Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans.

Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans.

Business Week reports that as carriers have dropped unlimited use data plans in favor of costly, restricted-usage offers, savvy customers have learned to conserve their data allowance by switching to Wi-Fi wherever possible. Adobe Systems reported this week that more than half of all wireless data traffic from smartphones occurs over Wi-Fi, not 3G or 4G networks. Total Wi-Fi traffic passed mobile data networks more than a year earlier.

AT&T and Verizon’s business plans depend on smartphone users accessing faster 4G LTE networks to consume high bandwidth online applications like video streaming, but that isn’t happening at the rate they expected. Instead, customers are waiting to connect to a Wi-Fi hotspot before watching.

The carriers are partly to blame for the Wi-Fi habit by encouraging customers to switch to Wi-Fi to reduce congestion on their 3G and 4G networks while they were upgraded and expanded. But after carriers completed those upgrades, customers are sticking with Wi-Fi.

“There’s a flavor of too much of a good thing here, where Wi-Fi offloads start to really impinge on the prospects of monetizing all that additional usage,” says industry analyst Craig Moffett. “All the carriers have put their eggs in the basket of incremental usage as the source of revenue growth. It isn’t going according to plan.”

AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi.

AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi.

‘As customers become more aware of the limits on their data plans, they’re more careful about moving to Wi-Fi as often as possible,’ says Tamara Gaffney, an analyst with Adobe’s Digital Index.

Wi-Fi hotspots are easier to find as cable companies provide them for their customers. Major shopping, dining and entertainment venues often offer free access to draw and keep customers.

As carriers began to realize smartphones would not be the data sucking vampires they were expecting, both AT&T and Verizon eagerly dove into the tablet business, hoping to convince customers to buy mobile-ready versions of the devices that would more likely be used for data allowance-killing online video.

But customers outsmarted them again, preferring tablets equipped only with Wi-Fi. Carriers responded by slashing prices, to no avail. Even those who splurged on 3G and 4G-ready tablets rarely use them on AT&T and Verizon’s wireless networks. More than 93% of tablet traffic is done over Wi-Fi, derailing a potential wireless data money train.

Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.

Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.

That hasn’t stopped AT&T, which won a lucrative contract to offer 4G LTE and/or HSPA+ support inside Audi and GM vehicles. To them, the “connected car” is a cash cow waiting to be milked.

“Five or six years ago when we talked to car OEMs, it was about safety and embedded modules and cheap rates,” said Glenn Lurie, CEO of AT&T Mobility.

That was the era of OnStar and other competing telematics systems that can monitor vehicle performance and notify emergency responders in the event of an accident. Verizon Wireless has supported GM’s OnStar system for years and until GM’s bankruptcy reorganization offered Verizon customers the option of adding their OnStar speakerphone to a Verizon Wireless family plan for $9.99 a month, sharing that plan’s voice calling minutes. Starting this year, AT&T has the contract.

AT&T is celebrating the end of cheap rates and see big dollar signs selling in-car connectivity, which will be available in dozens of car models.

Mary Chan from GM committed to offer AT&T 4G access on 33 GM model vehicles by the end of this year.

Customers will get a free sample of the service in promotions lasting from 30-90 days. After that, customers will need to pay:

- OnStar’s data plan (doesn’t include voice calling/emergency response) will cost $10 a month to add the car as a device on your AT&T Mobile Share plan and $10 a month for 200MB of data; $30 a month for 3GB of data, or $50 a month for 5GB;

- Applicable taxes and federal/state universal service charges, regulatory cost recovery charge (up to $1.25), gross receipts surcharge, administrative fees and other government assessments which are not taxes or government required charges are not included in the above-stated prices;

- A $5 day pass will be available for occasional users providing 250MB of access for up to 24 hours;

- All payments must be made in advance of receiving service and will be automatically renewed month-by-month until the customer cancels;

- The built-in Wi-Fi hotspot will support up to seven devices;

- Excessive roaming may result in service termination.

“The connected car will change the entire wireless industry,” said AT&T Mobility’s Ralph de la Vega. AT&T expects as many as 10 million connected cars will be signed up for service in just a few years.

But at AT&T’s prices, Moffett suspects the ingenuity of Silicon Valley and other entrepreneurs will eventually find a much cheaper solution, potentially robbing AT&T of yet another expected cash coup.

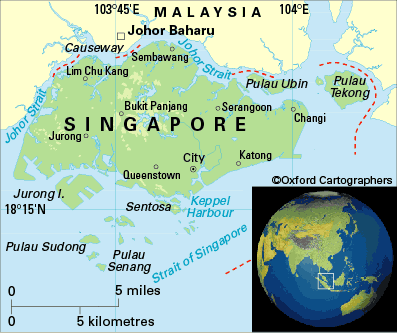

Three competing telephone companies in Singapore have launched an all-out price war on gigabit fiber to the home Internet access that shows what real competition can do for broadband pricing.

Three competing telephone companies in Singapore have launched an all-out price war on gigabit fiber to the home Internet access that shows what real competition can do for broadband pricing. Singapore’s largest phone company, SingTel, has its own unlimited gigabit offering for $55.13 a month, a price the company is now re-evaluating.

Singapore’s largest phone company, SingTel, has its own unlimited gigabit offering for $55.13 a month, a price the company is now re-evaluating.

Subscribe

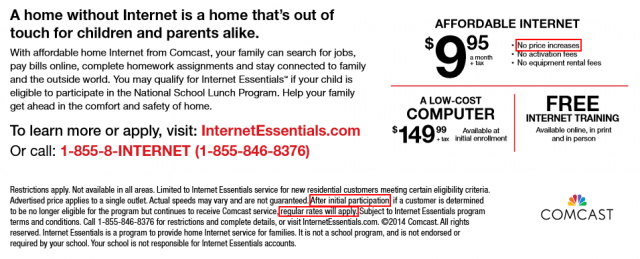

Subscribe As regulators ponder Comcast’s application to acquire Time Warner Cable, the issue of affordable Internet has been a hot topic as part of the merger review. So it is no surprise Comcast has announced it is extending its recent offer of six free months of Internet Essentials service to income-challenged families with school age children an extra 10 days.

As regulators ponder Comcast’s application to acquire Time Warner Cable, the issue of affordable Internet has been a hot topic as part of the merger review. So it is no surprise Comcast has announced it is extending its recent offer of six free months of Internet Essentials service to income-challenged families with school age children an extra 10 days.

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.) Staff at the New York regulator overseeing the state’s telecommunications companies have determined that some Time Warner Cable customers will see their largest rate increase in New York history — more than double their current rate — if Comcast is successful in its bid to acquire Time Warner Cable.

Staff at the New York regulator overseeing the state’s telecommunications companies have determined that some Time Warner Cable customers will see their largest rate increase in New York history — more than double their current rate — if Comcast is successful in its bid to acquire Time Warner Cable. Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans.

Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans. AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi.

AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi. Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.

Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.