not correctly select products available in their area or the site could not properly apply them to the shopping cart (a problem we found ourselves using the live site available now).

Our source tells us Frontier’s project manager is hell-bent on bringing the site up by Feb. 9, ready or not.

“We have brought up the fact that there are HUGE navigation issues that are completely not friendly to the customer,” says the employee. ” They are not concerned with any of those issues at the moment, just getting the product to launch. We have been told to manipulate the processes we are to use in order to be able to get any testing done.”

The whistleblower informs us customers are likely to have a range of problems using the new site if it launches in its current state:

- Customers will be able to place orders for products they can’t get;

- Customers will receive inaccurate information about the products and pricing;

- Customers will not be able to get any promotions that they can currently get on the existing Frontier.com application;

- Customers may not be correctly informed about installation charges or taxes, deposit requirements, credit validations, etc.

Frontier needs to take a lesson from some of their competitors that have greatly simplified the ordering process for consumers that can get quickly confused. Frontier should de-emphasize the tricks and traps from the many add-ons and service commitment agreements thrown at customers. Efforts to repeatedly up-sell customers on products and services should be managed separately, perhaps in a follow-up verification phone call where a customer service agent can handle any order changes required. With customers getting a choice between a cable, satellite, or a telco provider, those overwhelmed by one company’s website will simply find another provider.

In the meantime, those with questions or concerns about Frontier might do better just calling them directly at 1-800-921-8101.

Subscribe

Subscribe Time Warner Cable customers in southern California are bracing themselves for a rate increase that will

Time Warner Cable customers in southern California are bracing themselves for a rate increase that will  It is likely the latest rate increase does include the cost of the 2012 launch of Time Warner Cable SportsNet, which features the Los Angeles Lakers. Time Warner asks competing satellite and telephone company video services to pay between $4-5 a month to provide SportsNet to their customers.

It is likely the latest rate increase does include the cost of the 2012 launch of Time Warner Cable SportsNet, which features the Los Angeles Lakers. Time Warner asks competing satellite and telephone company video services to pay between $4-5 a month to provide SportsNet to their customers. Customers facing price increases can use the rate increase notification as the trigger to threaten to cancel service to win a lower price with a customer retention offer. Stop the Cap!

Customers facing price increases can use the rate increase notification as the trigger to threaten to cancel service to win a lower price with a customer retention offer. Stop the Cap!

The Digital Millennium Copyright Act strikes again.

The Digital Millennium Copyright Act strikes again. Verizon Wireless has been making a killing herding customers into its Family Share data plans.

Verizon Wireless has been making a killing herding customers into its Family Share data plans. Susan Crawford’s new book, “Captive Audience: The Telecom Industry and Monopoly Power in the New Gilded Age,” is on the receiving end of a lot of heat from industry lobbyists and those working for shadowy think tanks and “consumer groups.”

Susan Crawford’s new book, “Captive Audience: The Telecom Industry and Monopoly Power in the New Gilded Age,” is on the receiving end of a lot of heat from industry lobbyists and those working for shadowy think tanks and “consumer groups.”